Credit Cards

U.S. Bank Altitude® Go Visa Signature® Card Review: 0% intro APR

With different categories for earning bonuses, you can use this card internationally without worrying about expenses and fees, as it is very affordable! However, what are the requirements? Come find out more!

Advertisement

Dining out has never been as advantageous as with the bonuses offered!

Ready to explore a sea of opportunities with our U.S. Bank Altitude® Go Visa Signature® Card Review? With this card, you earn exclusive bonuses of up to 4 points per dollar spent!

Additionally, being a no-annual-fee card, you have the pleasure of saving while enjoying iconic benefits! So, come discover how the rewards system works and explore other positive points!

| Credit Score | 720 – 850; |

| Annual Fee | $0; |

| Purchase APR | 0% in the first year, and then: 18.24% – 29.24%; |

| Cash Advance APR | 0% in the first year, and then: 29.24%; |

| Other Fees | Balance transfer: 3% or $5 per transfer; |

| Welcome Bonus | Earn 20K bonus points when you spend $1K within 90 days; |

| Rewards | 4 points per $1 spent on dining; 2 points per $1 spent at grocery stores; 1 point per $1 spent on other purchases. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The U.S. Bank Altitude® Go Visa Signature® Card in action

So, this U.S. Bank Altitude® Go Visa Signature® Card Review is your opportunity to understand if this is truly the ideal card for you. Let’s check out some specific details.

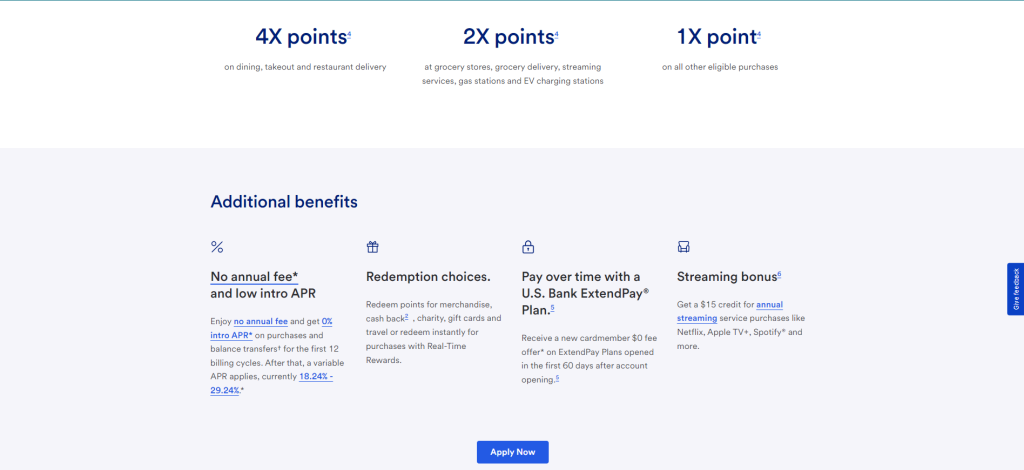

As mentioned earlier, one of the card’s highlights is the bonus points on each purchase. Earn 1 point for every dollar spent on eligible purchases.

Moreover, you can also earn 2 points for every dollar spent in the following categories: groceries, streaming services, electric vehicle charging stations, and fuel.

Finally, the best reward is 4 points for every dollar spent in the dining category. This includes delivery services or in-person dining at various types of restaurants.

Key advantages and possible limitations

In other words, this card is a great way for you to save your points. But what can you use these points for? Let’s understand more now and discover if this option also has disadvantages.

Positive aspects of the U.S. Bank Altitude® Go Visa Signature® Card

Firstly, one of the positive aspects of this credit card is that its points are unlimited and never expire! In other words, you can accumulate and keep them for as long as you want.

Additionally, you can spend them in a variety of ways. You can request cash back, but you can also redeem them for various types of products and even for travel. To see the possibilities, visit the rewards website.

Furthermore, another advantage is that you can earn 20K bonus points right off the bat. To do this, you need to spend at least $1K in the first 90 days.

Challenges with the U.S. Bank Altitude® Go Visa Signature® Card

However, will this review show you some points to consider before joining this credit card? Well, the performance of this card is excellent if it aligns with your lifestyle.

In other words, if you like to buy ingredients to make your own food or don’t frequently spend on meals, this may not be the best rewards card available!

Although it has a streaming program, with a $15 bonus on annual purchases in the category and 2 points per dollar spent, it does not offer any bonuses for entertainment services such as movies, shows, and sports.

Your blueprint for getting the U.S. Bank Altitude® Go Visa Signature® Card

In any case, if you’re here, it’s because this credit card interests you. So, how about discovering how you can apply for this card and its benefits?

The entire process can be done online on the institution’s website. Moreover, they assure you that it only takes a few seconds. Thus, we’ve prepared a blueprint to guide your steps in this new journey!

Must-have qualifications for the U.S. Bank Altitude® Go Visa Signature® Card?

The main requirement we point out in this U.S. Bank Altitude® Go Visa Signature® Card review is the need for a specific credit score.

In this case, it needs to be good, somewhere between 720 and 850 points. Additionally, you must live in the US and be over 18 years old!

Routes you can follow to apply for the U.S. Bank Altitude® Go Visa Signature® Card

So, if you think you meet the minimum requirements to apply, come register and request the card as soon as possible!

Completing your application online

Firstly, access the official card website we’ve made available to streamline your entire process! Thus, upon entering, you can find additional details about the services and benefits offered!

Then, click on the “apply” button and wait as you are redirected to a new page. Thus, you only need to fill out some basic information and await contact from U.S. Bank.

Try the Chase Freedom Flex® Credit Card for a different experience

Did you enjoy learning about the bonuses this card offers? Then, be sure to consider it as an option! However, besides that, it’s essential to explore other cards.

To assist you in your comparison, we’ll introduce you to the Chase Freedom Flex® Credit Card. Thus, this card has a profile similar to that of the U.S. Bank Altitude. With it, you don’t need to worry about an annual fee.

However, the major difference lies in how the bonus works. Thus, with a focus on travel, meals, and drugstores, this card offers a slightly broader range than the U.S. Bank Altitude! In other words, come check out our review to learn more!

Chase Freedom Flex® Credit Card Review

Explore Chase Freedom Flex® review for top rewards, no annual fee, and flexible cash back options. Ideal card for savvy spenders!

Trending Topics

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep Reading

Upgrade Triple Cash Rewards Visa® Review: The Smart Choice

Read our Upgrade Triple Cash Rewards Visa® review - get 3% cash back on select categories and no annual fees. Ideal for everyday spending.

Keep Reading

Revvi Credit Card Review: Rebuild Your Credit Securely!

Discover how to get cash back on all your purchases with the Revvi Credit Card Review. This card welcomes people with bad credit scores!

Keep ReadingYou may also like

Self Visa® Secured Card Review: Build credit!

Discover how the Self Visa® Secured Card can jumpstart your credit journey from scratch with no credit history!

Keep Reading

Reseña Destiny Mastercard®: línea de crédito de $300

La Destiny Mastercard® es una tarjeta de crédito sin garantía diseñada para aquellos que buscan reconstruir sus puntajes de crédito.

Keep Reading