Credit Cards

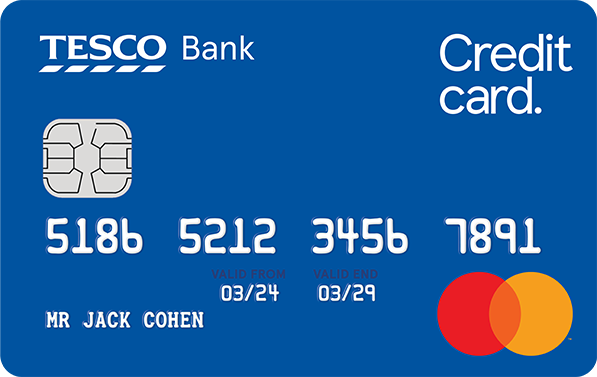

Tesco Foundation Card: great for a poor credit history

Discover the benefits of the Tesco Foundation Credit Card—build credit, earn rewards, and enjoy no annual fees. Read our full review now!

Advertisement

Tesco Foundation is a credit card that helps build credit!

The Tesco Foundation Credit Card is a perfect match for helping individuals in the UK with limited or poor credit histories.

It provides a structured and manageable way to build credit while offering access to Tesco’s popular Clubcard points system.

With a low initial credit limit and no annual fee, it is an attractive option for those looking to improve their credit scores responsibly.

You will be redirected to another website

Key Features of the Tesco Foundation Credit Card

The Tesco Foundation Credit Card offers several features that make it stand out among credit builder cards:

- Credit Limit: Ranges from £250 to £1,500 depending on individual circumstances.

- It offers a 29.9% APR (variable), lower than many other credit-builder cards on the market.

- Tesco Clubcard Points: you earn five Clubcard points for every £4 spent at Tesco stores and one point for every £8 spent elsewhere. You can redeem these points for rewards at Tesco and its partners.

- CreditView Access: Cardholders gain access to CreditView, powered by TransUnion, which allows users to monitor their credit scores for up to three years.

- No Annual Fee: The Tesco Foundation Credit Card has no annual fee, which helps keep costs low for users who manage their finances responsibly.

Advantages

1. Credit Building

The primary purpose of the Tesco Foundation Credit Card is to help users build or rebuild their credit scores.

Users can gradually improve their credit profiles by consistently making minimum payments on time and keeping balances low.

This makes it an excellent card for people with a history of bad credit or those new to responsibly using credit.

2. Rewards System

In addition to credit-building, the Tesco Foundation Credit Card offers a rewards system tied to Tesco’s well-known Clubcard points.

This feature allows cardholders to earn points for every purchase made at Tesco or elsewhere.

3. Lower Interest Rates for a Credit Builder Card

While many credit builder cards have high APRs of up to 50% or more, the Tesco Foundation Credit Card offers a comparatively lower 29.9% APR, making it less costly for those who occasionally carry a balance.

4. No Annual Fees

The card has no annual fee, which is an important consideration for individuals looking to keep their overall costs low while working to improve their credit.

Many other credit-building cards come with fees that can add up over time, making the Tesco card a more affordable option for long-term use.

5. Easy Credit Monitoring

With free access to Tesco’s CreditView, users can keep track of their credit scores and stay updated on changes.

This feature provides peace of mind and insight into how well you manage your credit.

Disadvantages

1. High APR for Carried Balances

Despite its lower-than-average APR for a credit builder card, the 29.9% APR can still be costly if you don’t clear your balance each month.

Credit builder cards typically have higher interest rates than standard cards, so carrying a balance over time could lead to significant interest charges.

2. Initial Credit Limit

The Tesco Foundation Credit Card has a low initial credit limit, typically between £ 250 and £1,500.

While this can help prevent over-borrowing, it may also limit its usefulness for larger purchases.

To build credit, it is important to stay within 25% of the credit limit, which can be restrictive if your limit is low.

3. Limited Introductory Offers

Unlike many credit cards on the market, Tesco Foundation Card doesn’t offer introductory 0% interest periods or balance transfer deals.

This may be a disadvantage for users who are looking for short-term interest-free credit.

4. Foreign Transaction Fees

The Tesco Foundation Credit Card charges a 2.75% foreign transaction fee if you frequently travel abroad.

This can add up quickly for users making purchases outside the UK, making it less suitable for international use.

Who is the Tesco Foundation Credit Card Best For?

The Tesco Foundation Credit Card is ideal for UK residents with poor or limited credit histories looking for a reliable way to improve their credit scores.

It’s also well-suited for people who regularly shop at Tesco and would benefit from earning Clubcard points on everyday purchases.

This card is designed to help users improve their credit responsibly, but it’s important to remember that carrying a balance can lead to high-interest charges.

As such, this card best serves those who can pay on time and clear their balance in full each month.

Applying for the Tesco Foundation Credit Card

Step 1: Check Eligibility

Before applying, it’s a good idea to use Tesco’s eligibility checker.

This tool performs a soft credit search and estimates your approval chances without affecting your credit score.

Step 2: Gather Required Documents

Ensure you have the necessary documents to complete your application smoothly, including proof of identity and address.

Step 3: Submit an Online Application

Visit the Tesco Bank website to complete your application.

The process usually takes about 10 minutes, and you’ll receive an instant decision.

Step 4: Manage Your Credit

Once approved, you can use your card responsibly, earn Clubcard points, and monitor your credit score with CreditView.

Conclusion

The Tesco Foundation Credit Card offers a strong combination of credit-building potential and rewards for regular Tesco shoppers.

A credit builder card has no annual fee and a relatively low APR, making it affordable and effective for improving your credit score.

However, managing the card responsibly is crucial to avoiding high interest charges, especially if you plan on carrying a balance.

Looking for a similar option with a focus on improving credit?

The Aqua Classic Credit Card is another strong alternative.

It offers a comparable low credit limit and tools for building credit, with features like a credit score tracker and no annual fees, much like the Tesco Foundation Card.

However, it also comes with no foreign transaction fees, making it more suitable for frequent travellers.

To explore this alternative and see which card better fits your needs, check out our full review of the Tesco Foundation Credit Card!

Aqua Classic Credit Card review: Build credit!

Explore the pros and cons of the Aqua Classic Credit Card in our comprehensive review. From its 60-second application process to its unique features!

Trending Topics

Sainsbury’s Balance Transfer Credit Card: A Smart Choice for Managing Debt in the UK

Sainsbury’s Balance Transfer Card: 0% interest on transfers, low fees, and Nectar points. Perfect for UK debt consolidation!

Keep Reading

Virgin Atlantic Reward Credit Card: Maximise Your Travel Rewards

Earn Virgin Points with the Virgin Atlantic Reward Credit Card. No annual fee and great rewards for frequent Virgin Atlantic flyers.

Keep Reading

Tesco Low Fee Balance Transfer Card: A Smart Debt Management Tool

Discover how the Tesco Low Fee Balance Transfer Card helps reduce debt with low fees and rewards, making financial management easier.

Keep ReadingYou may also like

Halifax Clarity Credit Card: The Ultimate Travel Companion

Halifax Clarity Card offers fee-free spending abroad, no annual fee, and competitive exchange rates. It is ideal for frequent travellers.

Keep Reading

Barclaycard Rewards Card Review: Earn Cashback!

Explore the Barclaycard Rewards Card in our latest review – a deep dive into its perks, rewards program, and user-friendly features!

Keep Reading

NatWest Balance Transfer Credit Card: A Smart Choice for Managing Debt

Manage your debt with the NatWest Balance Transfer Card. Enjoy 0% interest for 22 months on balance transfers with no annual fees.

Keep Reading