Credit Cards

Upgrade Triple Cash Rewards Visa® Review: The Smart Choice

Explore the perks in our Upgrade Triple Cash Rewards Visa® review. Enjoy 3% unlimited cash back on home, auto, health, and 1% on other purchases. Benefit from no annual fees and a predictable payment plan.

Advertisement

Experience the financial flexibility you deserve with high rewards and no extra charges

Are you looking for a card with a generous credit limit to help you with those big purchases? Then you should definitely check our Upgrade Triple Cash Rewards Visa® review.

With attractive rewards and the lack of an annual fee, this card offers a complete package. Especially for people who needs a boost in their savings. Sounds interesting? Let’s dive further.

| Credit Score: | Suitable for scores ranging from average to excellent. |

| Annual Fee: | Free of annual fees. |

| Purchase APR: | Ranges between 14.99% to 29.99%. |

| Cash Advance APR: | Specific rate details vary. |

| Other Fees: | Foreign transactions cost up to 3%;Balance transfers at up to 5%. |

| Welcome Bonus: | If you open a Rewards Checking Plus account and make at least 3 debit transactions, you can get a $200 bonus. |

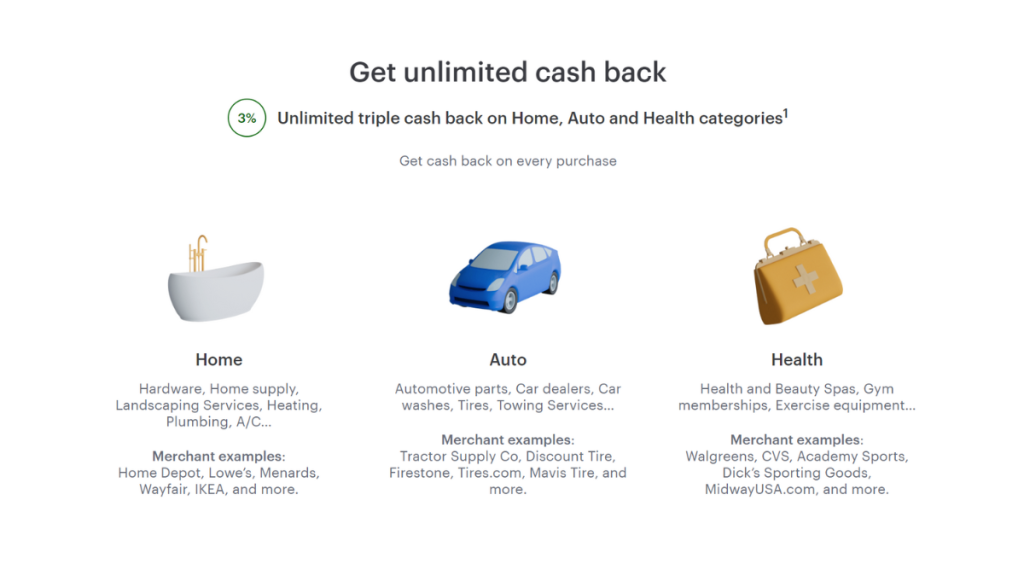

| Rewards: | You can get cash back up to 3% on select categories, plus a 1% rebate on all else. Upgrade Shopping gives you an extra 10% through a Dosh® partnership. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Upgrade Triple Cash Rewards Visa® in action

The Upgrade Triple Cash Rewards Visa® stands out on everyday expenses. Ideal for those with credit scores from average to excellent, it’s a reliable financial partner.

Additionally, you’ll be able to enjoy the ease of no annual fees. The card’s purchase APR ranges from 14.99% to 29.99%, which caters to different financial needs and lifestyles.

Furthermore, the card offers versatility in its cash advance APR, with tailored rates. While extra charges apply for foreign transactions and balance transfers, they’re manageable.

New cardholders are greeted with a tempting welcome bonus. But the catch is opening a Rewards Checking Plus account and completing a minimum of 3 debit transactions.

Lastly, you can earn up to 3% back in key categories that are already integrated into your routine, helping you save more. With 1% back on all else, every transaction is rewarding.

Key advantages and possible limitations

Continuing our Upgrade Triple Cash Rewards Visa® review, let’s take a much closer look into its many benefits and consider the possible downsides of this credit card.”

Understanding these aspects can help you make the best decision about whether or not this card aligns with what you’re looking for.

Positive aspects of the Upgrade Triple Cash Rewards Visa®

- Attractive welcome bonus with simple qualifying conditions.

- Generous rewards rate in popular spending categories, helping you save.

- Zero annual fees, ideal for cost-conscious individuals.

- Accessible to a broad range of credit scores, increasing its appeal.

- Extra cash back through Upgrade Shopping, amplifying reward potential.

Challenges with the Upgrade Triple Cash Rewards Visa®

- Variable purchase APR could be a concern for some users.

- Cash advance terms might increase overall costs.

- Foreign transaction fees may limit its appeal for travelers.

- Balance transfer fees could add to the cost of debt management.

- Lacks a low introductory APR feature, a common credit card benefit.

Your blueprint for getting the Upgrade Triple Cash Rewards Visa®

Getting the Upgrade Triple Cash Rewards Visa® is not an impossible task if you fit Upgrade’s basic criteria. Let’s dive into what those are below.

Must-have qualifications for the Upgrade Triple Cash Rewards Visa®

- Firstly, applicants should have a credit score within the range of 630 to 850.

- Secondly, a crucial requirement is a legal U.S. residency.

- Having a stable income source demonstrates the ability to manage credit effectively.

- Also, applicants must be at least 18 years old (or 19 in certain states).

Ways you can apply for the Upgrade Triple Cash Rewards Visa®

Like most modern financial tools, the application for this card is exclusively online via their official site. Keep following our Upgrade Triple Cash Rewards Visa® review to learn how.

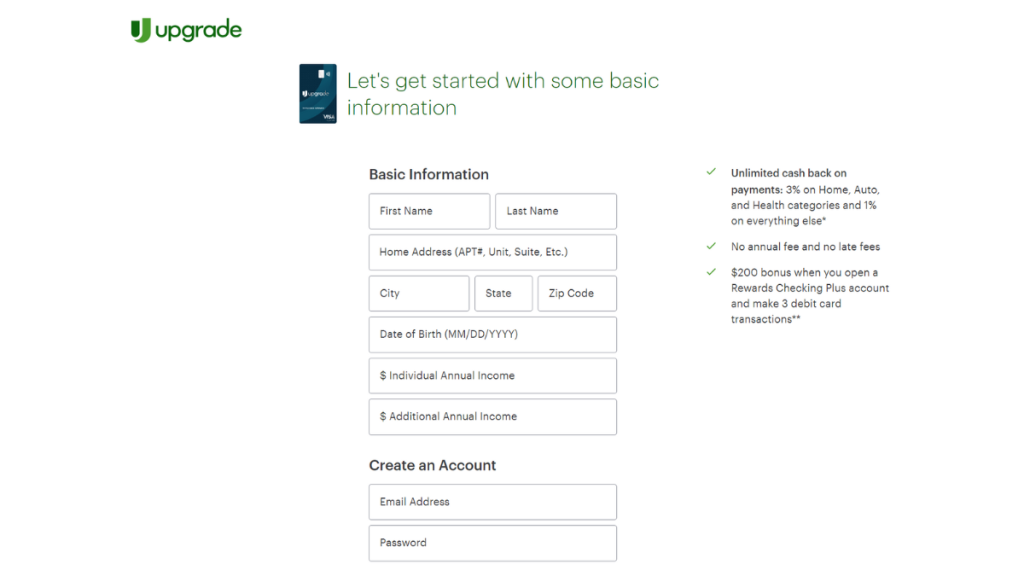

Completing your application online

Begin the process by heading to their website and selecting ‘Get Started’ in the Upgrade Triple Cash Rewards Visa® page. This initial step is straightforward and sets the stage.

Next, input your personal information, including your name and address. Ensure everything is correct for a seamless process, emphasizing security.

Then, provide your financial details, such as your individual income and annual amount. Accuracy here is important for a fair evaluation of your creditworthiness.

Afterwards, write down your email and create a password to create an account. Make sure to read their Terms of Use thoroughly, check the box, and then click on “Apply Now”.

Finally, after submitting your request, a quick response follows. If you’re approved, your new card will soon be on its way, marking a new financial chapter towards smarter spending.

Try the Gemini Credit Card® for a different experience

In conclusion, our Upgrade Triple Cash Rewards Visa® review highlights a credit card that offers robust rewards and no annual fees, making it a solid choice for many.

However, for those passionate about cryptocurrency, there’s an even more fitting option. The Gemini Credit Card® brings a unique twist to reward systems.

The Gemini Credit Card® stands out with zero annual fees, offering instant crypto rewards and wide acceptance. It’s a contemporary take on credit card spending.

Discover more about the Gemini Credit Card® and its application process in the following link. Explore in-depth details and take the plunge into the exciting world of digital currencies.

Gemini Credit Card® review

If you'd like to take the plunge into the world of cryptocurrencies, there's no better card than the Gemini Credit Card®! Check our full review to learn more.

Trending Topics

Group One Platinum Card Review: Shop with Ease

Discover the Group One Platinum Card in our review! Perfect for bad credit, with a $750 merchandise credit line, and no rates on purchases.

Keep Reading

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Don’t Let Limited Credit Hold You Back: Choose the Credit Card Tailored for You

Discover the best credit cards for limited credit and start building your credit history while enjoying rewards. Find the right card for you!

Keep ReadingYou may also like

Reflex Mastercard® Review: A Secure Option for Credit Rebuilding!

With the Reflex Mastercard® review, it's your moment to rebuild your credit score. Your history is sent monthly to major credit agencies!

Keep Reading

Chase Slate Edge℠ Review: Get Financial Control

Explore our Chase Slate Edge℠ Credit Card review for 0% intro APR, no annual fee, and exclusive benefits that can elevate your finances.

Keep Reading

Destiny Mastercard® Review: Designed to help you move forward

The Destiny Mastercard® is an unsecured credit card designed for those seeking to rebuild their credit scores.

Keep Reading