Credit Cards

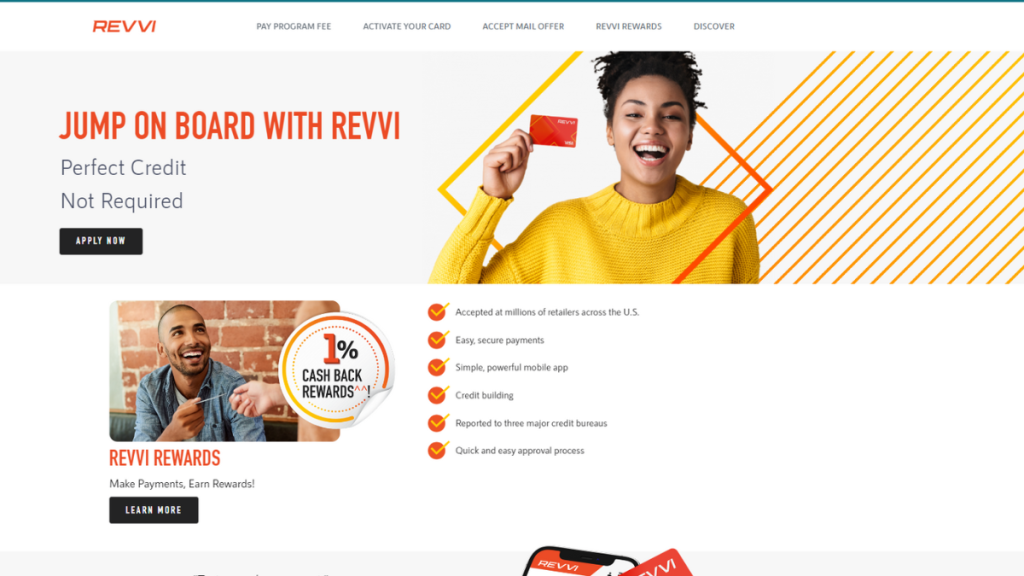

Revvi Credit Card Review: Rebuild Your Credit Securely!

A card that accepts individuals with different credit scores and still offers exclusive benefits is rare, so come and explore the Revvi Credit Card.

Advertisement

With the Revvi Credit Card, you don’t have to worry about a security deposit

If you want to learn more about the Revvi Credit Card, this review is perfect for you! This card is issued by MRV Banks of Missouri and is an option for those without a decent credit history.

Apply for Revvi Credit Card

If you want to apply for the Revvi Credit Card, you can relax! The entire process is done online without stress and complications!

It reports to major national agencies, helping you maintain an active and financially healthy profile. However, this depends on how you use the card and its features.

| Credit Score | 629 or lower; |

| Annual Fee | $75 in the first year and then $48; |

| Purchase APR | 35.99%; |

| Cash Advance APR | 35.99%; |

| Other Fees | One-time program fee: $95; Monthly fee: $0 in the first year, and then $8.25; Cash advance: $10 or 3%; Late fee: $41; |

| Welcome Bonus | Not available; |

| Rewards | 1% in cash-back rewards. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Revvi Credit Card in action

Now, let’s delve into Revvi Credit Card main features. The main feature that stands out with the Revvi Credit Card is that it’s designed for those with a low credit score.

However, with the 1% cash back, it transforms the way you use the card, making it more advantageous.

However, the exorbitant fees charged on this card can pose challenges to your goals.

So, if you’ve only obtained the minimum limit of US$ 300, your rebuilding efforts may be hindered.

This is because the sum of the fees ($170) is deducted from your limit, leaving only US$ 130. Moreover, remember that it’s important not to utilize your credit to maintain a good history heavily.

Key advantages and possible limitations

But do the positive points, like cash back, compensate for the excessive fees? Also, how does the credit limit work, and can it be increased during card usage?

Positive aspects of the Revvi Credit Card

Among the main advantages is the 1% cash back. However, it comes with some rules. Firstly, you only earn the money back when you pay the bank bill, not when making the purchase.

Additionally, you can only redeem it after six months of using the Revvi Credit Card! But it’s not just the cash back that is a positive point.

Furthermore, in this Revvi Credit Card review, it’s essential to highlight the benefits of this card being a Visa, including protection against unauthorized charges on your card and even roadside assistance!

Challenges with the Revvi Credit Card

The main one is that the card, despite being international, cannot be used for purchases abroad.

In other words, these purchases are prohibited and subject to taxation! So, forget about that possibility.

Additionally, although you can increase the card limit from US$ 300 after 12 cycles of card usage, there’s a condition.

Must-have qualifications for the Revvi Credit Card?

Among the requirements, you must be over 18 years old and reside in the US.

Moreover, the card accepts different individuals with various credit histories. Thus, even with a bad credit score, you are eligible to apply for the Revvi Credit Card!

Looking to get the Revvi Credit Card? We’ve compiled the necessary steps

If you liked the Revvi Credit Card, you must be eager to join. But the next question is: how to apply? To help you, we’ve prepared an exclusive blueprint!

Simply visit their website, and you can apply right away! The entire process is quick and convenient! So, come and learn more!

Apply for Revvi Credit Card

If you want to apply for the Revvi Credit Card, you can relax! The entire process is done online without stress and complications!

Trending Topics

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Rebuild Your Credit!

With cash back and no annual fee, the Petal® 1 "No Annual Fee" Visa® Credit Card is an option for those without a credit score!

Keep Reading

Gemini Credit Card® Review: Crypto on Every Swipe!

Explore our Gemini Credit Card® review to learn how you can get instant crypto rewards, stylish metal card designs, and top security.

Keep ReadingYou may also like

U.S. Bank Altitude® Go Visa Signature® Card Review: 0% intro APR

With this U.S. Bank Altitude® Go Visa Signature® Card Review, discover how to earn 20,000 bonus points in the first few months!

Keep Reading

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep Reading

Citi® Diamond Preferred® Card Review: Exceptional Benefits!

Enhance your financial life - Don't miss this Citi® Diamond Preferred® Card review! Privileged perks and consistent savings!

Keep Reading