Credit Cards

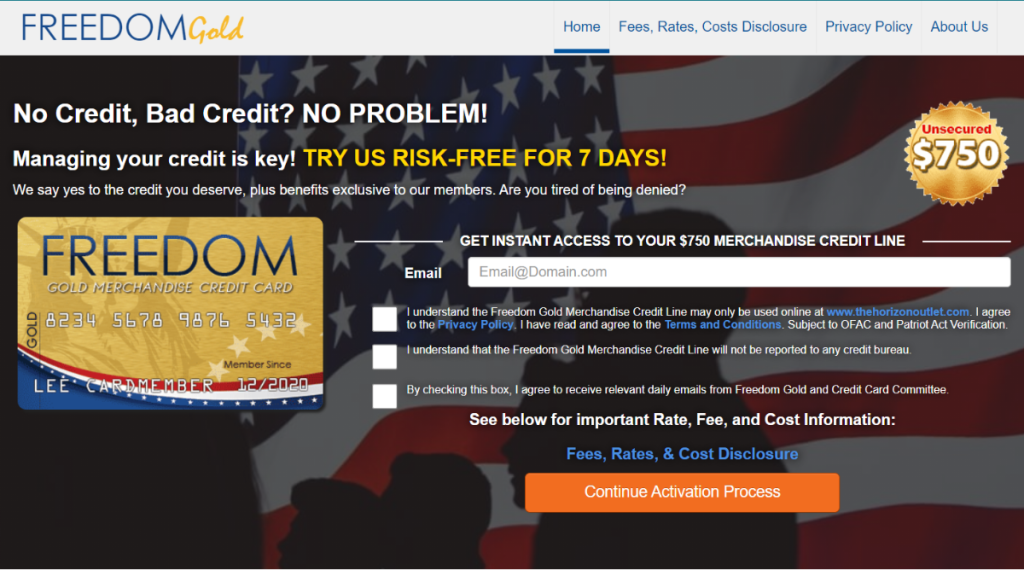

Freedom Gold Card Review: Up to a $750 credit limit!

The Freedom Gold Card is a card offered by Horizon! Despite this institution not being a bank, the fact that anyone can access this card makes it intriguing!

Advertisement

Freedom Gold Card: an opportunity for those with a bad credit history!

In this Freedom Gold Card review, we will show you how this card can be beneficial for loyal customers of Horizon Outlet. Moreover, this card is issued by Horizon Card Services!

Apply for Freedom Gold Card

If you want to know how to apply for the Freedom Gold Card, know that this process is done online and takes just a few moments!

Thus, anyone over 18 years old can access this card, even if unemployed and with a bad credit history. In other words, seize the opportunity to have a $750 credit limit!

| Credit Score | 300 – 600 (low) |

| Annual Fee | US$ 177,24 |

| Purchase APR | None; |

| Cash Advance APR | Not available; |

| Other Fees | None; |

| Welcome Bonus | None; |

| Rewards | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Freedom Gold Card in action

A Freedom Gold Card review must begin with more direct information on how the card functions in your daily life. Thus, you can understand the best way to enjoy its benefits.

It’s important to note that this card works only for purchases at Horizon stores! In other words, it does not function like a traditional credit card. Therefore, its greatest advantage is for loyal store customers!

As a result, the card does not offer many fees, cash back rewards, or other refunds, no welcome bonuses, and there is no APR! However, the Freedom Gold Card has a relatively high annual fee: $177.24!

Additionally, the delivery charge for your Horizon purchases cannot be paid with the Freedom Gold Card.

In other words, you need another card to support your purchases with the Freedom Gold, both for paying the delivery and the bill!

Key advantages and possible limitations

So, let’s explore some of the positive and negative aspects that the Freedom Gold Card offers to its customers. This way, you can make a more informed decision!

Positive aspects of the Freedom Gold Card

By joining the Freedom Gold Card, you are entitled to exclusive benefits that we will highlight in this review. Firstly, you have access to My Universal Rx.

In this program, you get a 50% discount at various pharmacies around the US. You can check all participating stores on the website. Additionally, you also get roadside assistance.

In other words, you can rely on one call or two requests per month but no more than 3 in a year!

Thus, the service limitation is 15 miles, and any fees exceeding $50 must be covered by you!

Challenges with the Freedom Gold Card

However, in this review, it’s also important to highlight the negative aspects of the Freedom Gold Card! The main one is that the card is not very useful if you don’t shop much at the Horizon store.

This is because, despite not having many fees or APR, you pay a quite high annual fee for a card with few benefits.

Moreover, you don’t earn any type of cash back or other financial rewards upon joining. So, think carefully before getting this card.

Must-have qualifications for the Freedom Gold Card?

As already mentioned in this review, joining the Freedom Gold Card is straightforward.

Thus, you don’t need to worry about your credit history or being unemployed.

All US residents over 18 years old have the right to try to get a Freedom Gold Card to enjoy its benefits.

Looking to get the Freedom Gold Card? We’ve compiled the necessary steps

So, if you found the Freedom Gold Card review interesting, you might want to find out how you can avail the services of this card.

Therefore, know that the entire process is virtual, and the card is known for providing a quick response to interested users!

Come check out our blueprint that will guide you through every step of the process!

Apply for Freedom Gold Card

If you want to know how to apply for the Freedom Gold Card, know that this process is done online and takes just a few moments!

Trending Topics

Travel on a Budget: Tips for Affordable Adventures

Conquer amazing destinations without breaking the bank. Essential tips for travel on a budget, from transportation to food.

Keep Reading

FIT Mastercard® Review: Rebuild Your Credit Securely!

Find out how FIT Mastercard® Credit Card can help you rebuild your credit score without paying a security deposit with our review!

Keep ReadingYou may also like

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading

Fortiva® Credit Card Review: An Objective Examination

The Fortiva Credit Card: Understand its features, benefits, and potential drawbacks. Make informed decisions for your financial health.

Keep Reading

Bank of America® Unlimited Cash Rewards Credit Card Review: earn cash back

With this review of the Bank of America® Unlimited Cash Rewards Credit Card, you'll discover how to increase your cash back!

Keep Reading