Credit Cards

Self Visa® Secured Card Review: Build credit!

Dive into our comprehensive review of the Self Visa® Secured Card and unlock insights into how it helps individuals establish and strengthen their credit profiles!

Advertisement

Self Visa® Secured Card Review: Apply easily!

Presenting the Self Visa® Secured Card review, a ground-breaking instrument that enables people with bad or poor credit to confidently start their credit-building path.

The Self Visa® Secured Card, which is based on the principles of financial inclusion, stands out as a ray of hope for those trying to create or repair credit. So, read on to learn more!

| Credit Score: | Chance to qualify even with poor credit. There is no credit check to get this card; |

| Annual Fee: | $25 annual fee; |

| Purchase APR: | 28.24% variable APR; |

| Cash Advance APR: | N/A; |

| Other Fees: | There is an administrative fee of $9 to open your account; You’ll need to pay late payment fees and return fees; |

| Welcome Bonus: | None; |

| Rewards: | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Self Visa® Secured Card in action

The Lead Bank Self Visa® Secured Card is a special chance for those with bad or no credit to build a credit history.

For people with poor credit histories or minimal access to fast cash, secured credit cards sometimes come with requirements, including a credit check and an upfront cash security deposit.

Also, the creation of a Credit Builder Account, a secured installment loan, is required in order to get the required security deposit for the Self Visa® Secured Card.

Moreover, this card operates somewhat differently from conventional credit cards.

However, you’ll still need to pay an annual fee to start using this card and some other common credit card fees.

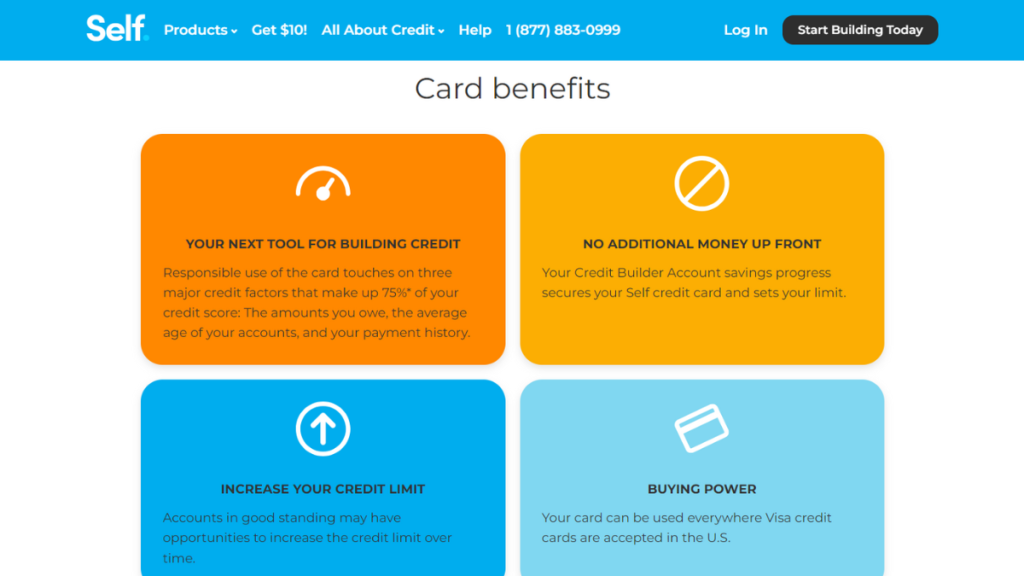

Key advantages and possible limitations

Now that you know more about how this card works, you can check out below to learn about the pros and cons of the Self Visa® Secured Card to know if this is the right card for your finances!

Positive Aspects of the Self Visa® Secured Card

This card can offer incredible perks, such as the chance to build your credit score. However, you’ll need to use this card responsibly to improve your credit score over time.

Moreover, this card doesn’t perform any hard credit checks during the application process.

Also, you’ll be able to build your security deposit over time while you use this card.

Challenges with the Self Visa® Secured Card

Even though this card offers great perks for those with low scores who need to build credit, there are also some downsides.

So, this card can charge some high fees, such as late fees, return payment fees, and more.

Also, this card charges a $25 annual fee, which can be considered high when compared to another similar card that charges no annual fee.

Moreover, there are no rewards or welcome bonuses to earn while you use this card to build your credit score.

Your blueprint for getting the Self Visa® Secured Card

If you want to apply for this card, you’ll need to have an internet connection and a computer.

So, you’ll need to go to the official website to choose the right Self card you need. Then, you’ll need to open an account to apply for one of their cards.

Moreover, you’ll need to complete the application process with no hard credit check and wait to get a response about your application.

Must-have qualifications for the Self Visa® Secured Card?

Before you start applying for this card, you’ll need to understand how the qualification process works.

Also, this card can be incredible for those who don’t have a high credit score. Moreover, you’ll be able to have a chance to qualify with no hard credit check!

In addition, this card doesn’t have any credit score requirements. However, this doesn’t mean that you’ll get approved for sure.

So, you’ll need to meet the eligibility requirements, such as having an active Credit Builder Account in good standing.

Also, you’ll need to make your payments on time, and there may be some other regular requirements to get this card.

Routes you can follow to apply for the Self Visa® Secured Card?

So, read below our tips on how to complete the application process for this card!

Completing your application online

Before you start the application process to get this card, you’ll need to read the requirements and see if you can pay for the annual fee and other fees this card may charge.

So, after you’re sure you want to use this card, you can go to the official website online and provide the information necessary to open your Self Credit Builder Account.

Then, you’ll be able to wait for a response and choose your card if you’ve been approved.

Try the Discover It® Secured Credit Card for a different experience

Now, if you’re looking for different credit-building cards, we can still help! So, you can try applying for the Discover It® Secured Credit Card!

Also, with this card, you’ll be able to earn up to 2% cash back and more perks to build your credit score!

Plus, there are no credit score requirements to get this card! So, if you’re interested, you can read our blog post below to learn all about this card’s perks and find out how to apply!

Discover It® Secured Credit Card review

Unlock financial freedom with our in-depth Discover It® Secured Credit Card review. Enjoy 2% cash back with no annual fee!

Trending Topics

Chase Freedom Flex® Credit Card Review: Max Rewards

Explore Chase Freedom Flex® review for top rewards, no annual fee, and flexible cash back options. Ideal card for savvy spenders!

Keep Reading

Investing for Beginners: Creating a Plan, and Managing Your Investments

Invest safely! This guide covers everything from basic concepts to advanced strategies to help you get started on your financial journey.

Keep ReadingYou may also like

Building an Emergency Fund: A Guide to Financial Security

Uncover the why, what, and how of saving for emergencies — unveil the purposes, types, and recommended amounts.

Keep Reading

Mission Lane Visa® Credit Card Review: for bad credit score!

People with different credit score levels can try to join the Mission Lane Visa® Credit Card: it's easy, fast, and comprehensive!

Keep Reading

Apply for PREMIER Bankcard® Secured Credit Card: Quick process!

If you want to apply for PREMIER Bankcard® Secured Credit Card, you must know you can apply in just a few minutes at the official website.

Keep Reading