Credit Cards

Discover it® Chrome Credit Card Review: Road Perks!

Read our Discover it® Chrome Credit Card review and see how to maximize your journeys with lucrative cash back on dining and gas. All without the burden of annual fees!

Advertisement

Fuel your adventures with dining and gas cash back perks

If you are a road runner and a food lover, our Discover it® Chrome Credit Card review is here to show you how you can turn your passions into valuable rewards.

From cash back to no annual fees, this enticing card is a must-have in your wallet to fuel your future trips and dine outs. Read on to learn every detail and stay ahead financially!

| Credit Score: | Ideally between good and excellent, above 690. |

| Annual Fee: | Absolutely none. |

| Purchase APR: | You’ll start with 0% for a 15-month period. Then, a variable 17.24%-28.24% applies according to your credit standing. |

| Cash Advance APR: | Steady at a 29.99% variable. |

| Other Fees: | Cash advances will cost you either $10 or 5%, and paying your balance late might cost up to $41. |

| Welcome Bonus: | After a year of card use, you’ll be rewarded with an identical match of your cash back total. |

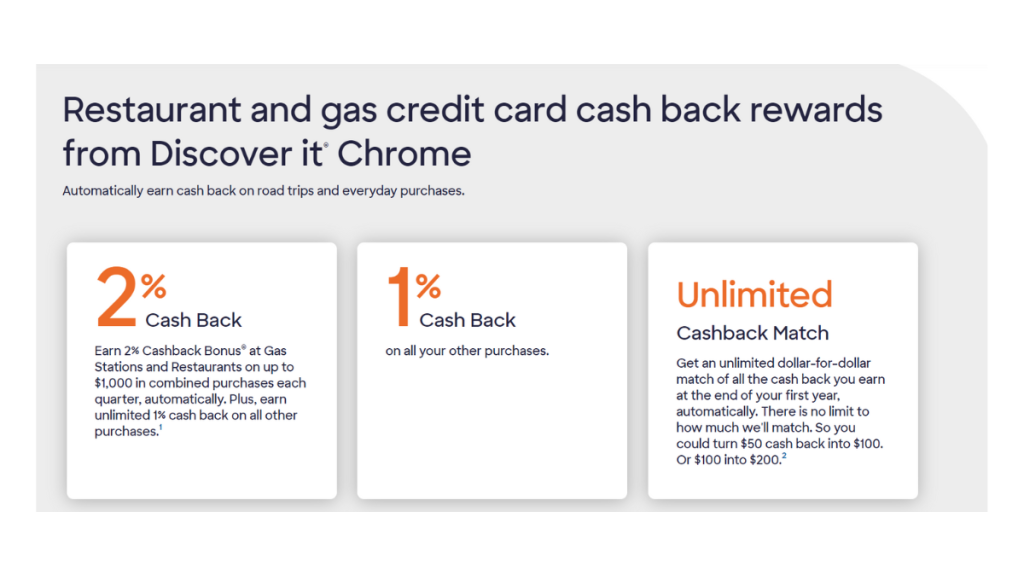

| Rewards: | Gas and dining expenses will give you 2% back on your pocket, capping at $1,000 quarterly. Everything else you purchase earns a 1% rebate, no caps. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Discover it® Chrome Credit Card in action

Start exploring more with our Discover it® Chrome Credit Card review. This card is a traveler’s dream, offering cash back on your gas and dining adventures.

Imagine a credit card without the yearly annoyance of a fee. This card is like having a financial buddy for your journeys, ready to save you money every step of the way.

If you’re thinking about a large purchase, or needs to consolidate debt, here’s a perk: an intro 0% APR. However, after the 15-month honeymoon period, a standard APR kicks in.

And the cherry on top is a cash back counter on your first account anniversary. Whatever you earn, this card doubles it—an invitation for you to maximize your savings on every swipe!

People with good to excellent credit scores find a friend in this card. It’s not just about spending; it’s about being rewarded for managing your finances well.

Key advantages and possible limitations

Curious about what makes this card shine and where it needs improvement? We now turn to the advantages and disadvantages in our Discover it® Chrome Credit Card review.

We’re going to take a closer look through its standout features and areas where it could rev up a bit more. Join us for a clear road map of what to expect.

Positive aspects of the Discover it® Chrome Credit Card

- Earn back on gas and dining, fueling your road trip joys.

- Your first year cash back gets a mirror match, putting more money in your pocket.

- Wave goodbye to the burdens of annual fees and say hello to savings.

- A 15-month period of 0% APR means a sweet start for new purchases.

- Cash in your rewards anytime you feel like it, with no restrictions.

Challenges with the Discover it® Chrome Credit Card

- Potential high APR post-intro period; so watch your balances.

- Higher rewards rate on gas and food are capped, which could be a deal breaker.

- If you need cash, the advance fee can be a wallet pinch.

- Late payments could cost you extra, with a heavy fee up to $41.

- Benefits mainly appeal to road trippers and food lovers, and even so are basic.

Your blueprint for getting the Discover it® Chrome Credit Card

Getting the Discover it® Chrome Credit Card is straightforward, but there are some qualifications to meet. We’ll break them down for you next.

Must-have qualifications for the Discover it® Chrome Credit Card

- Firstly, you need a credit score to match the perks, which is good to excellent.

- Secondly, you need to be a US resident with a valid Social Security number.

- Only adults can apply for this card, so you have to be 18 or older.

- Also, a sable income source to ensure repayment capacity.

- Discover also requires a minimal or manageable existing debt.

- Lastly, not having too many recent credit card applications can help.

Routes you can follow to apply for the Discover it® Chrome Credit Card

The convenience of the Discover it® Chrome Credit Card extends to its mobile app for management, but applying must be done on the web.

This is due to heavier encryption on website applications. It keeps your personal and financial information safe and free from possible breaches.

If you’re ready to earn more on your road adventures and dine-outs, our Discover it® Chrome Credit Card review will now reveal every step of the way.

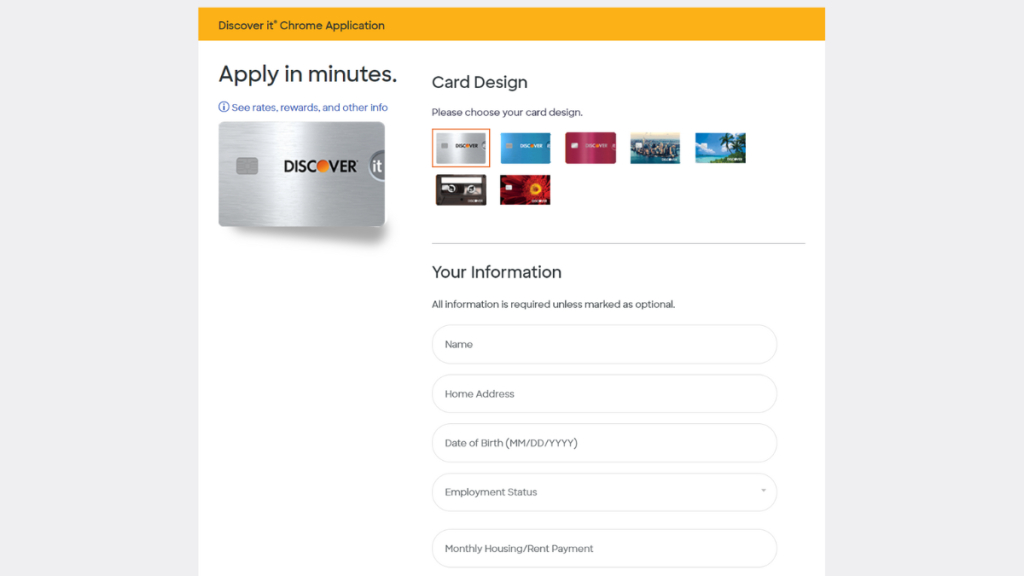

Completing your application online

Firstly, go to Discover’s website and sift through until the Discover it® Chrome Credit Card catches your eye. Click the inviting ‘Apply Now’ button.

Fill in personal details like name, address, and Social Security number. This step is important for identity verification, paving the way for a smooth application process.

Then, provide your financial information. This includes your employment status and annual income. This data helps Discover assess your financial stability and creditworthiness.

Furthermore, review the terms and conditions carefully. Understanding the fees, rates, and rewards structure helps you make wise decisions. Take your time to read through.

Lastly, submit your application. You’ll typically receive a response quickly, sometimes instantly. If approved, you’ll learn about your credit limit, APR, and more.

Try the Prime Visa Credit Card for a different experience

Hopefully this Discover it® Chrome Credit Card review was able to show you the smart way to earn more at the pump and at the café.

However, if you’re looking for broader rewards, consider the Prime Visa Credit Card. This alternative offers benefits beyond just gas and dining, catering to a wider range of spending habits.

The Prime Visa Credit Card stands out with its generous reward points and no annual fees. Curious to learn more? Discover all its features and how to apply in the link below.

Prime Visa Credit Card review

If you are an Prime member, there is a card waiting to give you all the rewards and special perks you deserve! Check out our Prime Visa Credit Card review to learn more!

Trending Topics

Fortiva® Credit Card Review: An Objective Examination

The Fortiva Credit Card: Understand its features, benefits, and potential drawbacks. Make informed decisions for your financial health.

Keep Reading

Reflex Mastercard® Review: A Secure Option for Credit Rebuilding!

With the Reflex Mastercard® review, it's your moment to rebuild your credit score. Your history is sent monthly to major credit agencies!

Keep Reading

Apply for Revvi Credit Card: Fill out the form in minutes!

If you want to apply for the Revvi Credit Card, you can relax! The entire process is done online without stress and complications!

Keep ReadingYou may also like

Self Visa® Secured Card Review: Build credit!

Discover how the Self Visa® Secured Card can jumpstart your credit journey from scratch with no credit history!

Keep Reading

PenFed Personal Loans Review: up to 50K

PenFed Credit Union a good option for those with solid credit because of its low interest rates and fast funding.

Keep Reading

Discover It® Secured Credit Card Review: Up to 2% cash back!

Unlock financial freedom with our in-depth Discover It® Secured Credit Card review. Enjoy 2% cash back with no annual fee!

Keep Reading