Credit Cards

Zopa Credit Card Review: £0 annual fee

Zopa Credit Card offers an efficient mobile app for you. Enjoy up to £2,000 credit limit. This is our Zopa Credit Card review.

Advertisement

The Zopa Card is a great credit-builder option!

Times are changing, and so is the way we’re banking. This Zopa Credit Card review will show a few reasons to apply for this modern card.

This card’s different approach has won over many consumers in the UK. If you’re curious about its features, keep reading his informative post.

| Credit Score | Not disclosed, but as a credit-builder card, it must accept applicants with low scores; |

| Annual Fee | You won’t have to pay even a penny for this card in monthly or annual fees; |

| Purchase APR | Variable 34,9%; |

| Cash Advance APR | 34,9% (v); |

| Welcome Bonus | Unfortunately, no welcome bonus is offered; |

| Rewards | The Zopa Credit Card offers no rewards. |

You will be redirected to another website

Zopa Credit Card Overview

Many UK residents already know Zopa for its personal loan offers. Now, you can also get a credit card from Zopa.

Thus, Zopa Credit Card communicates pretty well with the younger audience, with its modern approach to finances and focus on online services.

Everything is done online, through their website, from the application process to the account management, especially on the mobile app.

Moreover, this mobile app has very useful features for those who need a good tool to manage their finances.

The purchase and cash APR is a little salty, but if you pay your bill on time, you’ll have no problem with its rates and will build a great credit score.

Zopa Credit Card’s main features

Zopa Credit Card has no fancy rewards, but it will go straight to the point: an efficient credit lien to help you use credit and build your score.

And as there are many cards with this same purpose, read the pros and cons of this Zopa Credit Card review:

Pros

- Easy to apply and manage online;

- The mobile app helps you manage your finances with efficient features, such as balance updates, alarms, automatic payments, etc;

- No annual fee is charged for you to use the Zopa Credit Card;

- Initial credit limit ranges from £200 to £2,000;

- There are no foreign transaction fees.

Cons

- This is not a car to carry a balance over the months, as the high APR rates can cost you a lot of money;

- The Zopa Credit Card has no cashback or rewards, but that’s not typical on a credit-building card.

Minimum credit score to apply

Zopa does not disclose a minimum credit score. However, this card is designed for people looking to rebuild their scores.

However, you can check your eligibility before your credit score is checked, which is great for those with damaged scores.

How to apply for the Zopa Credit Card?

Like everything related to this credit card, the application process is also online and straightforward.

Online application process

Before you apply for the Zopa Credit Card, you can check your eligibility. This way, you’ll not waste a credit check on a credit card you’re not getting.

To do this, access Zopa’s website and see the “check my eligibility” button on the first page. Click on it, and you’ll be redirected to a form.

This form has 12 questions about your personal info, address, finances, and employment. It’s just the usual for a credit card application. Pay attention when filling out the form.

Zopa will analyze your profile and give you an answer. If you’re eligible, you’ll receive the credit card offer and can complete the application as they say.

You must also send some documents. Lastly, your card can be approved in a few or 10 days.

Mobile App application process

Indeed, their mobile app will manage everything related to your Zopa Credit card. So, having a suitable smartphone is a basic requirement.

However, per the previous instructions, you must apply for the Zopa Credit Card on the website. Once you’re approved, you can download the app.

Thus, the mobile app has useful features, including setting aside a portion of your credit limit. It will also help you build your credit score!

Zopa Credit Card or Post Office Money Classic Credit Card?

As life is made of choices, choosing a credit card is just another decision in your adult life. But luckily, you have plenty of options to choose from.

Here, we’ll present you with an alternative if you’re unsure about the Zopa Credit Card but need a credit card to build credit.

Aqua Classic Credit Card will cost you nothing yearly.

Both cards are suitable for low scores. If you’d like to learn more about the Aqua Classic Credit Card, please see the following content.

Aqua Classic Credit Card review: Build credit!

Explore the pros and cons of the Aqua Classic Credit Card in our comprehensive review. From its 60-second application process to its unique features!

Trending Topics

Aqua Classic Credit Card review: Build credit!

Dive into the details of the Aqua Classic Credit Card with our insightful review. Uncover the card's 24/7 fraud protection and more!

Keep Reading

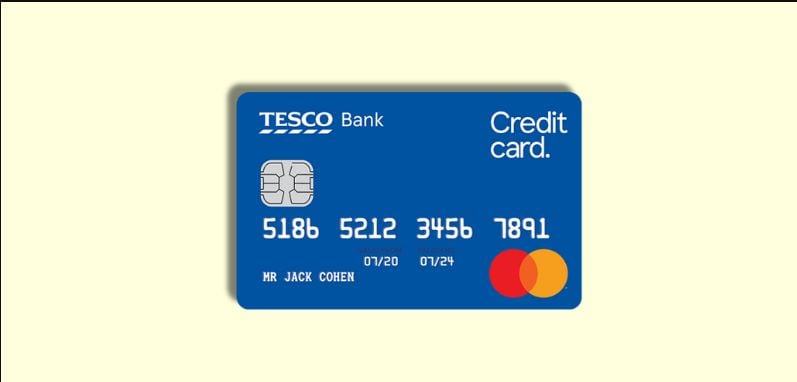

Tesco Balance Transfer Credit Card: A Smart Way to Consolidate Debt

Consolidate your debt with the Tesco Balance Transfer Card. Enjoy 0% interest on balance transfers for 27 months and earn Clubcard points.

Keep Reading

Tesco Foundation Card: great for a poor credit history

Learn how the Tesco Foundation Credit Card can help build your credit while earning Tesco Clubcard points. No annual fees, apply today!

Keep ReadingYou may also like

M&S Rewards Credit Card: A Card That Rewards Your Everyday Spending

Earn points on every purchase with the Barclaycard Rewards, plus enjoy 0% foreign transaction fees. Great for everyday spending and travel.

Keep Reading

Aqua Advance Credit Card review: No annual fee!

Unlock financial empowerment with our in-depth Aqua Advance Credit Card review! Discover its benefits and potential drawbacks!

Keep Reading

NatWest Balance Transfer Credit Card: A Smart Choice for Managing Debt

Manage your debt with the NatWest Balance Transfer Card. Enjoy 0% interest for 22 months on balance transfers with no annual fees.

Keep Reading