Credit Cards

Gemini Credit Card® Review: Crypto on Every Swipe!

Discover the Gemini Credit Card® to earn crypto with every purchase, with no annual or foreign fees, and robust security. Our review covers its unique benefits like instant rewards and luxury metal cards.

Advertisement

From Bitcoin to Ether, this credit card has the perfect reward for everyone

Get ready to meet the Gemini Credit Card® in our review. Perfect for the modern spender, it’s a game-changer in the financial world, blending traditional perks with crypto rewards.

This is a card with unique traits. From zero annual fees to cash back in crypto, it’s a different yet attractive choice. Dive in to learn how this card can change your credit experience.

| Credit Score: | You need a score ranging between good and excellent. |

| Annual Fee: | $0. Enjoy without yearly charges. |

| Purchase APR: | Variable, from 18.24% to 30.24%. |

| Cash Advance APR: | 31.24% variable. |

| Other Fees: | Cash advance: Either $10 or 3%;Late payment: up to $20;Returned payment: up to $35. |

| Welcome Bonus: | None, currently. |

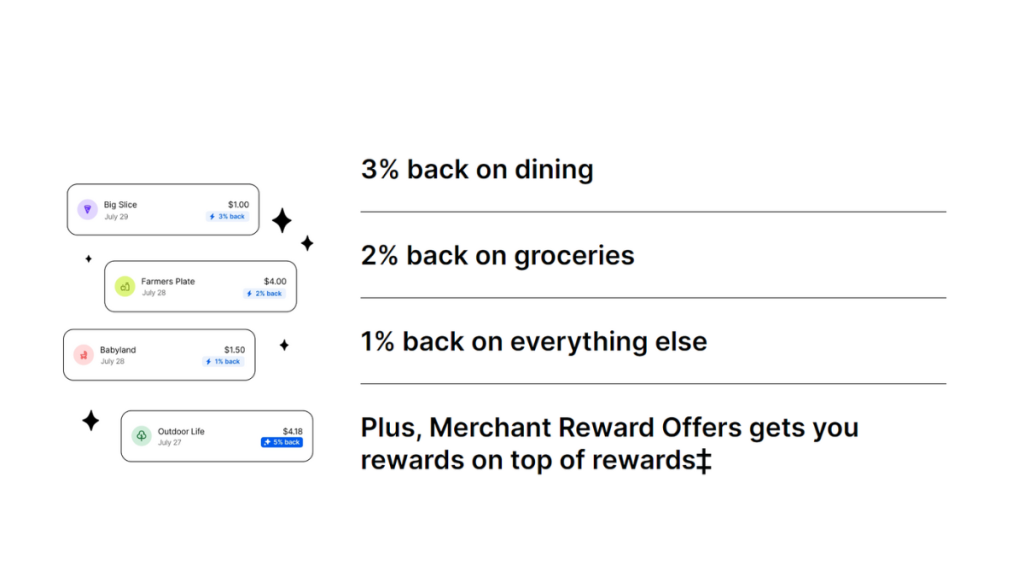

| Rewards: | Rates between 1% and 3%, earned instantly in cryptocurrency. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Gemini Credit Card® in action

Starting our Gemini Credit Card® review, it’s safe to say that this isn’t your regular card. Firstly, you get instant gratification on purchases in the form of cryptocurrencies.

Also, this credit card eliminates common fees. Say goodbye to annual and foreign transaction charges, making it an inexpensive choice for both travelers and everyday shoppers.

Additionally, the Gemini Credit Card® uses advanced encryption and two-factor authentication. This keeps your transactions and crypto earnings safe at all times.

Furthermore, the card offers aesthetic appeal. You can choose a metal card in three different colors, each designed for safety and style. It’s where elegance meets convenience.

Lastly, the Gemini Credit Card® also acts as an investment for the future. With up to 3% back on dining and more, it turns your regular purchases into potential crypto growth.

Key advantages and possible limitations

Next in our Gemini Credit Card®, we’re going to give you a balanced view of the card’s upsides. We’ll also cover the downsides you should consider before submitting a request.

Positive aspects of the Gemini Credit Card®

- Get instant gratification on every purchase, adding crypto to your account.

- Benefit from no annual or foreign transactions charges, boosting your savings.

- Enhanced security with encryption and two-factor authentication.

- Choose between three stylish metal choices: black, rose gold, and silver.

- Get cash back in common daily expenses, plus a consistent 1% return on all else.

Challenges with the Gemini Credit Card®

- High APR range (18.24% to 30.24%) can be costly with unpaid balances.

- The card is limited to crypto enthusiasts and not ideal for all users.

- Rewards in crypto may fluctuate with the market, adding a risk element.

- No welcome bonus to entice new applicants into joining in.

- Penalty APR of 35.24% for late payments can be steep.

Your blueprint for getting the Gemini Credit Card®

If a crypto rewards credit card is what you’re looking for, you can’t really go wrong with this one. If you meet the score and financial criteria, getting the Gemini Credit Card® is simple.

Must-have qualifications for the Gemini Credit Card®?

- Your current score must range between good an excellent for better chances.

- You need a decent annual income to show you can handle repayments.

- Opening a Gemini account is also necessary in order to receive and trade crypto.

- Being at least 18 years old (19 in some states) is mandatory.

- A spotless credit history with no recent bankruptcies.

- A track record of responsible credit use is also favorable.

Ways you can apply for the Gemini Credit Card®

Cryptocurrencies are completely digital, and so is the application process for this credit card. To avoid any issues, keep reading our Gemini Credit Card® review to see how to get yours.

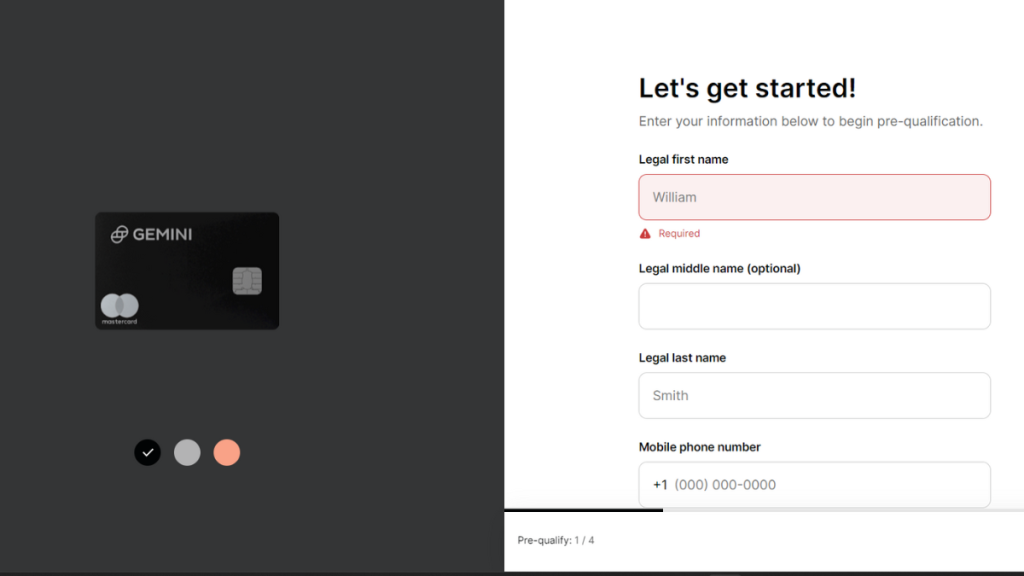

Completing your application online

Before you submit an official request, you can check your approval odds by pre-qualifying. To do so, head to the Gemini Credit Card® website and click on “apply now”.

Then, you’ll have to fill an online form with the usual inquiries, like your personal and financial information, along with your contact details and valid forms of identification.

Furthermore, the pre-qualification won’t harm your score as it only performs a soft pull. Got pre-approved? Now the real submission begins. During this part, a hard pull is conducted.

WebBank, the card’s issuer, will analyze your application and provide feedback within 60 seconds. After being properly approved, you can check your rates and credit limit.

You may need to provide extra details to open your Gemini account. Plus, you’ll also be able to choose the color of your new metal crypto credit card.

When that is done, you’ll receive a magnificent metal card with the design of your choice in a few days. Get ready to use it everywhere and earn rewards in over 50 cryptocurrencies!

Try the VentureOne Rewards Credit Card for a different experience

Concluding our Gemini Credit Card® review, it’s evident that this is a card designed for crypto enthusiasts, with an easy rewards structure and lack of traditional fees.

But if cryptocurrencies aren’t your thing, we have a great alternative to offer! The VentureOne Rewards Credit Card from Capital One, coming in strong with travel rewards.

This no-annual-fee financial solution has it all. From a generous welcome bonus to extensive low interest rates on purchases and balance transfers, it’s a traveler’s dream come true.

Excited to explore the details on the VentureOne Rewards? Then dive into the following link and we’ll tell you all about it, including how its application process works!

VentureOne Rewards Credit Card review

Looking for an all-in-one credit card with incredible travel rewards? Then you'll definitely want to check out this VentureOne Rewards Credit Card review.

Trending Topics

Destiny Mastercard® Review: Designed to help you move forward

The Destiny Mastercard® is an unsecured credit card designed for those seeking to rebuild their credit scores.

Keep Reading

U.S. Bank Altitude® Go Visa Signature® Card Review: 0% intro APR

With this U.S. Bank Altitude® Go Visa Signature® Card Review, discover how to earn 20,000 bonus points in the first few months!

Keep Reading

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep ReadingYou may also like

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Next Day Personal Loan Review: Quick Funds Access

Explore our Next Day Personal Loan review for quick funds delivery and secure application! Find your ideal loan match effortlessly.

Keep Reading

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading