Credit Cards

Neo Credit Card Review: Flexible Credit Solutions

Get the full picture with our Neo Credit Card review. Enjoy benefits like cash back on gas and groceries, advanced security, and instant digital access. Perfect for smart spenders!

Advertisement

Learn how to manage your finances better with real-time spending tips and cash back on purchases

In this Neo Credit Card review, we’ll take a closer look at a card that adapts to your lifestyle needs and spending habits, highlighting its unique features and benefits.

Learn how the Neo Credit Card stands out. From its flexible credit limit to impressive cash back rates, our review will shed light on what makes it a top choice for your wallet.

| Credit Score: | Having a fair to good score may increase your approval odds. |

| Annual Fee: | Absolutely zero, keeping finances straightforward. Unless you choose the premium account, which costs $4.99 monthly. |

| Purchase APR: | Ranges from 19.99% to 29.99%, adapting to different credit profiles. |

| Cash Advance APR: | Set between 22.99% and 31.99%. |

| Other Fees: | Not disclosed. |

| Welcome Bonus: | Enjoy up to 15% cash back on initial purchases at select partners. |

| Rewards: | Earn up to 5% cash back on everyday spends at select merchants. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Neo Credit Card in action

To kickstart our Neo Credit Card review the right way, the first thing you should know about this card is that it charges no annual fee. An ideal choice for those looking to earn and save.

However, if you want more from the card, you can subscribe to their monthly premium at $4.99 and add more value to your purchases, with extra perks and even greater rewards.

Furthermore, the Neo Credit Card offers a flexible approach to credit scores. This means that more people can access its benefits, which is appealing for a wider range of customers.

Additionally, the card’s purchase APR is set between 19.99% and 29.99%. While variable, it caters to different financial situations, offering a tailored credit experience for all.

Newcomers can enjoy cash back up to 15% on first-time purchases at Neo partnered merchants. This means more money in your pocket with every swipe.

Moreover, Neo’s reward system is where it shines the most. You can earn up to 5% back on select purchases, and every meal and gas expense rewards you a solid 1%.

Key advantages and possible limitations

Unpacking the Neo Credit Card in this review, we’ll explore its advantages and drawbacks next. Join us to see if Neo’s offerings align with your expectations and needs.

Positive aspects of the Neo Credit Card

- No annual fee, making it a wallet-friendly choice for daily expenses.

- Open to a wide range of credit scores, welcoming more users.

- Up to 5% cashback on purchases, turning spending into savings.

- Instant addition to digital wallets, ready for use right away.

- Attractive welcome offer with up to 15% cash back on first purchases.

Challenges with the Neo Credit Card

- Purchase APR reaching up to 29.99%, potentially costly for some.

- Higher cash advance APR, ranging from 22.99% to 31.99%.

- Available only in Canada, so it’s not suitable for international users.

- The welcome bonus is restricted to specific partner merchants.

- Cashback rates vary by merchant, so benefits are not set in stone.

Your blueprint for getting the Neo Credit Card

While Neo Finance has made this card accessible to many, there are still requirements you must meet in order to get it. But don’t worry—we’ve lined them up for you below.

Must-have qualifications for the Neo Credit Card

- Residency in Canada is a must for all applicants of the Neo Credit Card.

- A valid Canadian photo ID is required to verify your identity and residency.

- Applicants must have reached the age of majority in their province.

- The card accepts a variety of credit scores, but fair to good is preferable.

- The application process involves a credit check for eligibility.

Routes you can follow to apply for the Neo Credit Card

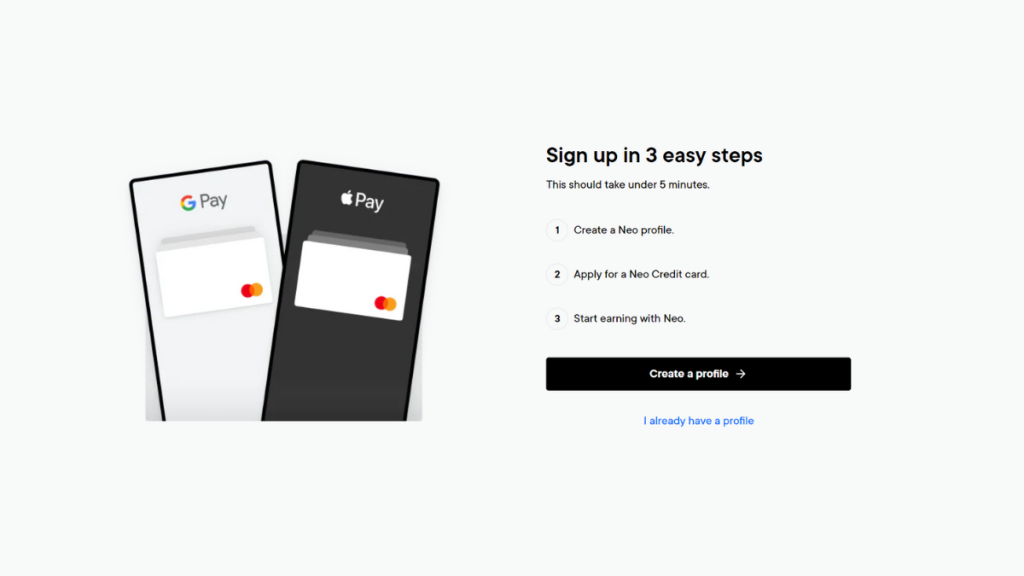

Neo Financial is a fintech company where you can manage most of your account features through their mobile app. However, applying for their credit cards can only be done online.

This means you’ll have to access their website through a web browser in order to get the card. The website is mobile-friendly though, so you can still do it on your phone.

Furthermore, the process is not at all complicated, but we have prepared a complete walkthrough to help you get started with your Neo Credit Card in our review, so read on!

Completing your application online

Starting your partnership with the Neo Credit Card begins on their website. The first step is simple: navigate to the Neo Credit Card page. Here, you’ll find an overview of the card.

Then, once you’re on the page, look for the ‘Apply Now’ button. Clicking this takes you to the application form. This form is straightforward and user-friendly, asking for basic information.

Next, you’ll need to provide proof of your Canadian residency. This can be done by uploading a copy of your valid Canadian photo ID. Just make sure the details are clear.

Following this, the next step involves a credit check. Neo Credit Card’s website makes this a hassle-free experience. Just follow the prompts to authorize the assessment.

Lastly, after finishing your application, you’ll get an almost instant decision. If approved, you can add your card to your digital wallet right away, as stated in our Neo Credit Card review.

Try the NOME DO PRODUTO for a different experience

Trending Topics

Citi® Diamond Preferred® Card Review: Exceptional Benefits!

Enhance your financial life - Don't miss this Citi® Diamond Preferred® Card review! Privileged perks and consistent savings!

Keep Reading

Avant Credit Card Review: Rebuild Credit with No Foreign Fees!

The Avant Credit Card is an intermediate option that aids in the ongoing credit building for those with a fair credit score.

Keep Reading

Destiny Mastercard® Review: Designed to help you move forward

The Destiny Mastercard® is an unsecured credit card designed for those seeking to rebuild their credit scores.

Keep ReadingYou may also like

Chase Freedom Unlimited® Credit Card Review: Versatile cash back

Chase Freedom Unlimited® full review - Get limitless rewards on every purchase - 0% intro APR and no annual fee!

Keep Reading

PenFed Personal Loans Review: up to 50K

PenFed Credit Union a good option for those with solid credit because of its low interest rates and fast funding.

Keep Reading

Fortiva® Credit Card Review: An Objective Examination

The Fortiva Credit Card: Understand its features, benefits, and potential drawbacks. Make informed decisions for your financial health.

Keep Reading