Credit Cards

Wells Fargo Reflect® Card Review: Extensive APR intro!

Explore our Wells Fargo Reflect Card review for a closer look into benefits like extended intro APR, cell phone protection, and absolutely no annual fees. Get your finances in control!

Advertisement

Find out how 21 months of zero APR can ease your financial management

Our Wells Fargo Reflect® Card review peels back the layers of a card not just for spending, but for smart financial management. This is without a doubt a card that demands attention.

As we go on, you’ll learn that the Wells Fargo Reflect® Card has more to offer than just basic perks. So read on and discover its full potential in our detailed review.

| Credit Score: | Aimed at those with good to excellent scores. |

| Annual Fee: | Absolutely zero, making it budget-friendly. |

| Purchase APR: | Starts at 0% for a 21-month period, which you can take advantage of for new purchases and select transfers. Then, it shifts to a 18.24% – 29.99% variable. |

| Cash Advance APR: | Stands at a variable 29.99%. |

| Other Fees: | A 5% fee, with a minimum of $5, applies to balance transfers;Cash advances are the greater between 5% and $10;International purchases incur a 3% foreign transaction;And late payments might cost you up to $40. |

| Welcome Bonus: | There’s none. |

| Rewards: | Skips the typical rewards, focusing on other benefits. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Wells Fargo Reflect® Card in action

The Wells Fargo Reflect® Card starts strong with a remarkable 21-month low introductory APR, which is great for managing new purchases or transferring credit card balances.

Then, after this period, the card’s APR shifts to a variable rate of 18.24%-29.99%. This change is tailored to your credit situation, offering financial adaptability.

This is a card that has balance transfers as its main focus. But it doesn’t mean it’s without valuable perks, like its cost-effective $0 annual fee, making it inexpensive to own.

Furthermore, the card presents a unique benefit of cell phone coverage up to $600. This protection, with a small $25 tax, covers your phone against unexpected incidents.

Additionally, the Wells Fargo Reflect® Card features a Zero Liability protection to give you extra peace of mind. It protects all transactions against unauthorized use.

Key advantages and possible limitations

Next up in our Wells Fargo Reflect® Card review, we’ll take a moment to weigh in the upsides, and what could use some improvement, in this popular financial solution.

Positive aspects of the Wells Fargo Reflect® Card

- Enjoy a lengthy intro APR stretch for 21 months, a perk for smart financing.

- Zero annual fees keep your wallet happy and your costs down.

- Benefit from $600 cell phone coverage, protecting your tech.

- Roadside Dispatch® on call 24/7, guarding your car rides all the way.

Challenges with the Wells Fargo Reflect® Card

- Variable APR post-intro period could climb up to 29.99%, a bit steep.

- Skips the allure of welcome bonuses and ongoing rewards.

- International spenders face a 3% fee on purchases abroad.

- A 5% balance transfer fee means moving large sums could be costly.

Your blueprint for getting the Wells Fargo Reflect® Card

There are some requirements in place for you to be able to add this card to your wallet. While they’re not as strict as you’d imagine, meeting them will improve your approval odds.

Must-have qualifications for the Wells Fargo Reflect® Card

- Firstly, a good to excellent credit score is needed to increase approval chances.

- Secondly, you must be a legal resident or citizen of the United States for eligibility.

- Also, a valid Social Security Number or ITIN is required.

- Applicants should have a stable income to meet the card’s credit criteria.

- Additionally, you must be of legal age to request the card.

- Lastly, a Wells Fargo account is not necessary, but may speed up the process.

Routes you can follow to apply for the Wells Fargo Reflect® Card

The Wells Fargo Reflect® Card is about convenience, and that applies even through its application processes. There’s more than one way to request yours: online, or in person.

In this next section of our Wells Fargo Reflect® Card review, we’ll give you a walkthrough of both alternatives. That way, you’ll be able to have the card in hand without any fuss.

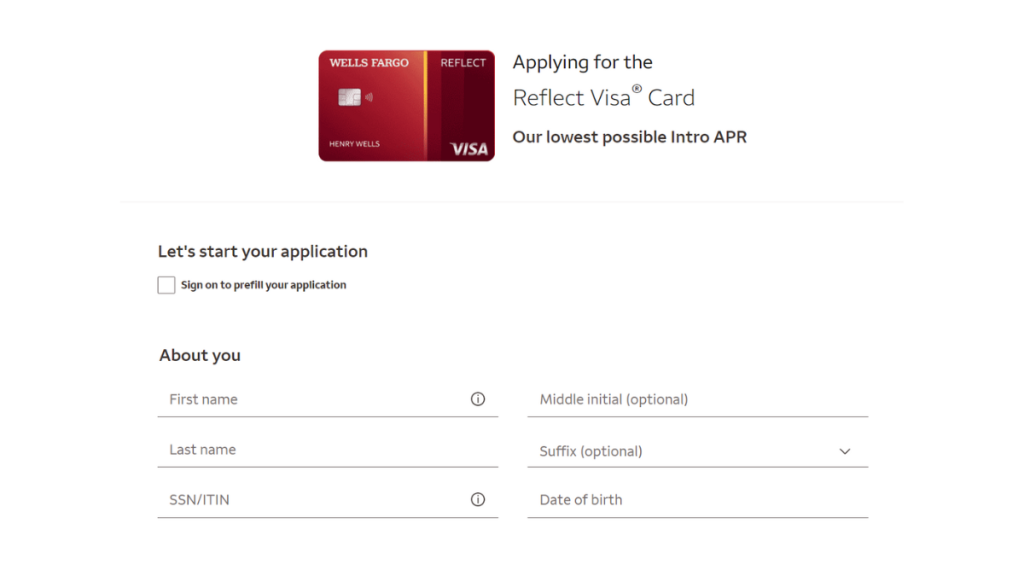

Completing your application online

Firstly, make sure you’re connected to the internet and head over to the Wells Fargo online portal. There, you’ll browse through their menu until you find the Reflect® card.

Then, select the ‘Apply Now’ button, which will take you to the application form. You’ll need to fill out personal information like your name, contact details, and more.

Following this, you’ll be asked to provide financial details. This includes your income, employment status, and monthly rent or mortgage.

Finally, review and submit your application. Wells Fargo usually lets you know if you’ve been approved right away. Then, further instructions should arrive by email.

Completing your application in person

If face-to-face interactions are more your thing, you can visit a local Wells Fargo branch and get things started from there. Just remember to take the necessary documentation.

In the branch, you’ll fill out the same application form as online. Provide your personal and financial information to the staff member, who will then guide you through the process.

Next, they may ask a few additional questions to understand your financial situation better. This interaction allows for a more tailored application experience.

Concluding your in-person application, you’ll submit your form to the representative. They will process it and inform you about the next steps regarding your request.

Try the Chase Slate Edge℠ for a different experience

Concluding this Wells Fargo Reflect® Card review, it’s easy to see why this is such a popular card. Even though it lacks traditional rewards, it serves its purpose well. But there’s more out there!

No annual fees and a lengthy no APR intro might steer you towards the Chase Slate Edge℠, which is an excellent alternative. This option brings a fresh perspective to credit with an impressive set of features.

The Chase Slate Edge℠ shines with a similar low APR period, potential APR reduction, and no annual fees. It’s a solid choice for those who want better financial health and more savings.

Wondering about the perks that come with the Chase alternative? Check the link below to learn more and find out how it could be the financial tool you’ve been looking for.

Chase Slate Edge℠ review

Looking for a credit card with a great 0% period and special Chase benefits? Then check out our Chase Slate Edge℠ Credit Card review!

Trending Topics

Don’t Let Limited Credit Hold You Back: Choose the Credit Card Tailored for You

Discover the best credit cards for limited credit and start building your credit history while enjoying rewards. Find the right card for you!

Keep Reading

Investing for Beginners: Creating a Plan, and Managing Your Investments

Invest safely! This guide covers everything from basic concepts to advanced strategies to help you get started on your financial journey.

Keep Reading

Financial Wellness: Tips for Achieving Financial Stability

In this article, learn practical strategies to achieve financial wellness and attain a more balanced and peaceful life.

Keep ReadingYou may also like

FIT Mastercard® Review: Rebuild Your Credit Securely!

Find out how FIT Mastercard® Credit Card can help you rebuild your credit score without paying a security deposit with our review!

Keep Reading

Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card: Earn back

If you want to know how to apply for the Petal® 1 "No Annual Fee" Visa® Credit Card, it's an easy process: receive it in 10 days!

Keep Reading

Avant Credit Card Review: Rebuild Credit with No Foreign Fees!

The Avant Credit Card is an intermediate option that aids in the ongoing credit building for those with a fair credit score.

Keep Reading