Credit Cards

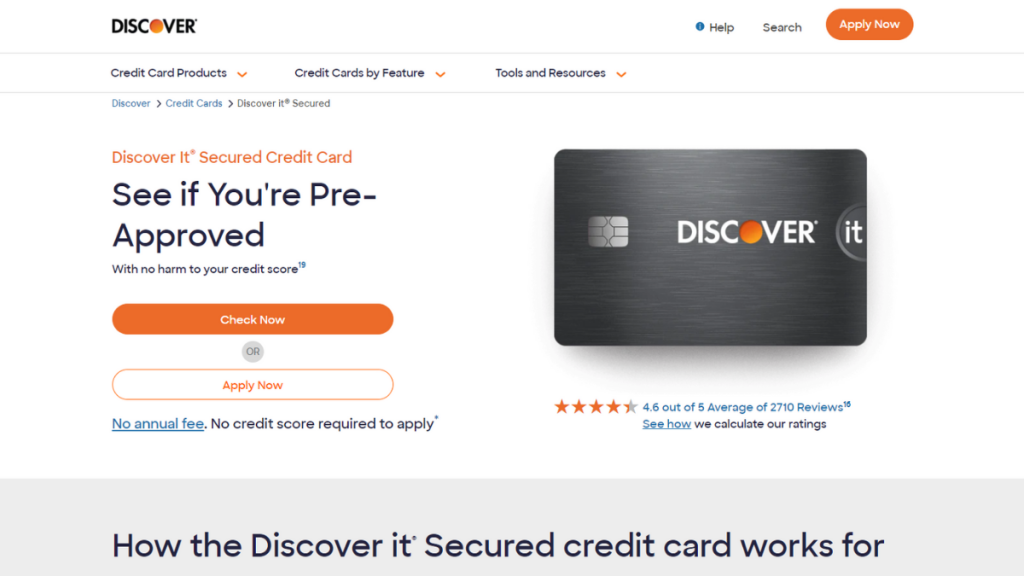

Discover It® Secured Credit Card Review: Up to 2% cash back!

Discover It® Secured Credit Card Review: Dive into our analysis of this essential financial tool, designed to help individuals strengthen their credit history while earning cash back!

Advertisement

Discover It® Secured Credit Card: No annual fee!

The Discover It® Secured Credit Card review will show that this card is a viable solution for individuals looking to take control of their financial future.

Also, this card offers a route to success and financial stability whether you’re new to credit or trying to repair it after prior setbacks.

| Credit Score: | All types of credit; |

| Annual Fee: | $0; |

| Purchase APR: | 28.24% (variable); |

| Cash Advance APR: | 28.24% (variable); |

| Other Fees: | Intro balance transfer fee of 3% of each transfer amount (valid for transfers that you post into your account by May 10, 2024). After that, there is a 5% for each transfer; Either $10 or 5% of each cash advance amount, whichever is greater. |

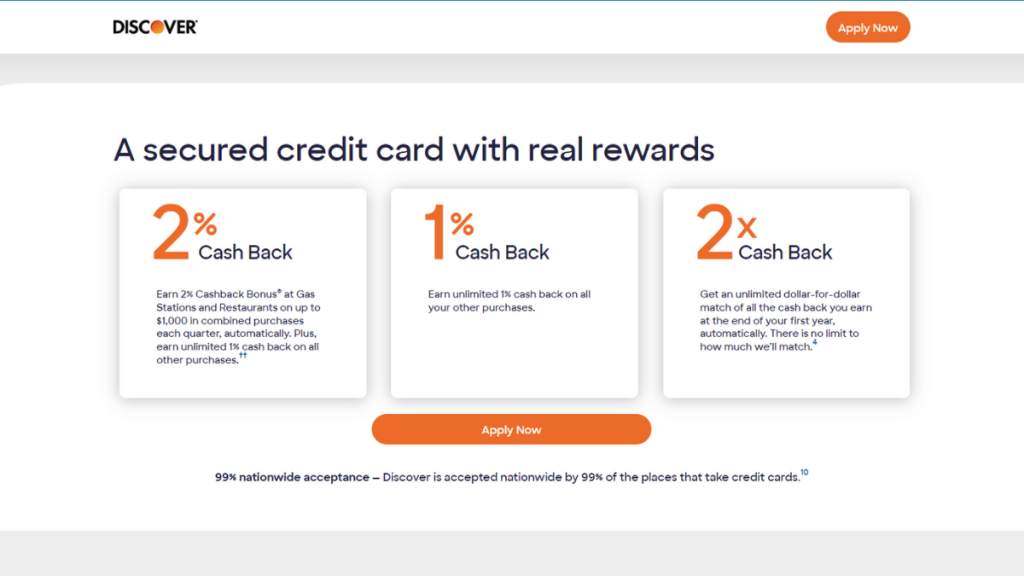

| Welcome Bonus: | You’ll be able to get a dollar-for-dollar match from Discover of all the cash back you’ve earned at the end of your first year using this card. |

| Rewards: | 2% cash back bonus for purchases at gas stations and restaurants (up to $1,000 in combined purchases every quarter); Unlimited 1% cash back on any other purchase you make with this card. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Discover It® Secured Credit Card in action

The Discover it® Secured Credit Card is the ideal partner when you lack a credit history or have bad credit.

This card, in contrast to the majority of its rivals, informs you when you may be eligible to convert to a regular card and receive your deposit back.

Also, Discover will examine your account after seven months to see if you qualify for an upgrade.

Moreover, the card offers benefits that secured credit cards sometimes do not, and it has no annual fees. Plus, a $200 minimum security deposit is needed.

In addition, there are no minimum credit score requirements to get this card and enjoy its incredible benefits!

Key advantages and possible limitations

Now that you know a bit more about this Discover It® Secured Credit Card, we can help you find out even more! So, read the pros and cons list below!

Positive Aspects of the Discover It® Secured Credit Card

There are many positive aspects of using the Discover It® Secured Credit Card! For example, there is no annual fee!

Moreover, regular reporting guarantees that the cardholder’s credit history continuously reflects responsible credit conduct, which helps to raise their credit score over time.

With this card, you’ll be able to check if you pre-qualify with no credit score harm.

Also, you can get up to 2% cash back for purchases you make at gas stations and restaurants (terms apply). Moreover, you’ll get unlimited 1% cash back for any other purchase.

Lastly, another incredible advantage of this card is that you can enjoy a dollar-for-dollar match from Discover It with all the cash back you earned at the end of your first year using it!

Challenges with the Discover It® Secured Credit Card

Since this is a secured credit card, you’ll need to make a security deposit during the application to start using the card.

Moreover, this card has some limited bonus rewards categories for the maximum cash-back perks.

Your blueprint for getting the Discover It® Secured Credit Card

To apply for this card, you must go to the official website and find the Discover card you want.

Then, you’ll be able to go through an easy pre-qualification process by providing the personal information required.

Must-have qualifications for the Discover It® Secured Credit Card?

To apply for this card and have a chance to qualify, you won’t need to have a high credit score.

Also, you’ll need to be at least 18 years old and have an SSN, a U.S. address, and a bank account.

Routes you can follow to apply for the Discover It® Secured Credit Card

Now we can show you more information about how to apply for this card in detail. So, check out our topics below to find out how to apply!

Completing your application online

To apply online for this card, you’ll need to complete the pre-qualification process, and if you pre-qualify, you’ll need to start the official application process.

Also, you’ll be able to do all of this from your computer. So, you’ll need to provide personal information, such as full name, home address, documents, and others.

Then, you’ll be able to wait for an official response from Discover about your application.

Try the Self Visa® Secured Card for a different experience

If you’re looking for similar secured credit card options, we can help you! So, you can try applying for the Self Visa® Secured Card!

Also, with this card, you’ll be able to build credit and complete a quick application process.

So, if you’re interested in this credit card option, you can read our blog post below to learn more about it and find out how to apply!

Self Visa® Secured Card review

Discover how the Self Visa® Secured Card can jumpstart your credit journey from scratch with no credit history!

Trending Topics

Don’t Let Limited Credit Hold You Back: Choose the Credit Card Tailored for You

Discover the best credit cards for limited credit and start building your credit history while enjoying rewards. Find the right card for you!

Keep Reading

Shop Your Way Mastercard® Review: Easy Point Earnings

Discover in our Shop Your Way Mastercard® review how to earn big on gas and groceries while enjoying extended warranty perks on purchases.

Keep Reading

Apply for Freedom Gold Card: Join and start shopping!

If you want to know how to apply for the Freedom Gold Card, know that this process is done online and takes just a few moments!

Keep ReadingYou may also like

Barclays Loans: Enjoy Fixed Interest Rating Benefits

Discover the benefits of Barclays Personal Loan with flexible terms and competitive rates. Learn how it can meet your financial needs today.

Keep Reading

Reflex Mastercard® Review: A Secure Option for Credit Rebuilding!

With the Reflex Mastercard® review, it's your moment to rebuild your credit score. Your history is sent monthly to major credit agencies!

Keep Reading

PenFed Personal Loans Review: up to 50K

PenFed Credit Union a good option for those with solid credit because of its low interest rates and fast funding.

Keep Reading