Looking for a credit card that rewards you with points on everyday purchases and travel?

The Virgin Atlantic Reward Credit Card is perfect for those who want to earn travel rewards without paying an annual fee!

Advertisement

The Virgin Atlantic Reward allows you to accumulate Virgin Points with every pound you spend, which can be redeemed for flights, cabin upgrades, and more with Virgin Atlantic and SkyTeam partner airlines. With the bonus of no annual fee, it’s a strong contender for anyone looking to enhance their travel experience without extra costs.

The Virgin Atlantic Reward allows you to accumulate Virgin Points with every pound you spend, which can be redeemed for flights, cabin upgrades, and more with Virgin Atlantic and SkyTeam partner airlines. With the bonus of no annual fee, it’s a strong contender for anyone looking to enhance their travel experience without extra costs.

You will remain in the same website

Below are some of its top features:

You will remain in the same website

You will be redirected to another website

Why Choose the Virgin Atlantic Reward Credit Card?

The Virgin Atlantic Reward Credit Card offers several unique advantages for cardholders who love to travel and are keen on building up points to spend on flights and other perks.

Advantages and Disadvantages of the Virgin Atlantic Reward Credit Card

Now, let’s examine the pros and cons of this card more closely so you can make an informed decision.

Pros:

- No annual fee: You can enjoy the benefits of this card without the financial commitment of an annual fee.

- Earn points easily: Collect 0.75 points per £1 on general spending and 1.5 points per £1 on Virgin Atlantic purchases.

- Rewards for high spenders: Spend £20,000 a year to receive a companion ticket or upgrade voucher, providing excellent value for frequent flyers.

- Global redemption: You can redeem points for flights with Virgin Atlantic and SkyTeam partners, such as Delta, KLM, and Air France.

- No foreign transaction fees on Virgin Atlantic bookings: If you frequently book travel directly with Virgin Atlantic, you won’t face extra charges for transactions in foreign currencies.

Cons:

- Foreign transaction fees: A 2.99% foreign transaction fee applies to purchases made in non-GBP currencies. This makes it less suitable for frequent international travellers who spend in foreign currencies.

- Cash withdrawal fees: Avoid withdrawing cash with this card. There’s a 5% cash withdrawal fee, plus interest starts accruing from the day of the transaction.

- High spending threshold for rewards: You need to spend £20,000 per year to unlock the companion ticket or upgrade voucher, which may be too high for some cardholders.

- No introductory bonuses: Unlike other reward cards, the Virgin Atlantic Reward Credit Card doesn’t offer a sign-up bonus or introductory interest-free period.

What Makes the Virgin Atlantic Reward Credit Card Special?

One key attraction of the Virgin Atlantic Reward Credit Card is its ease of earning points and redeeming them for valuable travel perks.

Whether you’re a frequent flyer or simply looking to build up points gradually through everyday spending, this card offers a solid opportunity.

Earning Virgin Points

The points system is simple:

- 0.75 points per £1 spent on all other purchases.

- 1.5 points per £1 spent on Virgin Atlantic flights and Virgin Holidays bookings.

While these rates are not the highest on the market, they offer consistent value, particularly if you frequently book Virgin Atlantic flights.

Over time, your points can accumulate to provide substantial savings on future travel.

What Can You Redeem Points For?

Virgin Points can be redeemed in a variety of ways, making the card flexible for all types of travellers.

Here are some of the key ways to use your points:

- Flights: Redeem points for flights on Virgin Atlantic or SkyTeam partner airlines, such as Delta, KLM, and Air France. You can use your points to book flights worldwide to a wide range of destinations.

- Cabin upgrades: Upgrade your flight experience by using points to move from economy to premium or from premium to upper class.

- Companion tickets: If you’ve earned enough points and spent £20,000 a year, you can bring a companion along on your next trip, either for free or at a reduced rate.

- Hotels: You can also redeem points for stays at selected hotels, adding even more flexibility to your travel plans.

The Upgrade Voucher and Companion Ticket

Two of the Virgin Atlantic Reward Credit Card's most exciting perks are the upgrade voucher and companion ticket, both of which are available if you meet the spending threshold of £20,000 per year.

- Upgrade voucher: Use this to move up one cabin class on a Virgin Atlantic flight. Whether upgrading from economy to premium economy or from premium economy to upper class, the voucher adds considerable value to your points.

- Companion ticket: Fly with a friend or family member in the same cabin class on a Virgin Atlantic flight, with one ticket being paid for entirely with points or partially with cash.

These perks can be worth hundreds of pounds, making the card a fantastic choice for those who frequently spend and fly with Virgin Atlantic.

While the card offers great rewards for booking flights with Virgin Atlantic, it’s not the best option for purchasing abroad due to the 2.99% foreign transaction fee. If you frequently spend abroad, you may want to consider a card with no foreign transaction fees, such as the Halifax Clarity Credit Card.

Yes, Virgin Points can be redeemed with SkyTeam alliance partners, including airlines like Delta, KLM, Air France, and more. This offers great flexibility when booking flights to various destinations worldwide.

If you don’t reach the £20,000 spending threshold, you won’t qualify for the companion ticket or upgrade voucher. However, you’ll still earn Virgin Points on all purchases, which can be redeemed for flights and other rewards.

Conclusion

The Virgin Atlantic Reward Credit Card is a great choice for Virgin Atlantic flyers and anyone who wants to earn Virgin Points on their everyday spending.

With no annual fee, it offers excellent value for those who regularly travel with Virgin Atlantic or its SkyTeam partners.

While the card’s foreign transaction fees and cash withdrawal costs make it less attractive for international spending, the companion ticket and upgrade voucher rewards can more than make up for it—especially if you hit the £20,000 annual spending target.

If you’re looking to boost your travel experience without paying an annual fee, the Virgin Atlantic Reward Credit Card offers solid rewards and valuable perks that can enhance your next holiday.

Looking for more benefits and faster point accumulation?

Consider the Barclaycard Rewards Credit Card!

Barclaycard Rewards Card Review: Earn Cashback!

From flexible redemption options to unique benefits, find out why this card stands out in the crowded credit card market. Maximize your rewards and make informed financia

Trending Topics

M&S Rewards Credit Card: A Card That Rewards Your Everyday Spending

Earn points on every purchase with the Barclaycard Rewards, plus enjoy 0% foreign transaction fees. Great for everyday spending and travel.

Keep Reading

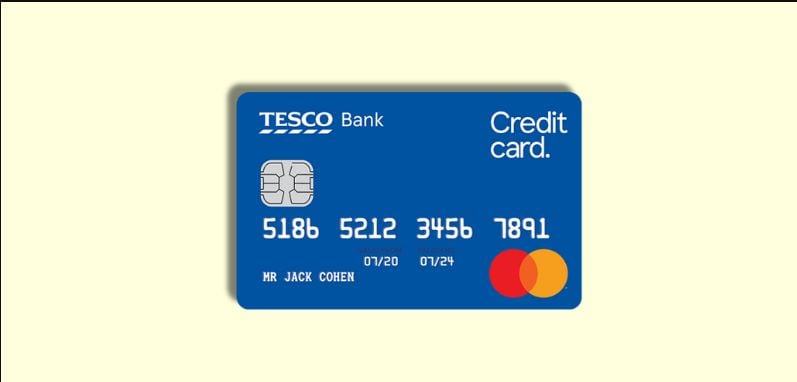

Tesco Balance Transfer Credit Card: A Smart Way to Consolidate Debt

Consolidate your debt with the Tesco Balance Transfer Card. Enjoy 0% interest on balance transfers for 27 months and earn Clubcard points.

Keep Reading

HSBC Student Credit Card: A Flexible Solution for Managing University Expenses

HSBC Student Credit Card offers a no-fee way to build credit while managing expenses. It has flexible limits and mobile banking support.

Keep ReadingYou may also like

Tesco Foundation Card: great for a poor credit history

Learn how the Tesco Foundation Credit Card can help build your credit while earning Tesco Clubcard points. No annual fees, apply today!

Keep Reading

NatWest Balance Transfer Credit Card: A Smart Choice for Managing Debt

Manage your debt with the NatWest Balance Transfer Card. Enjoy 0% interest for 22 months on balance transfers with no annual fees.

Keep Reading