Credit Cards

Prime Visa Credit Card Review: $100 Amazon Gift Instantly

The Prime Visa Credit Card offers valuable rewards for Prime members, and all without the burden of an annual fee. Check out our full review to learn how you can make the most out of your membership.

Advertisement

Get instant rewards and comprehensive travel protections with your Prime membership!

A Prime membership can offer far more than entertainment and free shipping. In this Prime Visa Credit Card review, we’re going to reveal the additional benefits waiting for you

Get ready to meet your next financial solution, perfect for earning high rewards and getting access to incredible perks. Keep reading to uncover every aspect of the Prime Visa Card.

| Credit Score: | Aim high! Ideal for good-to-excellent scores. |

| Annual Fee: | None, offering cost-effective card ownership. |

| Purchase APR: | 19.49%–27.49% (varies with market). |

| Cash Advance APR: | Stands at 29.99%, variable with the market’s prime rate. |

| Other Fees: | There’s a balance transfer fee of either $5 or 4% of the amount (whichever is greater), and a cash advance fee of either $5 or 4% of the transaction amount. Late and returned payment fees can go up to $39. |

| Welcome Bonus: | New members can enjoy a $100 gift card right away, as soon as their application is accepted. |

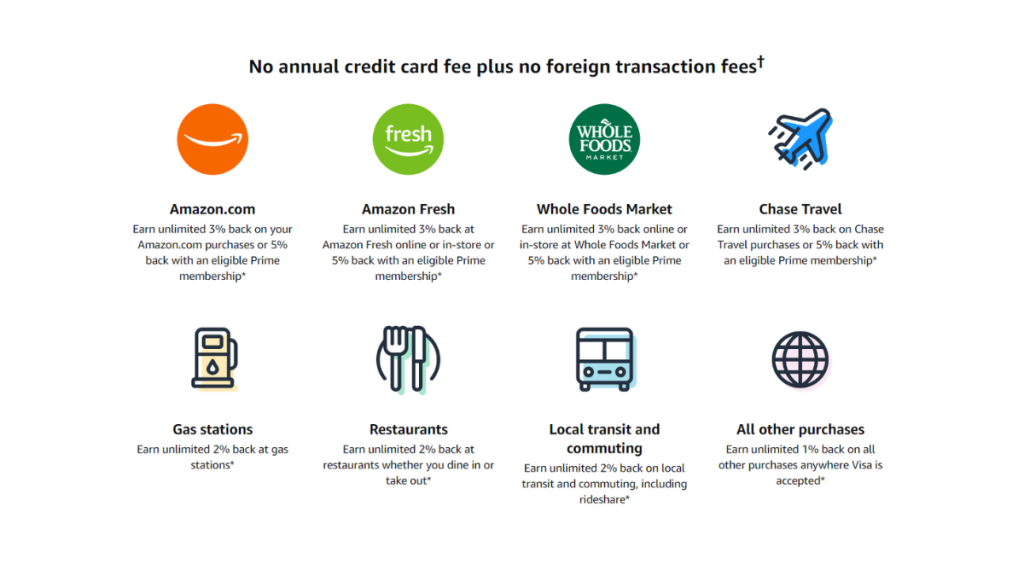

| Rewards: | A Prime membership lets you earn 5% back on Amazon and affiliates, 2% back at gas stations, restaurants, and local transit, and 1% on all other swipes. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Prime Visa Credit Card in action

The Prime Visa Credit Card shines for anyone who usually shops at Amazon. With a $100 welcome gift and zero annual fees, it’s a low-cost choice for savvy spenders.

Moreover, the rewards are very tempting. You can earn up to 5% back on selected purchases, and 1% back on everything else. This benefit adds value to every purchase.

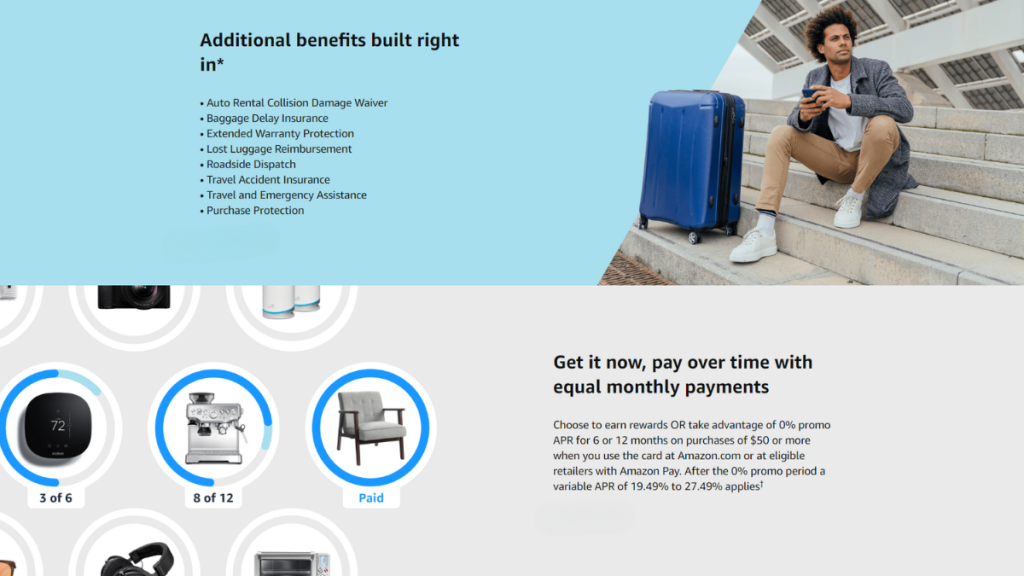

Additionally, the card is travel-friendly. No foreign transaction fees mean worry-free international shopping. It’s ideal for travelers and online buyers.

However, the variable APR of 19.49%–27.49% and cash advance APR of 29.99% call for an extra layer of attention. Managing the card well is key to enjoying its many benefits.

Key advantages and possible limitations

Continuing our Prime Visa Credit Card review, it’s time to take a closer look at where it stands high and where it falls short. Let’s see its highlights and potential drawbacks below.

Positive aspects of the Prime Visa Credit Card

- New cardholders are eligible for a delightful welcome gift to use at Amazon.

- Regular Whole Foods customers can also benefit from a high rebate.

- Zero annual fee makes it a wallet-friendly choice for users.

- Enjoy global shopping without extra charges on foreign transactions.

- Get perks designed for peace of mind like travel insurance and purchase protection.

Challenges with the Prime Visa Credit Card

- Variable APR can be relatively high, impacting those who carry balances.

- Cash advances come with a significant cost, not ideal for emergency funds.

- Also, some transactions like balance transfers add extra fees.

- Requires a strong credit score, which ends up excluding some applicants.

- Moreover, top-tier rewards are exclusive to Prime members, limiting perks for others.

Your blueprint for getting the Prime Visa Credit Card

Getting your Prime Visa Card might be just as simple as shopping on Amazon. That is, as long as you have a good score and a solid financial background to boost your chances.

Since Amazon is mostly internet-based, their website is your primary hub for a successful application. If you’re not sure how to begin, we are here to help you get things started.

Must-have qualifications for the Prime Visa Credit Card

- Firstly, aim for at least a good credit score to increase your odds.

- Secondly, you must have a Prime membership, or you won’t be able to apply.

- A stable financial history is essential, as it reflects your creditworthiness.

- Importantly, valid identification and U.S. residency are also required.

- Applicants should have a regular income source to show repayment capability.

- Finally, being at least 18 years old is also a requirement.

Routes you can follow to apply for the Prime Visa Credit Card

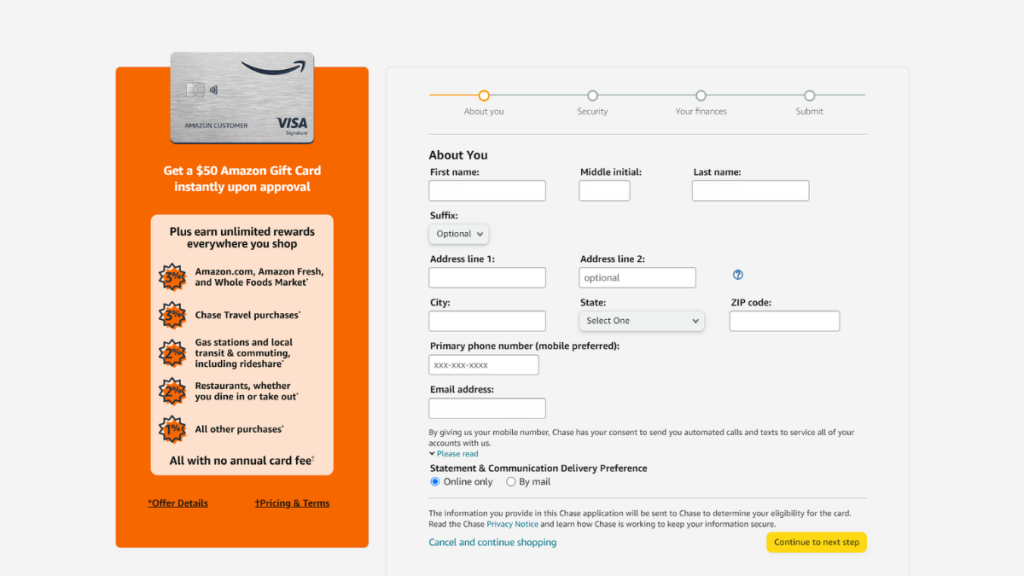

The Prime Visa Credit Card is backed by Chase, but you can only apply for it on Amazon’s official platform. Below, in our Prime Visa Credit Card review, we’ll relay the specifics.

Completing your application online

Before you even begin your application, you’ll have to log into your Amazon Prime membership account. This is crucial, since the card’s benefits are Prime-exclusive.

Logging in links your Prime status to your card request, which is another important step for processing and verifying your membership. It also fastens the entire procedure.

On Amazon’s website, look for the “credit cards” tab on the bottom of your screen. Here, you’ll find the application form, and is where your path towards impressive rewards begins.

Fill out the application form with your personal and financial details. Remember that accuracy here is key, as this information will determine your eligibility and credit limit.

Lastly, review and submit your application. Amazon’s user-friendly interface makes this step straightforward, and feedback takes only a few seconds.

If approved, Amazon will likely ship your new card to your address within a few business days. Activate the card, download the Chase mobile app, and enjoy!

Try the Upgrade Triple Cash Visa® for a different experience

While the Prime Visa Credit Card is an appealing option for Prime members, it offers very little value if you don’t have a membership or aren’t a regular customer.

Considering more flexibility in spending and earning rewards on your purchases? Then the Upgrade Triple Cash Rewards Visa® might fulfill those needs in a pretty spectacular way.

The Upgrade Triple Cash Rewards Visa® has a series of benefits designed to keep you on top of your spending. This includes high rewards and an even higher credit limit.

If this aligns with your idea of a perfect card, follow the link below to dive deeper into its details, including the application process.

Upgrade Triple Cash Visa®

Are you in the market for a credit card with a higher credit limit, no annual fee, and cash back rewards? Then check out this Upgrade Triple Cash Visa® review!

Trending Topics

Shop Your Way Mastercard® Review: Easy Point Earnings

Discover in our Shop Your Way Mastercard® review how to earn big on gas and groceries while enjoying extended warranty perks on purchases.

Keep Reading

Financial Wellness: Tips for Achieving Financial Stability

In this article, learn practical strategies to achieve financial wellness and attain a more balanced and peaceful life.

Keep Reading

Fortiva® Credit Card Review: An Objective Examination

The Fortiva Credit Card: Understand its features, benefits, and potential drawbacks. Make informed decisions for your financial health.

Keep ReadingYou may also like

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep Reading

Revvi Credit Card Review: Rebuild Your Credit Securely!

Discover how to get cash back on all your purchases with the Revvi Credit Card Review. This card welcomes people with bad credit scores!

Keep Reading

Reseña Destiny Mastercard®: línea de crédito de $300

La Destiny Mastercard® es una tarjeta de crédito sin garantía diseñada para aquellos que buscan reconstruir sus puntajes de crédito.

Keep Reading