Credit Cards

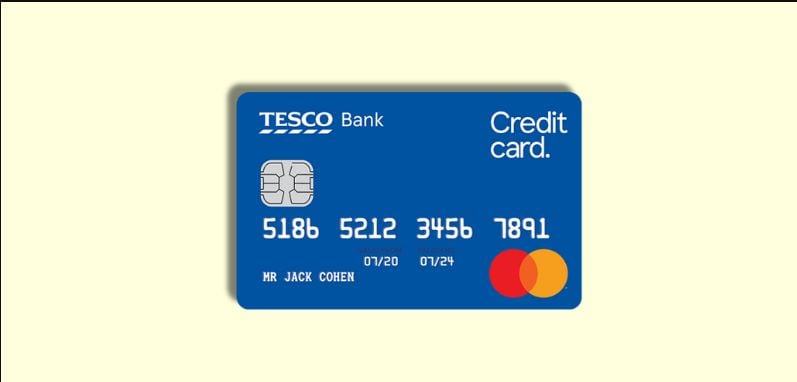

Tesco Balance Transfer Credit Card: A Smart Way to Consolidate Debt

The Tesco Balance Transfer Credit Card offers low fees, providing a long interest-free period to manage debt. Learn more here!

Advertisement

Why the Tesco Balance Transfer Credit Card Is a Strong Choice

The Tesco Balance Transfer Credit Card offers a great opportunity to consolidate your debts. It offers an extended 0% interest period for 27 months on balance transfers.

This allows you to transfer existing balances from other credit and store cards to the Tesco card, helping you avoid high interest rates.

With a low % transfer fee of 2.95%, the card provides flexibility to pay off existing debt more efficiently.

Additionally, it offers Clubcard points, which can be earned on your purchases, adding a bonus for regular shoppers.

You will be redirected to another website

Benefits of the Tesco Balance Transfer Credit Card

This card is designed to help those with existing credit card debt consolidate their balances into one manageable payment.

A 27-month interest-free period provides a significant timeframe to reduce your debt without worrying about

accruing interest. Let’s break down the key features that make this card an attractive option:

- 0% interest on balance transfers for 27 months, giving you more time to pay off your debt.

- A balance transfer fee of 2.95% is low compared to similar products.

- Clubcard points allow you to earn rewards for purchases redeemable in Tesco and other partner stores.

- Money transfers earn 0% interest for 9 months, giving you the option to move money from your credit card to your bank account.

The Tesco Balance Transfer Credit Card also allows you to transfer up to 95% of your available credit limit and provides simple management tools through the Tesco mobile app, which makes handling your card and tracking payments hassle-free.

If you’re looking for a way to simplify your finances by moving existing debts to one manageable account, the Tesco Balance Transfer Credit Card offers a range of benefits to help you do just that.

Tesco Balance Transfer Credit Card: Overview

The Tesco Balance Transfer Credit Card is a strong tool for consolidating existing credit card or store card debt.

With a 27-month interest-free period, you have plenty of time to focus on clearing debt without worrying about accumulating interest.

In addition to balance transfers, the card offers 0% interest on money transfers for the first 9 months, providing another option for managing your finances effectively.

Key features include:

- 27 months at 0% interest on balance transfers.

- A balance transfer fee of 2.95%.

- 0% interest on money transfers for 9 months with a 3.99% transfer fee.

- Ability to transfer up to 95% of your available credit limit.

- Access to Clubcard points on your purchases, which can be used in Tesco and partner retailers.

If you’re looking for a card to help consolidate and pay off debt without paying interest, this card offers one of the longest 0% periods available, making it easier to focus on repayments.

Advantages and Disadvantages of the Tesco Balance Transfer Credit Card

As with any financial product, there are pros and cons to consider before applying for the Tesco Balance Transfer Credit Card. Here’s an overview of the key advantages and disadvantages:

Advantages

1. Extended 0% Interest Period

The 27 months of 0% interest on balance transfers are among the longest periods offered by balance transfer cards.

This gives you over two years to focus on paying down your debt without the added pressure of interest accumulating.

2. Low Balance Transfer Fee

The balance transfer fee is relatively low at 2.95%, allowing you to move debt from other cards without significant upfront costs.

This can be especially helpful if you’re transferring a large balance and want to minimise additional fees.

3. Clubcard Points

The Clubcard points system allows you to earn rewards while using the card for everyday purchases, both in Tesco and elsewhere.

This adds value for Tesco customers, enabling you to turn your everyday spending into rewards that can be redeemed at Tesco stores and partner retailers.

4. Money Transfer Feature

The ability to make a money transfer from your credit card to your bank account with 0% interest for 9 months (subject to a 3.99% fee) gives additional flexibility in managing cash flow.

This can be a helpful feature if you need to pay off other debts or manage unexpected expenses.

Disadvantages

1. High APR After 0% Period Ends

Once the 27-month interest-free period ends, the card’s relatively high APR of 24.9% (variable) kicks in.

If you have a remaining balance after the 0% period, this high interest rate could result in significant costs.

Paying off the entire balance within the interest-free period is important to avoid these charges.

2. Transfer Fees

Although the 2.95% balance transfer fee is low compared to other cards, it’s still an upfront cost to consider, especially if you’re transferring a large balance.

The same applies to the 3.99% fee on money transfers.

3. No Purchase Introductory Offers

Unlike other cards, the Tesco Balance Transfer Credit Card does not offer a 0% interest offer on purchases made after the standard grace period.

This means that interest on new purchases will begin to accumulate immediately if you carry a balance from month to month.

How to Apply for the Tesco Balance Transfer Credit Card: Step-by-Step Guide

Applying for the Tesco Balance Transfer Credit Card is quick and straightforward. Most applications take only minutes online.

Here’s a step-by-step guide to help you through the process:

Step 1: Check Your Eligibility

Before applying, you can use Tesco’s eligibility checker, which won’t affect your credit score.

This tool helps you assess your chances of being approved for the card without risking a hard credit inquiry.

Step 2: Gather Your Documentation

You’ll need the following details to complete your application:

- Personal identification (e.g., passport or driver’s licence).

- Proof of address (utility bill or bank statement).

- Employment and income information.

Step 3: Complete the Online Application

Once you have the necessary information, you can apply directly on Tesco’s website. The application usually takes around 10 minutes to complete.

Step 4: Approval and Credit Limit

If your application is approved, Tesco will set your credit limit and provide the exact APR.

Your card will then be mailed to you. Once it’s activated, you can start transferring balances and making payments.

Tesco Balance Transfer Credit Card Alternative

While the Tesco Balance Transfer Credit Card offers many advantages, considering alternatives is important if this card doesn’t meet your needs.

Below is a similar product:

Barclaycard Platinum Balance Transfer Credit Card

This card offers up to 28 months of 0% interest on balance transfers, making it ideal for those seeking a slightly longer interest-free period.

However, its transfer fee may be higher than Tesco’s.

Ready to consolidate your debt with no interest? Apply for the Tesco Balance Transfer Credit Card and take advantage of 27 months at 0% interest today!

If you’re looking for cashback or longer terms, consider the Barclaycard Platinum Credit Card for additional options.

Barclaycard Platinum Credit Card review

Dive into our detailed review, dissecting its features and benefits to help you decide if this card aligns with your financial goals!

Trending Topics

Benefits of the MBNA Platinum Credit Card: A Flexible Solution for Balance Transfers

Discover the MBNA Platinum Credit Card's 0% interest on balance transfers and purchases, ideal for debt consolidation and big purchases.

Keep Reading

Vanquis Credit Builder Card: A Reliable Way to Improve Your Credit Score

Improve your credit score with the Vanquis Credit Builder Card, offering low limits, flexible payments, and no annual fee.

Keep Reading

Virgin Money Balance Transfer Card: Maximise Savings on Interest

Discover how the Virgin Money Balance Transfer Card can help consolidate debt with long 0% APR and competitive fees.

Keep ReadingYou may also like

The Advantages of the Post Office Credit Card: A Versatile Tool for UK Consumers

Discover the benefits of the Post Office Credit Card, from no overseas fees to 0% interest offers for UK shoppers.

Keep Reading

Tesco Foundation Card: great for a poor credit history

Learn how the Tesco Foundation Credit Card can help build your credit while earning Tesco Clubcard points. No annual fees, apply today!

Keep Reading

Virgin Atlantic Reward Credit Card: Maximise Your Travel Rewards

Earn Virgin Points with the Virgin Atlantic Reward Credit Card. No annual fee and great rewards for frequent Virgin Atlantic flyers.

Keep Reading