Credit Cards

FIT Mastercard® Review: Rebuild Your Credit Securely!

With the FIT Mastercard® Credit Card, your monthly progress is reported to the three major US credit bureaus. This is one of the best ways to rebuild your credit score! Explore the details in our review!

Advertisement

Double your limit in just a few months with the FIT Mastercard®!

If your credit score is low and you’re struggling to get a credit card, learn how to change that with the FIT Mastercard® full review! This way, you can start or restart your credit-building journey.

So, if you want to know the fees, rewards, advantages, and even the disadvantages of the FIT Mastercard® Credit Card, check out more details in the following article!

| Credit Score | 300-629/ Poor; |

| Annual Fee | $99; |

| Purchase APR | 29.99%; |

| Cash Advance APR | 29.99%; |

| Other Fees | Foreign transaction: 3%; |

| Welcome Bonus | Not Available; |

| Rewards | Not Available. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The FIT Mastercard® in action

Deciding if a credit card is the best option for you is not an easy task. This is because you need to consider various factors. Firstly, you must understand what your goal is with a card.

Thus, in this review, we help you understand more about how the FIT Mastercard® works so you can decide if it is right for you! Firstly, this is a basic card that earns points for its ease of acquisition.

Moreover, it may have its drawbacks related to excessive fees and charges. However, in daily use, it functions normally, with a limit of US$ 400 that can be increased to US$ 800.

By the way, the FIT Mastercard® reports monthly to the three major credit bureaus: TransUnion, Experian, and Equifax. If you can afford the costs, this card can change your financial life.

In other words, use this card to rebuild your credit history, and once successful, switch the FIT Mastercard® for another card that can offer you more benefits and advantages in your daily life!

Key advantages and possible limitations

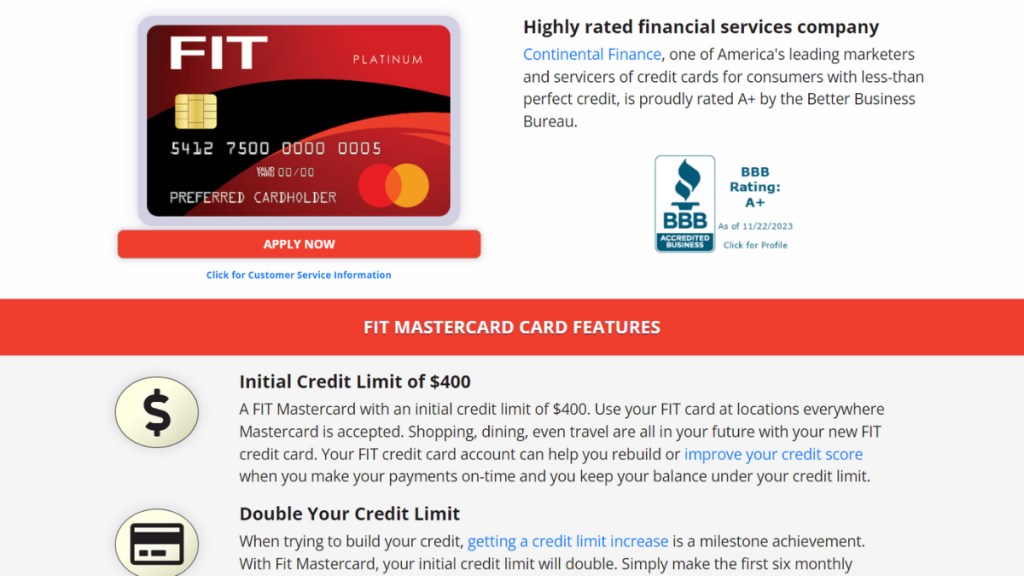

Despite its ability to help with credit rebuilding, the FIT Mastercard® has other points worth noting in this review.

This includes excessive fees and a high interest rate – is it worth it?

Positive aspects of the FIT Mastercard®

So, the first positive point is the ease of joining. In a short time, you receive feedback from the financial institution approving or rejecting your membership.

But it’s worth noting that it’s very difficult not to be able to join.

Furthermore, the possibility of doubling your credit limit is tangible and easy to achieve; just make the first six payments of your bills punctually and without any problems.

Finally, it’s worth noting that Mastercard offers zero liability protection in case of unauthorized charges on your card.

In other words, you are protected in case of fraud and irregular purchases.

Challenges with the FIT Mastercard®

However, the FIT Mastercard® also has points that are not so positive. Starting with the excess of charges. You need to pay an annual fee of US$ 99. In addition, to activate the card, you need to pay US$ 89!

Other charges include the monthly maintenance fee, which costs US$ 75. All these fees make the card quite costly. Other credit rebuilding card options may offer better conditions.

Finally, the interest percentage is quite high, which can lead to a debt snowball if you cannot make your payments on time or need a balance transfer.

Your blueprint for getting the FIT Mastercard®

Now, it’s time for this FIT Mastercard® Credit Card review to discuss how you can join the card.

First, as mentioned earlier, the process is quite simple and inclusive, and it can be done virtually.

So, check what the requirements are and if you have the necessary documents and information to complete your application.

Also, on the FIT Mastercard® website, you can find more information about the card.

Must-have qualifications for the FIT Mastercard®

The FIT Mastercard® is not a credit card that requires various qualifications for you to apply. This is because the card accepts people with fair and poor credit.

Additionally, you need to submit the requested documents and information in the application form.

This information includes full name, social security number, date of birth, proof of address, monthly income, and others.

Routes you can follow to apply for the FIT Mastercard®

To join the FIT Mastercard® Credit Card, you need to visit the card’s website. The entire process can be done easily from the comfort of your home.

On the other hand, if you prefer, you can apply by phone.

Completing your application online

Access the FIT Mastercard® Credit Card website provided in this review. Then, you just need to click on the red “apply now” button. Thus, fill out the form with the requested information.

At this point, you need to check the information about fees and how the electronic signature works. After reading, if you agree with all the details presented, click on “submit application.”

Now, wait for the institution’s response, which is usually instant. But, if necessary, the bank will check more information before giving you a definitive answer.

And, in three business days, you receive your card!

Try the Chase Freedom Unlimited® Credit Card for a different experience

Did you like our FIT Mastercard® Credit Card Review? This could be a viable option for you if you want to rebuild your credit score and believe you have the money to sustain the somewhat above-standard fees.

But, if your profile is different and you’re looking for cards that offer greater benefits, how about getting to know the Chase Freedom Unlimited® Credit Card? With this option, you have access to exclusive benefits.

Cashbacks of up to 5% on your purchases without worrying about an annual fee! In addition, you get 0% APR in the first three months for balance transfers!

In other words, if all these benefits seem attractive to you, why not learn all the details of Chase Freedom? Come discover if this is the ideal card option for you in our review below.

Chase Freedom Unlimited® Credit Card Review

Chase Freedom Unlimited® full review – Get limitless rewards on every purchase – 0% intro APR and no annual fee!

Trending Topics

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep Reading

Reseña Destiny Mastercard®: línea de crédito de $300

La Destiny Mastercard® es una tarjeta de crédito sin garantía diseñada para aquellos que buscan reconstruir sus puntajes de crédito.

Keep Reading

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep ReadingYou may also like

First Digital Mastercard® Review: Apply even with a low credit!

The First Digital Mastercard® review introduces you to a credit card with 1% cash back on all purchases and no security deposit required!

Keep Reading

Reflex Mastercard® Review: A Secure Option for Credit Rebuilding!

With the Reflex Mastercard® review, it's your moment to rebuild your credit score. Your history is sent monthly to major credit agencies!

Keep Reading

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading