Credit Cards

VentureOne Rewards Credit Card Review: Travel Perks Galore

Discover in our VentureOne Rewards Credit Card review how you can earn a big welcome bonus, miles on every purchase, and pay no annual fee. Perfect for those who love to travel!

Advertisement

Unlock 20,000 bonus miles and more with this card, perfect for adventurers and travel lovers!

If you’re constantly on the road, you have to get a credit card that offers more for your spending. In this VentureOne Rewards Credit Card review, you’re getting just that!

Discover how the VentureOne card blends travel benefits with financial ease. Here, we’ll highlight its key features, from a low intro APR to bonus miles, perfect for smart budgeting.

| Credit Score: | Requires excellent credit for eligibility. |

| Annual Fee: | $0 – Enjoy without the worry of annual charges. |

| Purchase APR: | New members can take advantage of a low intro APR on purchases and balance transfers for the initial 15-month period. Then, a variable 19.99% – 29.99% applies. |

| Cash Advance APR: | Fixed at 29.99%, subject to market variations. |

| Other Fees: | Balance transfer fee at 3% during the low intro period, then 4%; cash advance fee is the greater of $3 or 3% of each advance, and late payment fee is up to $40. |

| Welcome Bonus: | New cardholders who spend at least $500 within the first 3 months can earn a valuable 20,000 bonus miles. |

| Rewards: | A flat 1.25 miles on every purchase you ever make with the card. By booking future travels with Capital One, you can earn 5 miles. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The VentureOne Rewards Credit Card in action

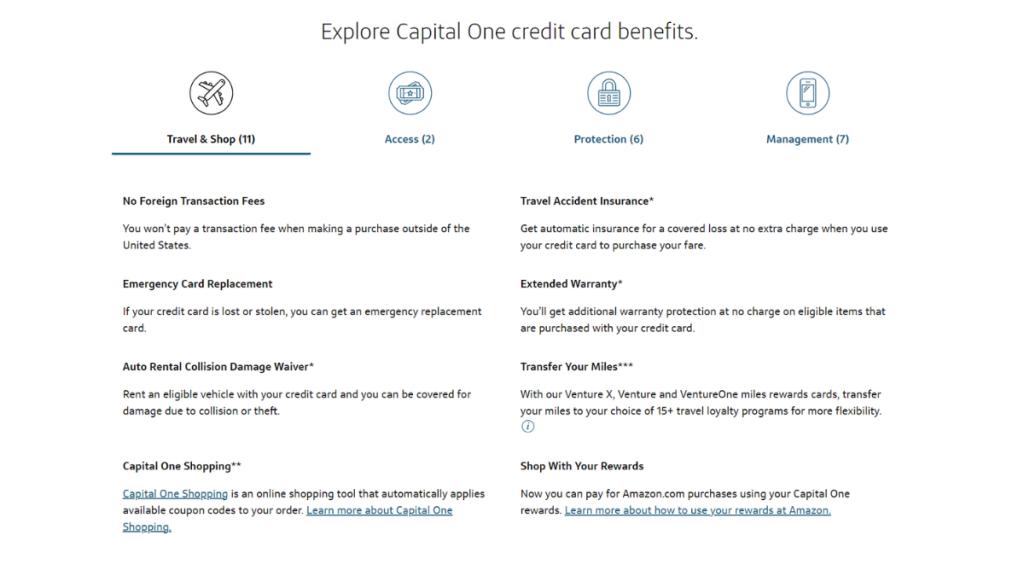

We’re kicking off our VentureOne Rewards Credit Card review with its most impressive feature: absolutely no annual fee—a win for those who love rewards without extra costs.

Moving on, the card offers an appealing low intro APR for the first 15 months. Ideal for those planning big purchases or balance transfers without the stress of high interest.

Moreover, for travel enthusiasts, this card is a work of art. You can earn 5 miles per dollar on bookings through Capital One Travel, turning every trip into a chance to earn even more.

Additionally, every purchase earns you 1.25 miles per dollar. It’s great for everyday spending, from groceries to gas, making routine expenses more rewarding.

Lastly, the VentureOne Rewards is aimed at those with excellent credit. It’s a wise choice for who’s looking for simple financial management and the perks of travel with ease.

Key advantages and possible limitations

In this section of our VentureOne Rewards Credit Card review, we’re about to dive into the advantages and potential limitations of this popular travel rewards card.

Understanding both is crucial for making an informed decision, so let’s get into the details to help you decide whether or not it’s the right fit for your wallet.

Positive aspects of the VentureOne Rewards Credit Card

- Earn unlimited 1.25 miles per dollar, which adds value to daily expenses.

- Benefit from zero annual fee and save money every year.

- Earn a generous 20,000 bonus miles offer, a warm welcome from Capital One.

- Book your travels with Capital One and earn even more – perfect for adventurers.

- Take advantage of an extensive low intro APR for big purchases and debt consolidation.

Challenges with the VentureOne Rewards Credit Card

- Requires excellent credit, so it’s not available for all interested parties.

- Possible high APR once the intro period ends, so be careful with rising rates.

- Rewards are limited to miles, so it’s not ideal for those who’d like cash back.

- You’ll have to endure a balance transfer fee, even during the intro period.

- Offers limited premium travel benefits, meaning it’s not the top-tier for luxury.

Your blueprint for getting the VentureOne Rewards Credit Card

There are multiple ways you can snatch your VentureOne card simply by it being a financial solution by Capital One. Next, we’ll outline them step-by-step so you can choose.

Must-have qualifications for the VentureOne Rewards Credit Card

- Firstly, an excellent credit score is non-negotiable for approval.

- Secondly, being a U.S. resident is important for application eligibility.

- Also, you’ll need to provide information like income and employment status.

- Don’t forget, a history of responsible credit use is crucial as well.

- Lastly, only legal adults can apply, so you must be over the age of 18.

Ways you can apply for the VentureOne Rewards Credit Card

One of the many benefits of investing in brick and mortar banks is that they offer different channels to access their products and services. Let’s see how you can apply through them.

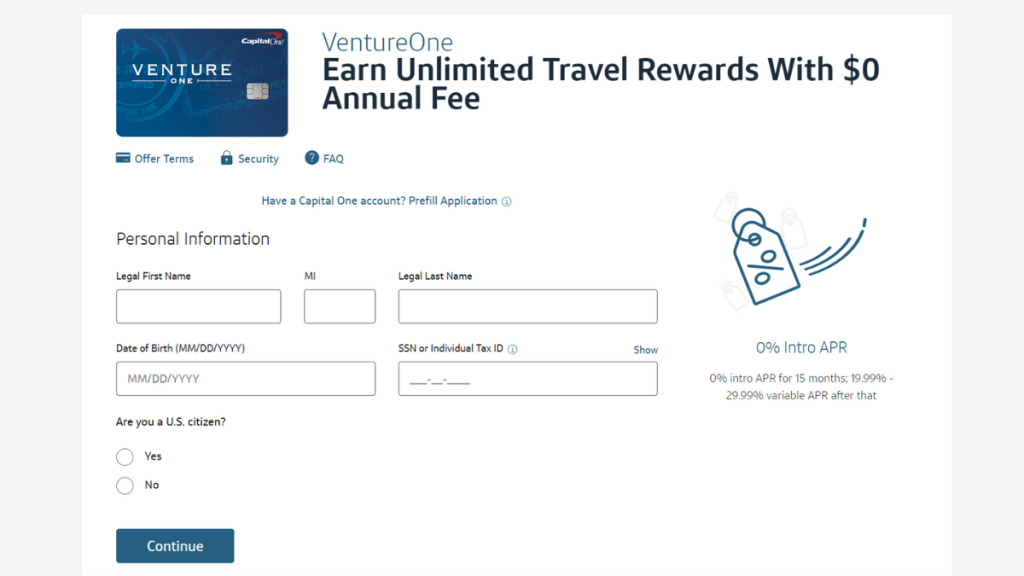

Completing your application online

This step-by-step guide from our VentureOne Rewards Credit Card begins by simply directing you to Capital One’s website. Then, find the VentureOne in the ‘Credit Cards’ tab.

Next, you’ll find the ‘Apply Now’ button. Clicking on this takes you to the application form. Here, you’ll need to fill in your personal details, including name, address, and SSN.

Following this, enter your financial information. Capital One will ask about your income, employment status, and monthly housing payment to assess your creditworthiness.

Finally, double-check every detail you’ve entered. Once satisfied, submit your application. Capital One will then perform a credit check to tell you if you’ve been approved or not.

Completing your application via mobile app

If you’re already banking with Capital One, check their mobile app for a simpler way to get the VentureOne card. The app might show it as an option for you, making things easier.

In the app, the process is more streamlined. Plus, Capital One already has your info, so getting your VentureOne card is just a few taps away. It’s quick and hassle-free.

Completing your application in person

Visiting a Capital One branch offers a personal touch to your application. Walk into any branch with the required documents, and a representative will guide you directly.

Applying in person means you can get answers to your questions right away. The staff will help fill in your details, using the information they already have if you’re an existing customer.

The in-branch experience is perfect for those who prefer face-to-face interactions. Applying in person might provide a bigger sense of security than online procedures.

Try the Quicksilver Cash Rewards Credit Card for a different experience

In conclusion, our VentureOne Rewards Credit Card review showcases how this credit card could be the perfect ally for travelers who enjoy earning miles and not paying yearly charges.

But if cash back aligns better with your needs, you might find more value in the Quicksilver Cash Rewards Credit Card. With a flat rate and an array of perks, it’s a solid alternative.

Curious about the specifics of the Quicksilver card? Explore the following link for a detailed guide and a walkthrough on how to start your journey towards rewarding spending.

Quicksilver Cash Rewards Credit Card review

Are you in the market for the perfect cash back rewards credit card? Well, you've found it! Check our full Quicksilver Cash Rewards Credit Card review to learn more.

Trending Topics

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Apply for Freedom Gold Card: Join and start shopping!

If you want to know how to apply for the Freedom Gold Card, know that this process is done online and takes just a few moments!

Keep Reading

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep ReadingYou may also like

Don’t Let Limited Credit Hold You Back: Choose the Credit Card Tailored for You

Discover the best credit cards for limited credit and start building your credit history while enjoying rewards. Find the right card for you!

Keep Reading

Financial Wellness: Tips for Achieving Financial Stability

In this article, learn practical strategies to achieve financial wellness and attain a more balanced and peaceful life.

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Rebuild Your Credit!

With cash back and no annual fee, the Petal® 1 "No Annual Fee" Visa® Credit Card is an option for those without a credit score!

Keep Reading