Credit Cards

Reflex Mastercard® Review: A Secure Option for Credit Rebuilding!

The Reflex Mastercard® offers several benefits as a Mastercard credit card, including extensive insurance coverage and purchasing possibilities.

Advertisement

High initial limit and the potential to increase it in a few months? Only with the Reflex Mastercard®!

A credit rebuilding card is the main highlight of this Reflex Mastercard® review! This card accepts individuals with different credit scores, making access easier.

However, it may also come with somewhat higher fees compared to other cards. But there are exclusive possibilities for those who maintain consistent payments during the initial months! Let’s find out more.

| Credit Score | 300-719; |

| Annual Fee | $75 – $125, after that $99 – $125; |

| Purchase APR | 29.99%; |

| Cash Advance APR | 29.99%; |

| Other Fees | Cash advance: US$ 10 or 3%Foreign transaction: 3%Monthly fee: $0 – $10; |

| Welcome Bonus | Not Available; |

| Rewards | Not Available. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Reflex Mastercard® in action

In this Reflex Mastercard® review, we’ll help you understand how this card fits among various credit rebuilding options.

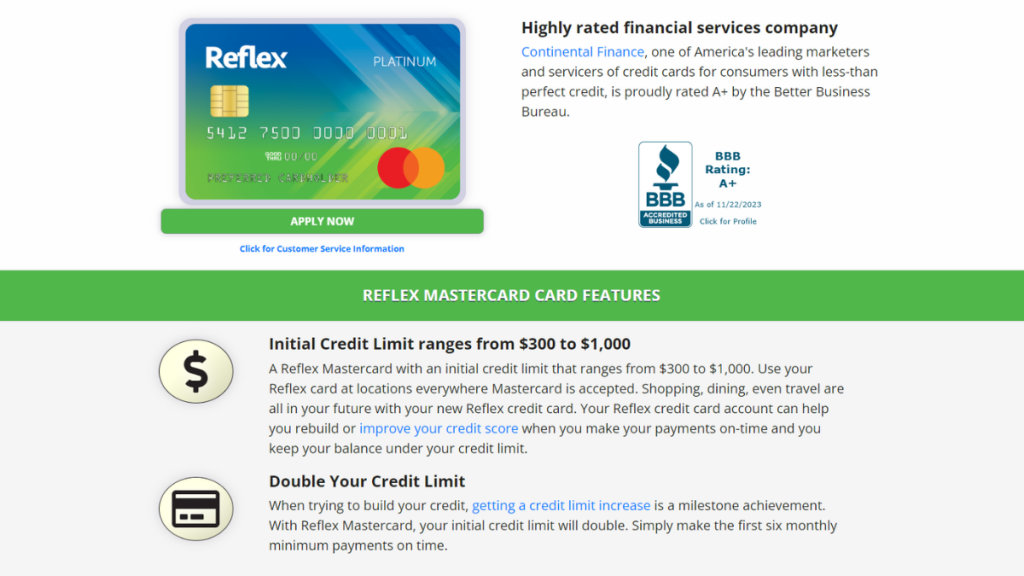

Firstly, the Reflex Mastercard® is a secure card with an initial limit between $300 and $1,000! Your credit score will help determine this value during the application.

Moreover, to double your limit, simply make the first six payments punctually. Within this period, you can have access to $2,000. This is a high amount for cards of this profile.

However, this card comes with many fees, making its use difficult and expensive, including foreign transaction fees, cash advance fees, and even a monthly fee that can be up to $10!

Key advantages and possible limitations

To make the Reflex Mastercard® review more comprehensive, let’s explore some positive and negative aspects that can influence whether this card is a good option.

Positive aspects of the Reflex Mastercard®

The first positive point of the Reflex Mastercard® in this review is its easy accessibility. It accommodates individuals with bad credit but also accepts those with good credit!

Additionally, with its monthly reporting to the three major U.S. financial agencies, you ensure that you can explore better options in a short time!

Furthermore, the ability to double your limit is enticing for those seeking broader possibilities with a credit card!

Challenges with the Reflex Mastercard®

However, not everything is positive in this Reflex Mastercard® review. With high-interest rates and elevated fees, you may end up accumulating more debt instead of rebuilding your credit score.

So, it’s crucial to stay vigilant. In addition to the high annual fee that can reach up to $120, you must also pay a monthly maintenance fee of up to $10! And the charges don’t stop there!

Moreover, the interest rate is 29.99%, making it challenging to make purchases or even request cash advances.

In other words, your actions with the Reflex Mastercard® are limited.

Your blueprint for getting the Reflex Mastercard®

In this Reflex Mastercard® review, we’ll also guide you on obtaining your card! The entire process is conducted virtually to facilitate and expedite it. In just a few moments, you can know the result.

Nevertheless, you need to be aware of some details, such as basic requirements for obtaining the card. So, check out these details and follow our blueprint to join!

Must-have qualifications for the Reflex Mastercard®?

There aren’t many requirements to join the Reflex Mastercard®. Firstly, you need to have a credit score of at least 300, a considered low value, but limited.

However, the higher your score and income, the more benefits you can enjoy with this card, such as a lower annual fee and a higher credit limit! So, consider these factors.

Additionally, you must be over 18 years old and a resident of the U.S. Moreover, you have a great chance of getting this card!

Routes you can follow to apply for the Reflex Mastercard®

Despite the Reflex Mastercard® having a mobile app, the best way to join is through the Continental Finance website.

So, you can access it through the link we provide below.

Completing your application online

Upon entering the Reflex Mastercard® page, click on the “apply now” option. You’ll be redirected to a new tab with a form.

Take advantage of this moment to read the details and clarify any doubts about the card. In any case, fill out the form to initiate your application process.

Remember to provide your name, phone number, address, email, and social security number. Additionally, you need to calculate your monthly income. After submission, just wait for a quick response!

Try the Fortiva® Credit Card for a different experience

If you liked the findings in our Reflex Mastercard® review, join as soon as possible. However, it’s essential to compare and explore different credit card offers before making your decision.

So, we present the Fortiva® Credit Card, an option also focused on securely and functionally helping those in need of credit rebuilding.

This card accepts different types of individuals and is quite accessible.

However, fees are a point to consider when evaluating this option. So, if you want to discover more information about the card’s features and how to join, come check out our exclusive review!

Fortiva® Credit Card Review

The Fortiva Credit Card: Understand its features, benefits, and potential drawbacks. Make informed decisions for your financial health.

Trending Topics

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep Reading

Travel on a Budget: Tips for Affordable Adventures

Conquer amazing destinations without breaking the bank. Essential tips for travel on a budget, from transportation to food.

Keep Reading

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep ReadingYou may also like

Chase Slate Edge℠ Review: Get Financial Control

Explore our Chase Slate Edge℠ Credit Card review for 0% intro APR, no annual fee, and exclusive benefits that can elevate your finances.

Keep Reading

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep Reading

Investing for Beginners: Creating a Plan, and Managing Your Investments

Invest safely! This guide covers everything from basic concepts to advanced strategies to help you get started on your financial journey.

Keep Reading