Loans

Next Day Personal Loan Review: Quick Funds Access

Discover in our Next Day Personal Loan review how easy it is to get the funds you need fast. With a big lender network and welcoming all credit types, finding the right loan has never been easier.

Advertisement

Borrow up to $40,000 with fast funding in a safe online process

Our Next Day Personal Loan review highlights easy, fast funding for urgent needs. Learn how this loan network simplifies borrowing and offers quick help for all financial situations.

Read on to find out about their wide loan choices and easy application. We will guide you through the advantages of choosing Next Day Personal Loan for your money needs.

| APR: | Varies by lender. |

| Loan Purpose: | Personal use, tailored to your needs. |

| Loan Amounts: | From $100 to $40,000. |

| Credit Needed: | All types considered. |

| Origination Fee: | Depends on the lender. |

| Late Fee: | Determined by each lender. |

| Early Payoff Penalty: | Subject to lender’s terms. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Next Day Personal Loan in action

In our Next Day Personal Loan review, you’ll learn how you can get funds up to $40,000 that can help you cover emergencies or any need you may have.

Although the interest rates change depending on your lender, Next Day Personal Loans, guarantees you can find a rate that fits your budget. Fair and clear pricing is a priority.

Additionally, when it comes to terms, they’re as varied as the lenders. This means you can pick a payment plan that’s easy on your wallet. No one-size-fits-all here, which is great.

Furthermore, each lender sets their own fees. This includes origination and late fees. It’s a good idea to check these early on. Knowing what to expect makes budgeting simpler.

Finally, some lenders might also charge an early payoff. The smart move here is to use Next Day to look closely at the available offers and compare them to find the best one.

Key advantages and possible limitations

Now we’ll analyze the highs and lows of this lending services in our Next Day Personal Loans review. Let’s explore the pros and cons to give you a clearer picture.

Positive aspects of the Next Day Personal Loan

- Access a wide range of lenders, increasing your chances of approval.

- Flexible loan amounts from up to $40,000 covering all kinds of different needs.

- The application process is quick, easy, and entirely online.

- Accepts all credit types, offering options for different financial histories.

- Funds can be available as soon as the next business day for immediate relief.

Challenges with the Next Day Personal Loan

- APR and terms can vary significantly between different lenders.

- Not a direct lender, but a network connecting you with lenders.

- Some lenders may charge origination or other additional fees.

- Late fees and early payoff penalties depend on the lender’s policy.

- There’s very little information about fees and rates on the official website.

Your blueprint for getting the Next Day Personal Loan

Since Next Day is not a direct lender, the companies you’ll be matched with depend entirely on your current financial standing. Therefore, a solid financial background can lead to better terms.

Must-have qualifications for the Next Day Personal Loan

- Firstly, you must meet the age requirements and be at least 18 years old.

- Secondly, a legal residency in the United States is required.

- Thirdly, you need proof of a stable income, though the specific amount may vary.

- Also, a valid checking or savings account in your name.

- All credit types are considered, but terms may vary based on creditworthiness.

- You need to provide accurate personal information, including ID and contact details.

- Additionally, a stable employment or a consistent income source is necessary.

- Lastly, your debt-to-income ratio may be evaluated to determine loan affordability.

Routes you can follow to apply for Next Day Personal Loan

Next Day Personal Loan only offers one official channel for new applications, and that’s their website. If you’re not sure how to apply, read on and we’ll give you a complete walkthrough.

Completing your application online

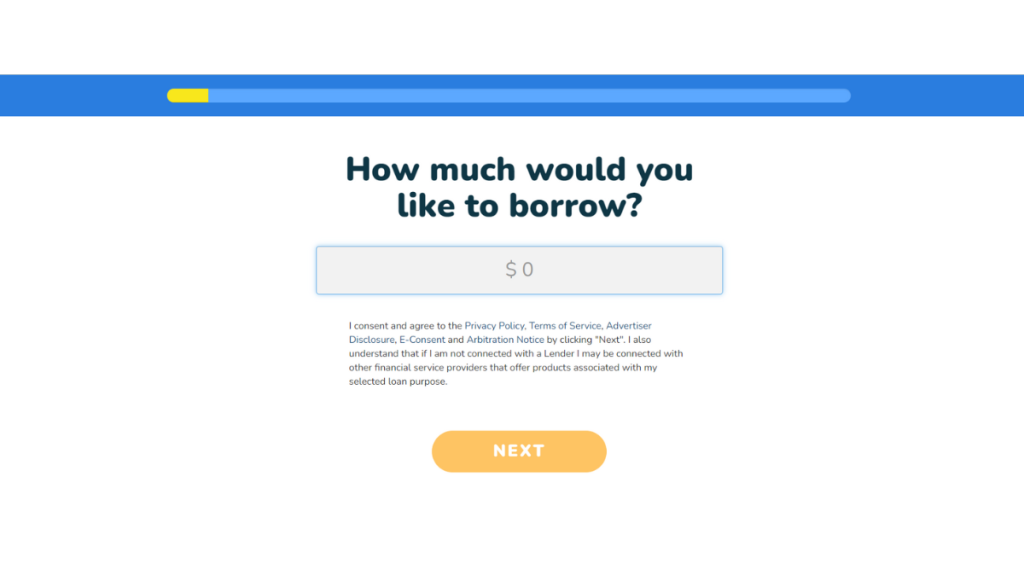

As you may have gathered from our Next Day Personal Loan review, using their services is simple and quick. To begin, head to their website and select the ‘Get Started’ orange button.

Then, tell them how much you wish to borrow (up to $40,000) and click ‘next’. Inform how you intend to use the money and click ‘next’ once more. Then tell them about your score.

Furthermore, inform them if you’re employed and how often you receive your salary. Type down your monthly income, then confirm if you have a checking account and direct deposit.

Following this, write down your ZIP code and street address. Mention your housing situation, and finally write down your email, name, phone number, and Social Security Number.

Next Day will search for available pre-approved offers and you should have access to them within a couple of minutes. Look carefully through them until you find one that resonates.

By checking an offer, you’ll be directed to the lender which will then conduct a hard pull on your score to determine your loan’s terms. See? Easy-peasy.

Try the Upgrade Triple Cash Rewards Visa® for a different experience

In conclusion, our Next Day Personal Loan review shines a light in a service that stands out for its flexibility and variety. Ideal for those looking for quick loan options.

But if you’re considering options, maybe take a look at the Upgrade Triple Cash Rewards Visa®. While this is not a loan exactly, it does offer plenty of loan characteristics.

For instance, you can have access to a high credit limit (up to $25,000) and repay your purchases on equal, fixed, monthly installments. Sounds pretty good, right?

To discover more about the Upgrade Triple Cash and how the application process works, check the link below. Explore this financial tool that blends credit with incredible perks.

Upgrade Triple Cash Visa®

Are you in the market for a credit card with a higher credit limit, no annual fee, and cash back rewards? Then check out this Upgrade Triple Cash Visa® review!

Trending Topics

Neo Credit Card Review: Flexible Credit Solutions

Read our Neo Credit Card review for insights on how to earn up to 15% cashback on first-time purchases and easy, secure card management.

Keep Reading

Discover It® Secured Credit Card Review: Up to 2% cash back!

Unlock financial freedom with our in-depth Discover It® Secured Credit Card review. Enjoy 2% cash back with no annual fee!

Keep Reading

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep ReadingYou may also like

Chase Freedom Unlimited® Credit Card Review: Versatile cash back

Chase Freedom Unlimited® full review - Get limitless rewards on every purchase - 0% intro APR and no annual fee!

Keep Reading

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep Reading

Destiny Mastercard® Review: Designed to help you move forward

The Destiny Mastercard® is an unsecured credit card designed for those seeking to rebuild their credit scores.

Keep Reading