Credit Cards

Mission Lane Visa® Credit Card Review: for bad credit score!

Come learn more about the Mission Lane Visa® Credit Card: the possibility of no annual fee while rebuilding your credit score!

Advertisement

Mission Lane Visa® Credit Card makes enrollment easy!

For those with a low credit score, finding an inclusive credit card can be challenging, but we’ll show you that it can change with this Mission Lane Visa® Credit Card Review! So, check out all the details.

Despite not offering exclusive benefits, the Mission Lane Visa® Credit Card gives you the opportunity to start from the bottom and rise with your credit! Check details about fees and other basic card features.

| Credit Score | 300 – 689; |

| Annual Fee | $0 – $59; |

| Purchase APR | 19.99% – 29.99%; |

| Cash Advance APR | 19.99% – 29.99%; |

| Other Fees | Foreign transactions: 3%; |

| Welcome Bonus | Not Available; |

| Rewards | Not Available. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Mission Lane Visa® Credit Card in action

Let’s delve into the Mission Lane Visa® Credit Card review. First and foremost, it’s important for you to know that choosing a credit card is a task that requires attention!

You need to know your spending patterns and what main goal you are looking for in a card. In this case, the Mission Lane Visa® Credit Card is for those looking to build credit score.

Thus, all the features of this card are geared toward this goal: they offer simple enrollment requirements, accepting people with a bad history.

Moreover, the possibility of getting a fee-free card helps a lot!

Key advantages and possible limitations

Therefore, this Mission Lane Visa® Credit Card review wouldn’t be complete without information about the card’s advantages and limitations. Do the fees outweigh the positives?

Positive aspects of the Mission Lane Visa® Credit Card

Let’s start with the main positives in this Mission Lane Visa® Credit Card review, with the fact that you can increase your limit just six months after starting to use the card.

This process is automatic and only happens if you keep your payments on time and without any overdue balance. In other words, you have to show good management.

Moreover, the absence of the need for a security deposit sets it apart from other cards.

Thus, you can save right from the start. Additionally, being a Visa card gives you access to the brand’s benefits, zero liability in case of fraud, and even roadside assistance!

Challenges with the Mission Lane Visa® Credit Card

The main disadvantage of the Mission Lane Visa® is the fees. Depending on your profile, you may need to pay up to US$ 59 in annual fees.

Another drawback is the lack of benefits, such as cashbacks and other welcome bonuses, to facilitate your daily operations.

In fact, other cards in the same range may offer more cost-effective benefits.

Your blueprint for getting the Mission Lane Visa® Credit Card

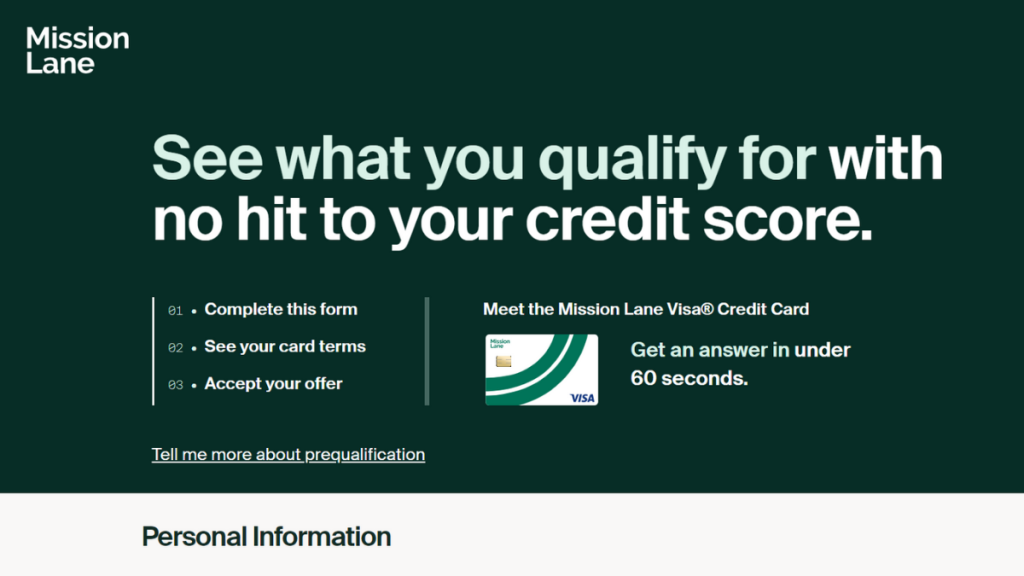

In this review, we’ll also help you discover how to join the Mission Lane Visa® Credit Card? The entire process must be done virtually, making your application easy.

Moreover, Mission Lane offers a way for you to anticipate some information about your eligibility with a virtual prequalification form! So, if you like the conditions, you can join right away.

So, without further ado, let’s discover this special blueprint for you to apply for your Mission Lane Visa® Credit Card and find out if you can join.

Must-have qualifications for the Mission Lane Visa® Credit Card?

Although the requirements for the Mission Lane Visa® Credit Card are a bit opaque, you need to provide some information on the application form, such as monthly income, current job, etc.

These financial details will help the institution decide on the characteristics of your card, limit, and annual fee, for example. Also, you need to live in the USA and be over 18 years old.

Routes you can follow to apply for the Mission Lane Visa® Credit Card

So, to join the Mission Lane Visa® Credit Card, you need to access the website. Moreover, you can use the link provided in this review. Then, you will be directed to the card’s page.

Completing your application online

Click on the blue “See if I’ll be approved” button to discover the offer available to you. Answer the form questions and click the blue button again at the end to submit and find out if you will be approved.

Then, you will receive personalized terms for the Mission Lane Visa® Credit Card. If you are interested in the offer, just accept it and wait for the card to be sent! In five minutes, you can complete the entire process and join!

Try the Citi® Diamond Preferred® Card for a different experience

With this card, you can enjoy great ease in recovering from bankruptcy or starting a credit history.

So, you can join right now! On the other hand, knowing and comparing different credit cards is essential to make the right choice. So, consider your needs and profile.

In this way, we present the Citi® Diamond Preferred® Card, an opportunity to secure an annual fee-free card and other exclusive benefits. But, pay attention to whether you qualify for the credit score.

Want to know more details? Come check out our exclusive review and decide which card works and fits your budget!

Citi® Diamond Preferred® Card

Enhance your financial life – Don't miss this Citi® Diamond Preferred® Card review! Privileged perks and consistent savings!

Trending Topics

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

FIT Mastercard® Review: Rebuild Your Credit Securely!

Find out how FIT Mastercard® Credit Card can help you rebuild your credit score without paying a security deposit with our review!

Keep Reading

Group One Platinum Card Review: Shop with Ease

Discover the Group One Platinum Card in our review! Perfect for bad credit, with a $750 merchandise credit line, and no rates on purchases.

Keep ReadingYou may also like

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep Reading

U.S. Bank Altitude® Go Visa Signature® Card Review: 0% intro APR

With this U.S. Bank Altitude® Go Visa Signature® Card Review, discover how to earn 20,000 bonus points in the first few months!

Keep Reading

Don’t Let Limited Credit Hold You Back: Choose the Credit Card Tailored for You

Discover the best credit cards for limited credit and start building your credit history while enjoying rewards. Find the right card for you!

Keep Reading