Reviews

PenFed Personal Loans Review: up to 50K

Get up to $50,000 with fast funding! PenFed Personal Loans is the financial solution you need! No hidden fees!

Advertisement

Low rates, no fees, and simple solutions!

Whether it’s to consolidate debt, finance a large purchase, or cover an unexpected expense, read our PenFed Personal Loan review to discover a possible choice for individuals who are seeking financial flexibility without the burden of high costs.

It accepts borrowers with excellent credit, and unlike other credit unions, you can apply for membership as part of your loan application.

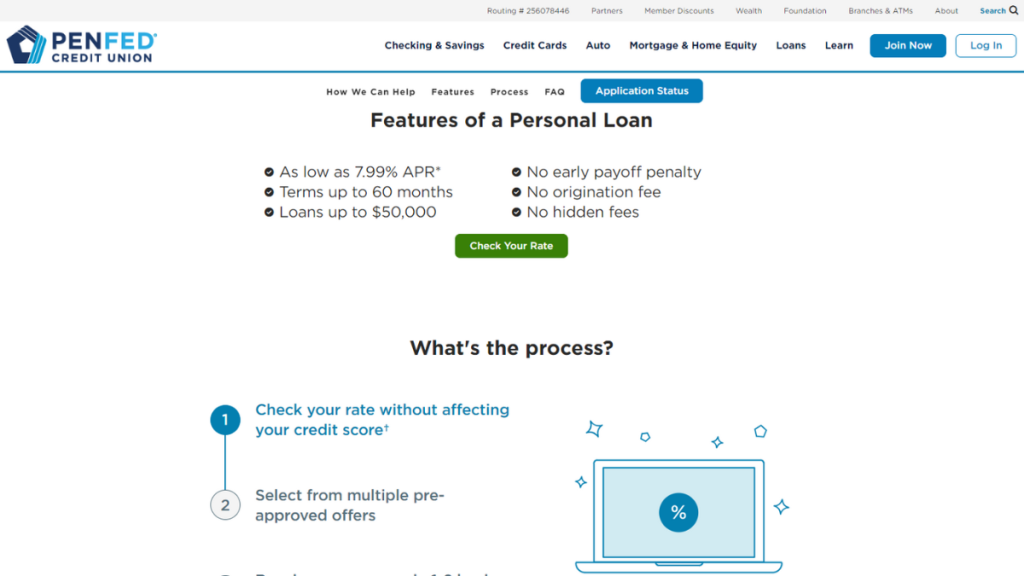

| APR | 7.74% – 17.99%; |

| Loan Purpose | Debt Consolidation, home improvement, and more; |

| Loan Amounts | $2,000 to $50,000; |

| Credit Needed | 700; |

| Origination Fee | No origination fee; |

| Late Fee | $29; |

| Early Payoff Penalty | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The PenFed Personal Loans in action

PenFed Credit Union offers personal loans that are designed to meet the financial needs of a wide range of individuals.

These loans are unsecured, meaning they don’t require collateral, and they come with fixed interest rates.

PenFed is known for its competitive rates and flexible terms, making it suitable for various purposes, including debt consolidation, home improvement, and unexpected expenses.

The application process is straightforward, with PenFed providing clear guidelines on how to apply.

Key advantages and possible limitations

PenFed Personal Loans offer several benefits, but like any financial product, they also have their limitations. Understanding both aspects is crucial for potential borrowers.

Positive aspects of the PenFed Personal Loans

- Competitive interest rates: PenFed offers some of the lowest rates in the market, making these loans more affordable over time.

- No origination fees or prepayment penalties: Borrowers can save money with no upfront fees and the flexibility to pay off the loan early without extra charges.

- Flexible loan amounts and terms: PenFed provides options that cater to different borrowing needs, with loans ranging from small to substantial amounts.

- Quick funding: Once approved, borrowers can receive funds rapidly, often within a few business days, which is ideal for urgent financial needs.

Challenges with the PenFed Personal Loans

- Membership requirement: To apply for a loan, individuals must first become PenFed members, which may not appeal to everyone.

- Credit score impact: Applying for a PenFed Personal Loan involves a hard credit check, which can temporarily lower the applicant’s credit score.

- Higher rates for lower credit scores: While PenFed offers competitive rates, those with lower credit scores may receive higher interest rates compared to borrowers with excellent credit.

Your blueprint for getting the PenFed Personal Loans

Applying for a PenFed Personal Loan is a straightforward process. Prospective borrowers should first ensure they meet the credit union’s eligibility criteria. Next, gathering necessary financial documents, such as proof of income and identification, is essential for a smooth application process. Finally, applicants can choose their preferred application method: online, via mobile app, or in person.

Must-have qualifications for the PenFed Personal Loans?

To qualify for the PenFed Personal Loans, applicants should meet the criteria:

- Membership with PenFed Credit Union is mandatory.

- A good to excellent credit score is generally required for the best rates.

- Proof of stable income to ensure the borrower can repay the loan.

- A valid government-issued ID is needed for identity verification.

- Be a U.S. citizen and provide an SSN.

- Show four active credit accounts and no bankruptcies.

Routes you can follow to apply for the PenFed Personal Loans

There are several convenient ways to apply for a PenFed Personal Loan.

Completing your application online

- Visit the Official PenFed Website: You will find detailed information about their personal loans, including interest rates, terms, and any fees associated with the loan.

- Membership Application (if not already a member): You can usually apply for membership as part of the loan application process.

- Complete the Loan Application: Fill out the personal loan application form. This form will ask for detailed information, including your employment history, income, and the amount you wish to borrow. You’ll also need to authorize a credit check, as your credit score will play a significant role in determining your loan eligibility and interest rate.

- Submit Required Documentation: Submit additional documentation to support your loan application.

- Review and Accept the Loan Offer: If your application is approved, PenFed will present you with a loan offer, which includes the loan amount, interest rate, term, and any applicable fees. Review this offer carefully to ensure it meets your expectations and financial situation

- Receive Your Funds: After accepting the loan offer, the final step is receiving your funds.

Completing your application via mobile app

- Download the PenFed Mobile App: Available for free on both Android and iOS platforms;

- Log In or Sign Up for Membership: If you’re already a PenFed member, you can log in using your existing credentials. New users will need to sign up for PenFed membership through the app;

- Navigate to the Personal Loan Section;

- Fill Out the Application Form: The app will guide you through the personal loan application process, you’ll also be required to consent to a credit check, which will help determine your loan eligibility and interest rate;

- Upload Necessary Documentation;

- Review and Accept Your Loan Offer;

- Receiving Your Loan Funds.

Completing your application in person

- Locate Your Nearest PenFed Branch;

- Visit the Branch with the Necessary Documentation;

- Complete the Loan Application Form;

- Submit Your Application and Wait for Approval.

Try the Next Day Personal Loan for a different experience

For those seeking an alternative to PenFed Personal Loans, the Next Day Personal Loan platform could be a viable option.

This service provides a fast and straightforward way to connect with multiple lenders, offering flexibility in terms and conditions.

The application process is simple, with a single online form that can lead to receiving funds as soon as the next business day.

It’s an excellent alternative for individuals who value speed and convenience or those who may not meet the PenFed membership requirements.

Like any financial decision, it’s important to compare offers and read the fine print to ensure it meets your financial needs.

Trending Topics

Reseña Destiny Mastercard®: línea de crédito de $300

La Destiny Mastercard® es una tarjeta de crédito sin garantía diseñada para aquellos que buscan reconstruir sus puntajes de crédito.

Keep Reading

Destiny Mastercard® Review: Designed to help you move forward

The Destiny Mastercard® is an unsecured credit card designed for those seeking to rebuild their credit scores.

Keep Reading

Shop Your Way Mastercard® Review: Easy Point Earnings

Discover in our Shop Your Way Mastercard® review how to earn big on gas and groceries while enjoying extended warranty perks on purchases.

Keep ReadingYou may also like

PREMIER Bankcard® Secured Credit Card Review: Enhance Your Credit!

With the PREMIER Bankcard® Secured Credit Card review, you'll learn how to build credit by having your history reported to major bureaus!

Keep Reading

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep Reading

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep Reading