Credit Cards

Group One Platinum Card Review: Shop with Ease

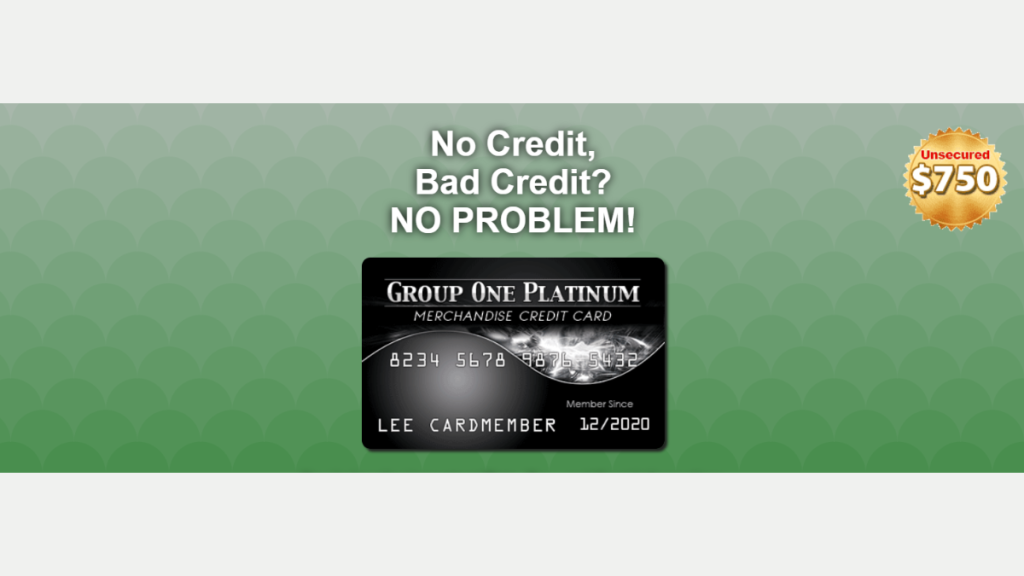

Say goodbye to old clothes and worn-out sneakers. The Group One Platinum Card will give you a $750 credit to refresh your wardrobe regardless of your score! Keep reading to learn more.

Advertisement

Get a quick $750 credit boost for Horizon Outlet purchases, available for all credit types

If you’re struggling with a low credit score or need some breathing room in your wallet, this Group One Platinum Card review was tailored-made for you.

Everyone deserves a chance at credit, and Group One is here to give that to you. See how you can get a credit line of $750 to help you pave the way towards financial freedom.

| Credit Score: | All Welcome! Bad or no credit, get ready to be approved. |

| Annual Fee: | A modest $14.77 monthly for exclusive benefits. |

| Purchase APR: | 0%, making shopping more affordable. |

| Cash Advance APR: | Not applicable, simplifying your finances. |

| Other Fees: | Shipping fees, which vary according to your purchase. |

| Welcome Bonus: | There are no welcome bonuses available at this time. |

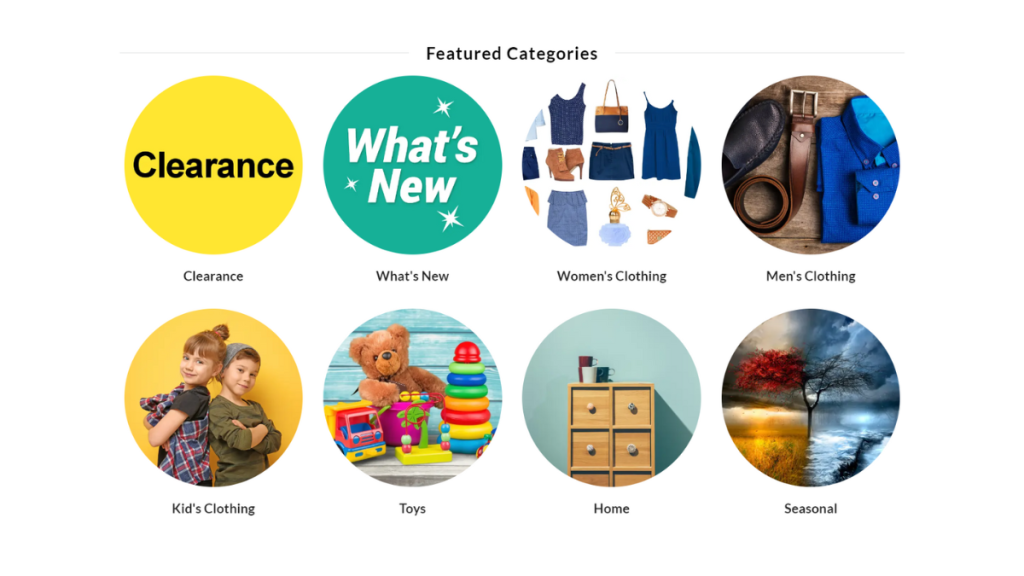

| Rewards: | Shop at Horizon Outlet with member-only perks and security benefits. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Group One Platinum Card in action

The Group One Platinum Card is perfect for people with limited credit options. It offers a $750 line exclusive to Horizon Outlet, with no credit checks, making it super easy to get.

This card stands out with 0% APR on Horizon Outlet purchases. Although there’s an annual fee billed monthly at $14.77, it’s still a cost-effective choice for regular shoppers.

The monthly fee unlocks exclusive Horizon Outlet access and shopping benefits. While it doesn’t help in building credit, it provides a unique, interest-free shopping experience.

Beyond shopping, you’ll be able to enjoy perks like legal assistance and identity theft protection. The card offers a blend of shopping convenience and security features.

Additionally, a 7-day trial lets you test the waters before committing. It’s a chance to see if the card’s shopping benefits and perks align with your financial needs and lifestyle.

Key advantages and possible limitations

Our Group One Platinum Card review wouldn’t be complete without a rundown of its advantages and limitations. Let’s take a closer look at the good and at what could be better.

Group One Platinum Card upsides

- Accessible to all credit types with no credit checks, opening doors for many.

- Enjoy $750 credit at Horizon Outlet, expanding your shopping options.

- Zero APR on purchases, making it budget-friendly.

- Added benefits like legal aid and roadside assistance for extra security.

- Take advantage of a 7-day risk-free trial to make sure it fits your needs.

Group One Platinum Card shortcomings

- Limited to purchases at Horizon Outlet only, restricting shopping options.

- Monthly fee of $14.77 adds up to $177.24 annually, impacting your budget.

- Doesn’t build credit, missing a chance to improve your credit score.

- Added benefits may not justify the costs depending on your needs.

Your roadmap to applying for the Group One Platinum Card

You can easily jumpstart your finances with the Group One Platinum Card, and applying online takes a minute. It’s quick, hassle-free, and perfect for all credit backgrounds.

Next in our Group One Platinum Card review, we’ll show you everything you need in order to get your hands on that $750 merchandise credit line. Curious about the process? Let’s go!

What are the basic qualifications for the Group One Platinum Card?

- A bank account is necessary for membership and shipping fees.

- Must be a U.S. resident as the card available exclusively in the U.S.

- Age requirement is 18 or older, so only legal adults can apply.

Ways you can apply for the Group One Platinum Card

Getting the Group One Platinum Card is a straightforward process, but you can only apply using their official website. If you’re not sure how, we’ll give you the step-by-step below.

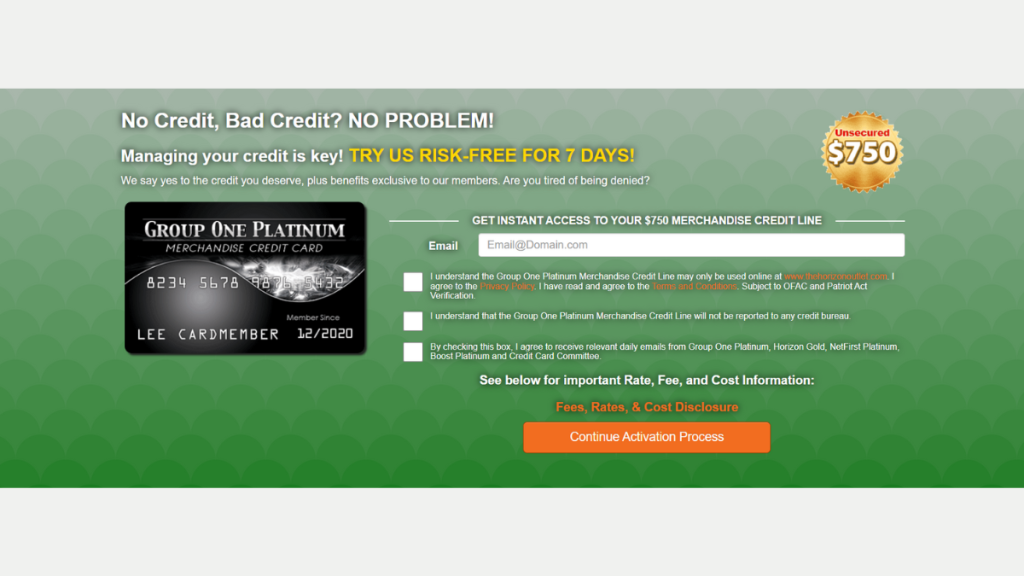

Completing your application online

As we already mentioned above in our Group One Platinum Card review, getting this merchandise card is really easy. Just make sure you head over to their official website.

Then, enter your email on the blank space in their homepage. Almost everyone gets approved, making the Group One Platinum an inclusive choice for credit access.

Next, you’ll have to simply check a few boxes to agree to the terms. This includes receiving marketing emails from Horizon Outlet. This part is also quick and user-friendly.

Once you’re done, your $750 credit line is ready. Click the orange button to start the activation process and start enjoying online shopping online with your new card!

Not the right fit? Try this suggestion: Shop Your Way Mastercard®

Concluding our Group One Platinum Card review, this is a card that offers easy access for those who need credit. But if you have a better credit rating, we have a better alternative.

The Shop Your Way Mastercard® by Citi, is your chance at better rewards and benefits. Perfect for those with good credit, it offers more than just a simple credit line.

With features like cash back rewards and wider acceptance, the Shop Your Way Mastercard® is a fantastic way to get the most out of your everyday expenses.

How about getting to know the Shop Your Way Mastercard® better? Check the following link to find out how it can upgrade your wallet and how to easily apply!

Shop Your Way Mastercard® Review

Learn how you can earn valuable points on everday expenses and enjoy the advantage of no annual fee with this credit card!

Trending Topics

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep Reading

Apply for Revvi Credit Card: Fill out the form in minutes!

If you want to apply for the Revvi Credit Card, you can relax! The entire process is done online without stress and complications!

Keep Reading

Upgrade Triple Cash Rewards Visa® Review: The Smart Choice

Read our Upgrade Triple Cash Rewards Visa® review - get 3% cash back on select categories and no annual fees. Ideal for everyday spending.

Keep ReadingYou may also like

Reflex Mastercard® Review: A Secure Option for Credit Rebuilding!

With the Reflex Mastercard® review, it's your moment to rebuild your credit score. Your history is sent monthly to major credit agencies!

Keep Reading

Chase Slate Edge℠ Review: Get Financial Control

Explore our Chase Slate Edge℠ Credit Card review for 0% intro APR, no annual fee, and exclusive benefits that can elevate your finances.

Keep Reading

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading