Credit Cards

First Digital Mastercard® Review: Apply even with a low credit!

There are numerous cards on the market, but the First Digital Mastercard® is one of the few that offers cash back, although the fees can be a bit excessive. Is it the option you're looking for? Let's find out more!

Advertisement

First Digital Mastercard®: rebuild credit and earn cash back!

With the First Digital Mastercard® review, discover how you can achieve your dream credit score!

Apply for First Digital Mastercard®

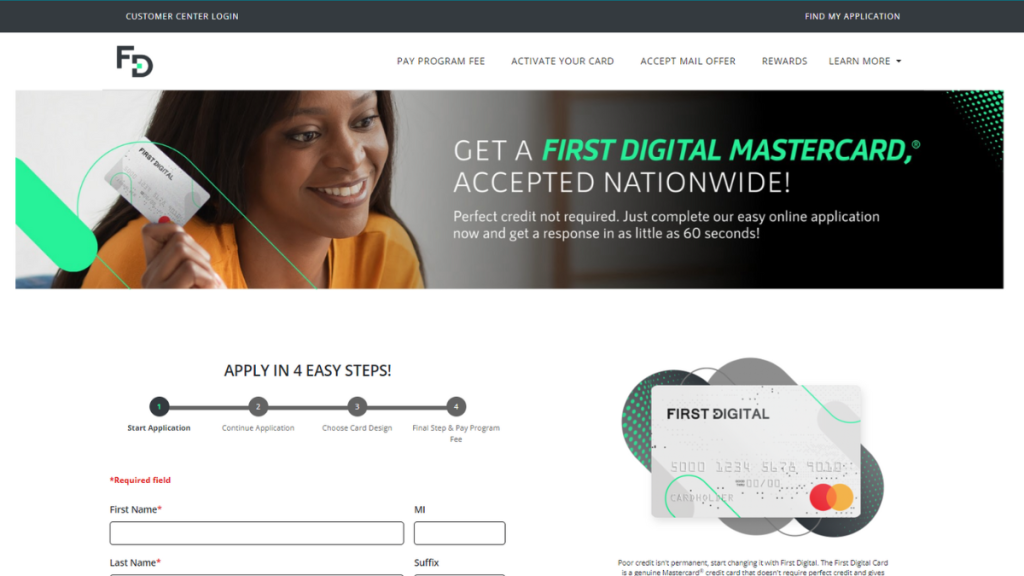

If you want to apply for the First Digital Mastercard®, know that the process is virtual, no need to go to the bank to get your card!

With this option, the likelihood of your application being quickly approved is quite high. However, information about the card is somewhat limited and not very transparent. So read on!

| Credit Score | 629 or lower; |

| Annual Fee | $75 for the first year, and then $48; |

| Purchase APR | 35.99%; |

| Cash Advance APR | 35.99%; |

| Other Fees | One-time fee: $95 monthly fee: $0 for the first year, and then US$ 8,25. Cash advance: $10 or 3%; |

| Welcome Bonus | Not Available; |

| Rewards | 1% Cash back. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The First Digital Mastercard® in action

Now, let’s begin this First Digital Mastercard® review by understanding how the card works in your daily life. Firstly, the card maintains contact with the country’s three major financial agencies.

This is a crucial step to ensure the rapid improvement of your score! Additionally, you don’t need a bank account to pay off the card debts. In other words, everything can be resolved with a money order!

However, it’s worth noting that in your daily purchases, the card may pose a challenge.

This is because the APR is quite high, making your purchases and indebtedness difficult. Furthermore, no international purchases are allowed!

Another usability challenge is the credit limit the card offers. Despite having the chance to increase it during use, there is an embedded fee that charges you 25% of your limit. This is a quite high percentage!

Key advantages and possible limitations

How about delving into the positive and negative points that this card offers? So check it out!

Positive aspects of the First Digital Mastercard®

The main advantage of this card is that it doesn’t require a security deposit. Typically, deposits are charged on low-credit cards to secure the money to the bank.

Furthermore, the ease of joining and acceptance of people with low credit scores makes it accessible to everyone.

Additionally, the cash back is one of the standout features in the First Digital Mastercard® review, right? So, you earn 1% in cash back when paying your monthly bill, not when making the purchase!

Challenges with the First Digital Mastercard®

Still, on the topic of cash back, there is a downside to this advantage offered by the First Digital Mastercard®! You can only access this amount after six months of card usage!

Moreover, the cash back doesn’t offset the fees the card charges. As a result, you need to spend over $1,400 per month during the first entire year for the card’s cash back to offset the fees charged.

This is not to mention the 35.99% APR that can leave you more indebted.

Must-have qualifications for the First Digital Mastercard®?

Fortunately, as highlighted in this First Digital Mastercard® review, there aren’t many requirements to join the card. Your credit score should be below 629, which is a fairly broad range.

Moreover, the card only requires you to be over 18 years old and have a fixed residence in the USA. All data must be verified with relevant documentation.

Looking to get the First Digital Mastercard®? We’ve compiled the necessary steps

So, there you have it! In this First Digital Mastercard® review, we’ve shown you that despite this card bringing interesting advantages, the fees charged may not be the best in the market!

Either way, it is indeed an easy card to join. If you want to discover more details, we’ve prepared the blueprint you were looking for to help you! Come and check it out!

Apply for First Digital Mastercard®

If you want to apply for the First Digital Mastercard®, know that the process is virtual, no need to go to the bank to get your card!

Trending Topics

Chase Slate Edge℠ Review: Get Financial Control

Explore our Chase Slate Edge℠ Credit Card review for 0% intro APR, no annual fee, and exclusive benefits that can elevate your finances.

Keep Reading

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Citi® Diamond Preferred® Card Review: Exceptional Benefits!

Enhance your financial life - Don't miss this Citi® Diamond Preferred® Card review! Privileged perks and consistent savings!

Keep ReadingYou may also like

Freedom Gold Card Review: Up to a $750 credit limit!

Do you enjoy shopping at Horizon Outlet? Then, explore the Freedom Gold Card review and take advantage of not paying a security deposit!

Keep Reading

Apply for PREMIER Bankcard® Secured Credit Card: Quick process!

If you want to apply for PREMIER Bankcard® Secured Credit Card, you must know you can apply in just a few minutes at the official website.

Keep Reading

Avant Credit Card Review: Rebuild Credit with No Foreign Fees!

The Avant Credit Card is an intermediate option that aids in the ongoing credit building for those with a fair credit score.

Keep Reading