Credit Cards

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Discover the perks in our Quicksilver Cash Rewards Credit Card review. Enjoy endless cash back and zero annual fees, plus exclusive access to travel and shopping rewards that elevate every purchase.

Advertisement

Explore endless rewards and exclusive benefits with the Quicksilver Cash Rewards

Com explore a world of unlimited perks in our Quicksilver Cash Rewards Credit Card review. With this card, every purchase earns you more, making it a powerful everyday financial ally.

Imagine a card that adds value with each swipe. The Quicksilver Card isn’t just a payment method; it’s your ticket to smarter spending. So read on to see how you can benefit from it.

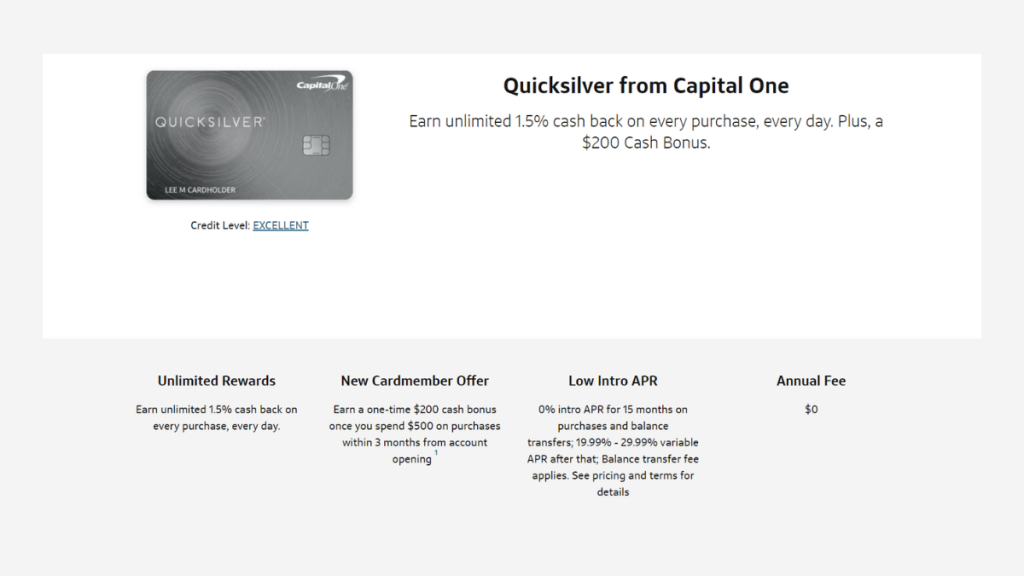

| Credit Score: | Aim for a higher score, as this one requires excellence. |

| Annual Fee: | Pay zero annual fees to enjoy the card’s many perks. |

| Purchase APR: | Newcomers get a 15-month period of low APR on transfers and purchases, then 19.99% – 29.99% variable kicks in. |

| Cash Advance APR: | Steady at 29.99% variable. |

| Other Fees: | Balance transfers start at 3%, cash advances at $3 or 3%, and late payments could cost up to $40. |

| Welcome Bonus: | A warm hello with a $200 bonus after a $500 spend in 3 months. |

| Rewards: | With every swipe comes a 1.5% return, unlimited and uncapped! |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Quicksilver Cash Rewards Credit Card in action

The main goal in this Quicksilver Cash Rewards Credit Card review is to help you see if it aligns with your expectations. So we’ll begin with its first standout feature: the lack of annual fees.

If this is enough to get you interested, there’s plenty more! Like a shiny, generous welcome bonus. Spend $500 in the first 3 months and hello, $200 right in your pocket.

Now let’s talk rewards. Every swipe with the Quicksilver Card means 1.5% back in your wallet. Whether it’s coffee or a couch, you’re earning. It’s simple: spend more, earn more.

Additionally, the initial 0% APR period is a financial breather. For 15 months, enjoy no interest on purchases and balance transfers. After that, the variable 19.99% – 29.99% APR kicks in.

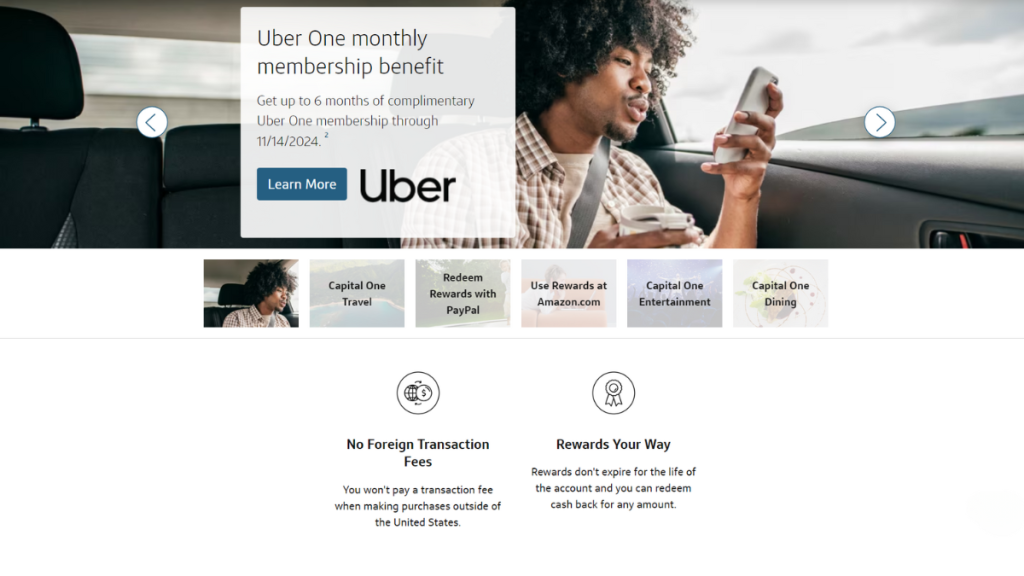

Lastly, travel perks and security features add value. Shopping online? Virtual card numbers keep your money safe. It’s not just a card; it’s your trusted financial companion for life.

Key advantages and possible limitations

While the card offers a plethora of benefits that cater to everyday spending and financial management, it’s essential to weigh these against its drawbacks

Next in our Quicksilver Cash Rewards Credit Card review, we’ll examine the card’s strengths and potential downsides so there are no surprises down the line.

Positive aspects of the Quicksilver Cash Rewards Credit Card

- Zero annual fee keeps your budget happy and intact.

- Welcome aboard with a $200 bonus for just $500 spent in 3 months.

- Every purchase smiles back with a 1.5% cash back reward.

- A 15-month no-interest honeymoon on purchases and balance transfers.

- International travelers can rejoice with no extra fees on foreign transactions.

Challenges with the Quicksilver Cash Rewards Credit Card

- Not for newcomers to credit, since an excellent score is a must.

- Cash advances come with a steep 29.99% APR.

- Post-15 months, balance transfers get pricier at 4%.

- The post-intro APR might give your wallet a workout if you don’t manage it properly.

- Miss a payment and face a penalty up to $40. Stay alert!

Your blueprint for getting the Quicksilver Cash Rewards Credit Card

While the requirements might pose a limitation to most customers, if you’re able to meet Capital One’s financial criteria, getting this card in your arsenal is as simple as it gets.

Must-have qualifications for the Quicksilver Cash Rewards Credit Card

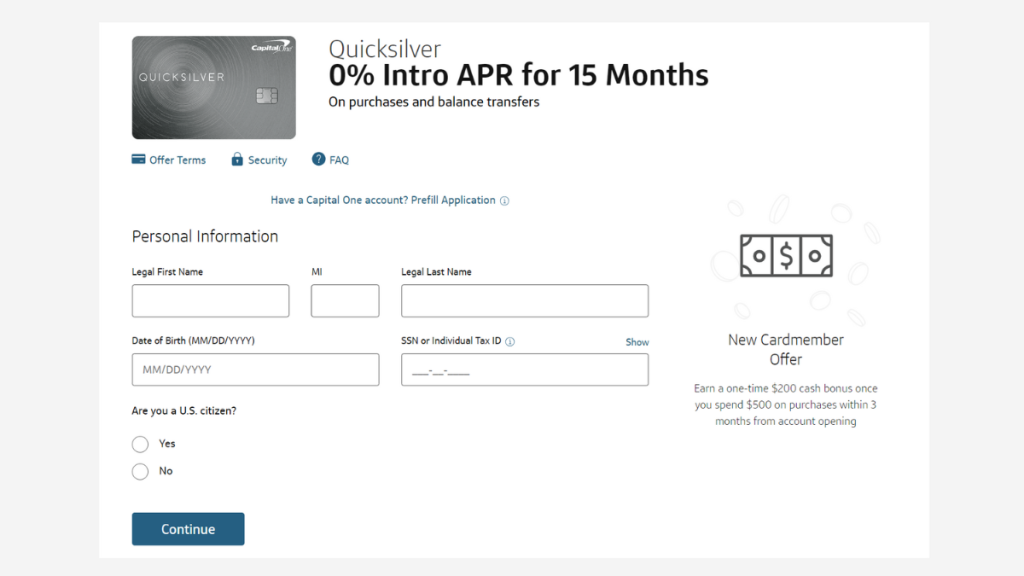

- Provide personal details like full name, date of birth, and Social Security number.

- Include financial information such as employment status and annual income.

- Share contact essentials including home address, email address, and phone number.

- Offer banking details for balance transfers or rewards deposits.

- Finally, meet the age requirement of at least 18 years old, 19 in some states.

Routes you can follow to apply for the Quicksilver Cash Rewards Credit Card

The advantages of the Quicksilver Cash Rewards Credit Card go beyond its perks and benefits, extending it to its application options. You can do it online, via app, or in person.

Completing your application online

Starting is super easy! Firstly, head over to Capital One’s official website and, on the home page, find the ‘Credit Cards’ section. Here, you’ll find their entire catalog.

Then, find and select the Quicksilver, entering its product’s page. Click on ‘Apply Now’ to begin the process. You’ll be prompted to enter personal and financial details for eligibility checks.

Once you’ve input your information, review it carefully for accuracy. After reviewing, click ‘Submit’ to send your application to Capital One for approval.

Lastly, await Capital One’s decision. This typically comes quickly, often instantly. If approved, you’ll receive details on your credit limit and card arrival.

Completing your application via mobile app

Download the Capital One mobile app for free so you can begin applying. First, log in or sign up if you’re new. Navigate to the ‘Credit Cards’ section to explore your options.

Within the app, browse until you find the Quicksilver card. Tap ‘Apply Now’ to begin. The app will guide you through entering your personal and financial information correctly.

After filling out the form, double-check all details. Submit your application with a tap. You’ll receive a quick response, and if approved, info about your new card.

Completing your application in person

To apply in person, visit your nearest Capital One branch. Start by speaking with a representative. They are the most qualified people to tell you about the card.

Then, the representative will help you with the application. Provide your personal and financial details. These ensure a secure and thorough process for your application.

Lastly, after completing the form, the representative will process it. You’ll receive feedback on your application status shortly, possibly even during your visit.

Try the Discover it® Chrome for a different experience

Our Quicksilver Cash Rewards Credit Card review highlighted its broad appeal. Yet, for specific needs, the Discover it® Chrome Credit Card is a notable alternative.

The Discover it® Chrome shines bright with bonuses on gas and dining, offering cash back where it counts. Its first-year cashback match and no annual fee are attractive perks.

Interested in earning rewards at the pump and at the table? Learn more about the Discover it® Chrome Credit Card and how to apply at the link below.

Discover it® Chrome Credit Card review

Looking for a credit card that gives you more on your gas and dining experiences? Check our Discover it® Chrome Credit Card review!

Trending Topics

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Shop Your Way Mastercard® Review: Easy Point Earnings

Discover in our Shop Your Way Mastercard® review how to earn big on gas and groceries while enjoying extended warranty perks on purchases.

Keep Reading

FIT Mastercard® Review: Rebuild Your Credit Securely!

Find out how FIT Mastercard® Credit Card can help you rebuild your credit score without paying a security deposit with our review!

Keep ReadingYou may also like

Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card: Earn back

If you want to know how to apply for the Petal® 1 "No Annual Fee" Visa® Credit Card, it's an easy process: receive it in 10 days!

Keep Reading

First Digital Mastercard® Review: Apply even with a low credit!

The First Digital Mastercard® review introduces you to a credit card with 1% cash back on all purchases and no security deposit required!

Keep Reading

Self Visa® Secured Card Review: Build credit!

Discover how the Self Visa® Secured Card can jumpstart your credit journey from scratch with no credit history!

Keep Reading