Credit Cards

Shop Your Way Mastercard® Review: Easy Point Earnings

Get the full picture with our Shop Your Way Mastercard® review! See how to maximize rewards at where you spend the most, and take advantage of the generous welcome bonus for new cardholders.

Advertisement

Discover how you can earn valuable points easily on everyday purchases!

In this Shop Your Way Mastercard® review, we’ll explore how this credit card can help you make the most of every purchase, whether you’re filling up your tank or enjoying a meal out.

Join us to learn how you can get much more than credit with this incredible financial solution. From a generous welcome bonus to substantial savings, it’s a shopper’s dream come true.

| Credit Score: | A good to excellent score increases your approval rate. |

| Annual Fee: | Absolutely none, making it a cost-effective choice. |

| Purchase APR: | Expect variable rates at 30.49%. |

| Cash Advance APR: | Also variable at 29.99% |

| Other Fees: | The cash advance fee is 5% per transaction;Balance transfer fee is 5% per transfer;Foreign transaction fee charges 3% in U.S. dollars. |

| Welcome Bonus: | Up to $225 in statement credits for new users. (terms apply) |

| Rewards: | Members can earn up to 5% back on eligible purchases, with a flat 1% rate on everything else they buy with the card. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Shop Your Way Mastercard® in action

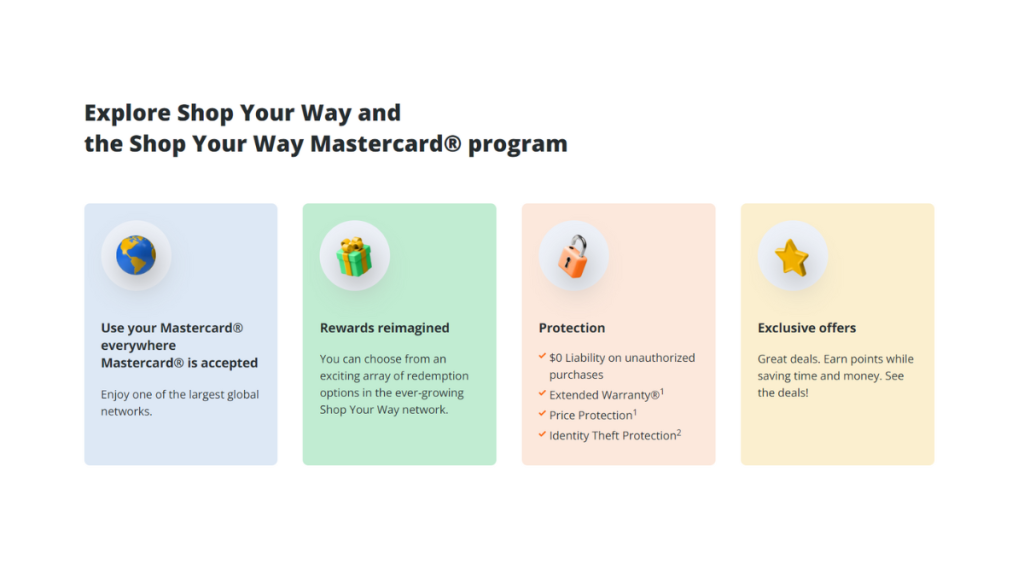

Firstly, the Shop Your Way Mastercard® offers no annual fee, which makes it perfect for daily spending. Its rewards are designed to frequent shoppers, adding value to routine purchases.

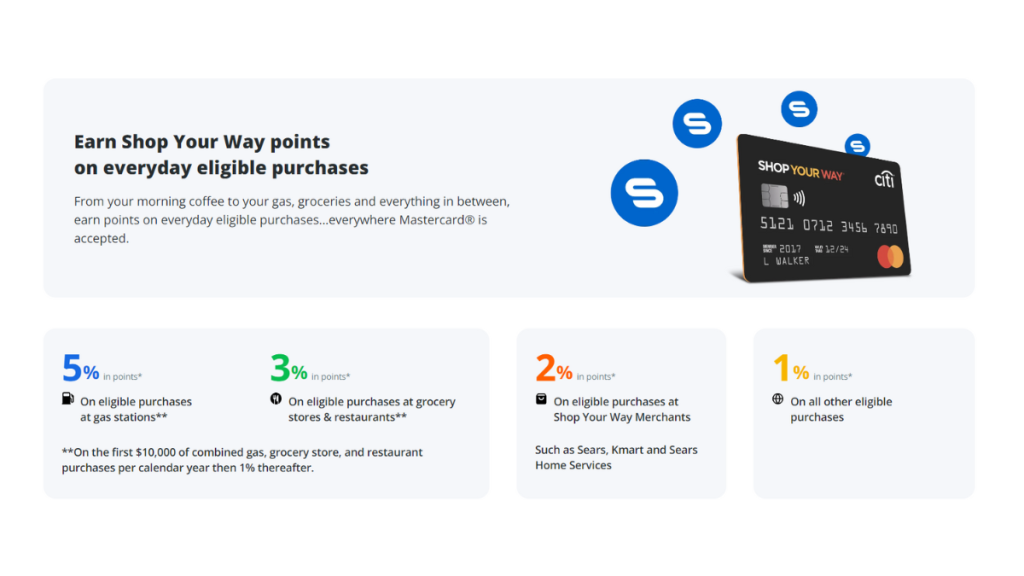

Earning 5% on gas and 3% on groceries and dining (up to $10,000 annually), the card is a fantastic wallet companion for commuters and foodies, shifting to 1% thereafter.

The Shop Your Way also provides a 2% rebate at eligible merchants and a steady 1% on all other purchases, making sure that every swipe adds something back in your pocket.

Better suited for those with good to excellent credit, it has a variable purchase APR of 30.49% and a cash advance APR of 29.99%, which is something to be aware of.

With its welcome bonus and other advantages like extended warranty and identity theft protection, the card is a solid choice for maximizing spending benefits.

Key advantages and possible limitations

Starting a new credit card journey demands a careful evaluation of the tools at your disposal, and the Shop Your Way Mastercard® is no exception.

Next in our Shop Your Way Mastercard® review, we’ll examine the positive impact the card can have on your finances and some potential drawbacks you should know before applying.

Shop Your Way Mastercard® upsides

- No annual fee, making it a cost-effective choice for everyday use.

- Earn 5% in points on gas station purchases, ideal for frequent drivers.

- 3% back on groceries and dining, up to $10,000 yearly, then 1%.

- 2% rewards at Shop Your Way Merchants for better shopping experiences.

- Automatic 1% in points on all other eligible purchases.

- Attractive welcome bonus with up to $225 in statement credits.

- Additional benefits like extended warranty and identity theft protection.

Shop Your Way Mastercard® shortcomings

- High Purchase APR of around 30.49% which can be expensive if carrying a balance.

- Requires good to excellent credit score, limiting its accessibility.

- Rewards are mostly beneficial for specific spending categories.

- Foreign currency conversion outside the U.S. can add up.

- The high reward rate on gas, groceries, and dining has an annual cap.

Your roadmap to applying for Shop Your Way Mastercard®

Getting a Shop Your Way Mastercard® credit card is easier than you might think. Whether you want to apply online or in person, the process is straightforward in both situations.

Below in our Shop Your Way Mastercard® review, we’ll guide you step-by-step on how to get your hands on this card and start enjoying its many benefits! Let’s get started.

What are the basic qualifications for the Shop Your Way Mastercard®?

- Having a good to excellent credit score is essential.

- You need to be a legal adult in order to apply, so the age requirement is 18+.

- You need a valid Social Security Number (SSN) for identification.

- You must have U.S. citizenship or permanent residency status.

- Additionally, a steady source of income is required to meet financial criteria.

- Also, a valid U.S. address for communication and billing.

- Lastly, an active email and phone number for contact and notifications.

Ways you can apply for the Shop Your Way Mastercard®

The Shop Your Way Mastercard® is designed for convenience, so you can easily apply for it online using your phone or a computer. The application takes only a few minutes.

Alternatively, you can also get the card in-person at your local Sears by requesting it at checkout. Keep reading our Shop Your Way Mastercard® review for the details.

Completing your application online

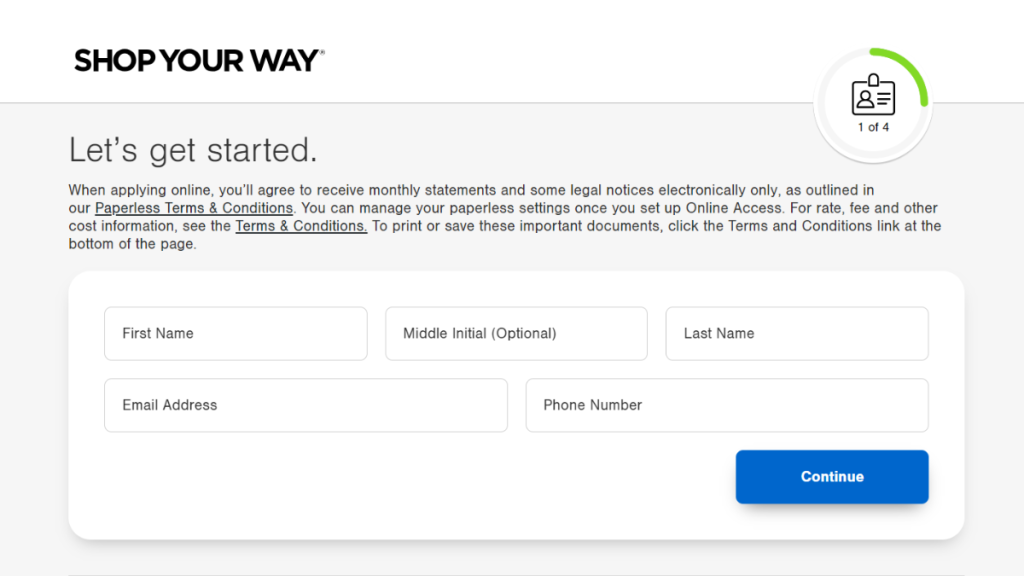

To begin, visit Citi’s official website and browse their drop down menu until you find the Shop Your Way Mastercard®. Then, click “Apply Now” to kickstart the process.

Next, complete the online application form with your personal information. Add your name, address, Social Security Number, and contact details accurately to avoid delays.

Additionally, you’ll have to provide details about your financial situation, such as income and employment. This will help Citi in assessing your eligibility.

Furthermore, take a moment to thoroughly review the card’s terms and conditions. Get to know its interest rates, fees, and rewards structure to make sure it works for you.

Lastly, after completing the application, submit it for review. Citi will carefully evaluate your information, and upon approval, you’ll receive your Shop Your Way Mastercard® by mail.

Completing your application in person

You can also request the card in person if you’d like. Just visit your nearest Sears store and find the Shop Your Way Mastercard® application station—they’re easy to spot.

Once you’ve found the station, pick up an application form. Fill it out with your personal details, including your name, address, Social Security Number, and contact information.

After completing the form, submit it to the store’s staff. They’ll help you with the process, answer any questions, and guide you through the in-store application.

Not the right fit? Try this suggestion: Group One Platinum Card

The Shop Your Way Mastercard® is a rewarding choice for smart shoppers. But if you can’t qualify for it yet, maybe consider an alternative in the Group One Platinum Card.

The Group One Platinum is a credit solution with a merchandise shopping line. It’s available to all credit types, with no employment or credit checks. However, it’s only for Horizon Outlet.

While this may not seem like a great perk, the card charges no interest on purchases, and you can try it for a 7-day risk free period to see if it aligns with your financial needs.

If this sounds like something you’d be interested in, then make sure to check out the following link. We’ll give you a roundup about the card and show you how to apply.

Group One Platinum Card review

Are you looking for an exclusive merchandise credit line that will elevate your spending power up to $750? Then check out our Group One Platinum Card review!

Trending Topics

PREMIER Bankcard® Secured Credit Card Review: Enhance Your Credit!

With the PREMIER Bankcard® Secured Credit Card review, you'll learn how to build credit by having your history reported to major bureaus!

Keep Reading

Group One Platinum Card Review: Shop with Ease

Discover the Group One Platinum Card in our review! Perfect for bad credit, with a $750 merchandise credit line, and no rates on purchases.

Keep Reading

Fortiva® Credit Card Review: An Objective Examination

The Fortiva Credit Card: Understand its features, benefits, and potential drawbacks. Make informed decisions for your financial health.

Keep ReadingYou may also like

Citi® Diamond Preferred® Card Review: Exceptional Benefits!

Enhance your financial life - Don't miss this Citi® Diamond Preferred® Card review! Privileged perks and consistent savings!

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Rebuild Your Credit!

With cash back and no annual fee, the Petal® 1 "No Annual Fee" Visa® Credit Card is an option for those without a credit score!

Keep Reading

Investing for Beginners: Creating a Plan, and Managing Your Investments

Invest safely! This guide covers everything from basic concepts to advanced strategies to help you get started on your financial journey.

Keep Reading