Credit Cards

Citi® Diamond Preferred® Card Review: Exceptional Benefits!

Are you ready to achieve your full financial potential? Then don't miss the Citi® Diamond Preferred® Card! 0% intro APR period and $0 annual fee!

Advertisement

Enjoy low APR and high-class perks to elevate your finances effortlessly!

If you seek a credit card designed to streamline your financial matters, be sure not to overlook this comprehensive review of the Citi® Diamond Preferred® Card!

It brings so many useful features that you’ll achieve financial fit in no time! So read on and discover how this credit card can help you!

| Credit Score: | 670 forward – Good to excellent; |

| Annual Fee: | None; |

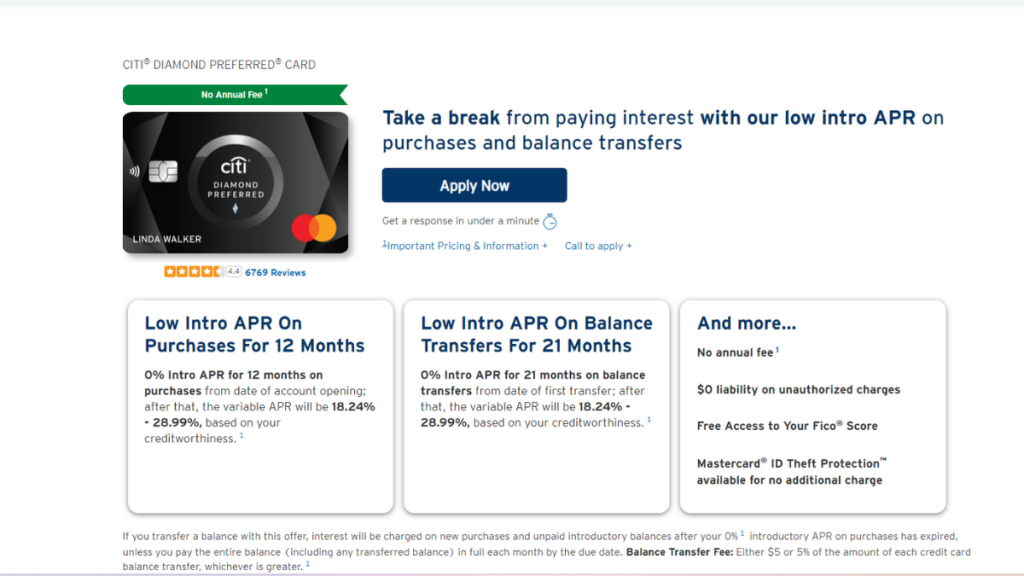

| Purchase APR: | 0% for 12 months – then 18.24% – 28.99%; |

| Cash Advance APR: | 29.99%; |

| Other Fees: | Balance transfer: $5 or 5% each transfer. Cash Advance: 5% or $10. Foreign Purchase – 3% of each purchase transaction in U.S. dollars. Late Fee – Up to $41! |

| Welcome Bonus: | 21 months of 0% APR on balance transfers; |

| Rewards: | N/A. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Citi® Diamond Preferred® Card in action

The commencement of the Citi® Diamond Preferred® Card showcases a significant benefit for cardholders—a notably prolonged 0% introductory APR period specifically designed for balance transfers.

This feature, which lasts for 21 months from the date of the first transfer, can be essential for individuals looking to pay down debt more quickly.

The Citi® Diamond Preferred® Card offers an exclusive benefit known as Citi Entertainment, including discounted and pre-sale tickets for events, concerts, sporting games, and more.

Despite offering no reward program, it charges no annual fee, making it a good choice to those who want to save!

Key advantages and possible limitations

For individuals seeking to eliminate interest and experience excellent features, the Citi® Diamond Preferred® Card stands as a favorable choice!

However, it’s essential to weigh the benefits against the possible drawbacks.

Positive aspects of the Citi® Diamond Preferred® Card

- 0% Intro APR – Seize the opportunity with the 0% Intro APR, enjoying a substantial 21-month period for balance transfers along with an extra 12 months on purchases.

- Citi Entertainment – Enjoy tickets for thousands of events, including discounted and pre-sale tickets – as well as exclusive experiences like concerts and sporting games.

- No Annual Fee – A $0 annual fee is an ally when it comes to saving!

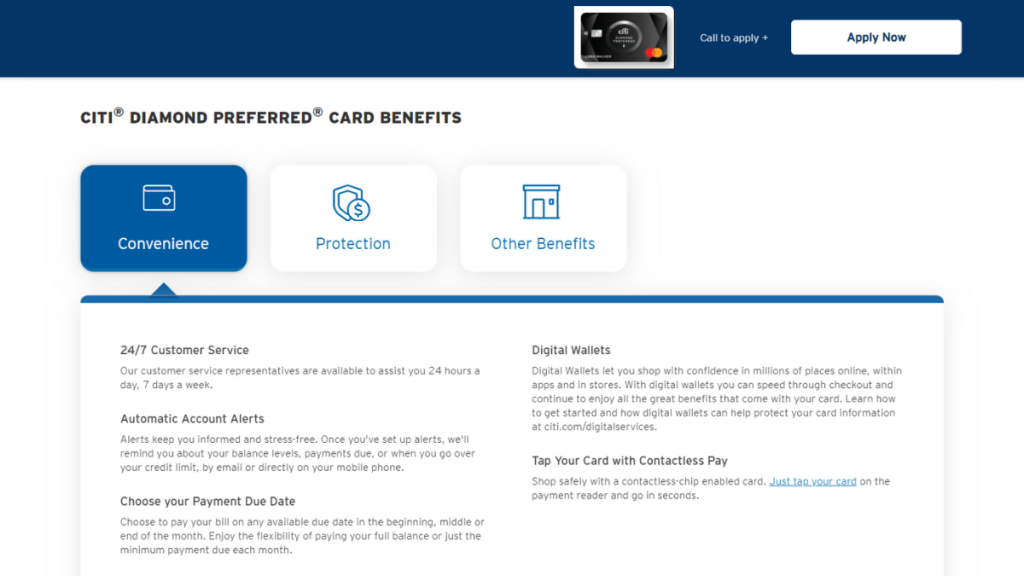

- Free Access to FICO Score – Gain complimentary access to your FICO Score and keep track of your credit progress.

- ID Theft Protection – Benefit from identity theft protection with ongoing monitoring to safeguard both yourself and your finances!

Challenges with the Citi® Diamond Preferred® Card

- No Rewards – Citi won’t offer points or cashback on purchases made with this card.

- High Variable APR after Intro Period – After the introductory period, you’ll pay a variable APR.

- Other fees – Despite is no annual fee, this card brings other charges.

- Limited Additional Perks – Apart from the extended 0% Intro APR period and Citi Entertainment, the card offers a few additional perks.

Your blueprint for getting the Citi® Diamond Preferred® Card

Indeed, there are some requirements one must meet to apply for this card successfully. Including having a higher credit rating.

Check below their eligibility criteria to make your journey easier!

Must-have qualifications for the Citi® Diamond Preferred® Card?

To qualify for the Citi® Diamond Preferred® Card, applicants must fulfill certain criteria:

- Credit Rating – Applicants should possess a credit rating ranging from good to excellent.

- Credit History and Income – This is also an important criterion to apply for this card.

- Debt-to-Income Ratio – Your debt-to-income ratio, which assesses the proportion of your debt relative to your income, is also taken into consideration.

Routes you can follow to apply for the Citi® Diamond Preferred® Card

Securing the Citi® Diamond Preferred® Card is a straightforward process. Access the card’s official page to start your application!

There, you’ll need to provide your personal information, including contact and a valid SSN! Next, submit the form and wait for the result.

Approval is subject to a credit check and other conditions.

Completing your application online

- Visit the Citibank (Citi) website – we’ve provided the link through our article;

- Select “Apply Now” and access their form;

- Fill in the required information, review it, and submit your form.

Completing your application by phone

You can apply by calling Citi’s customer service number specifically dedicated to applications. A customer service representative will guide you through the application process.

Complete your application in person

- Visit a Citibank branch in person.

- If you’re interested in acquiring the Citi® Diamond Preferred® Card, express your intention to apply for it.

- The representative will provide you with an application to fill out.

- You might need to bring identification and possibly proof of income with you.

Complete your application by mail

- Sometimes, Citi sends out pre-approved or invitation offers through the mail.

- If you receive such an offer, it will include instructions and a code for applying.

- You would typically complete the enclosed application form and mail it back to Citi.

If you have any specific questions or need assistance during the application process, you can contact Citi’s customer service for help.

Try the Chase Freedom Unlimited® for a different experience

The Citi® Diamond Preferred® Card is essential for those aiming to simplify their financial management!

But if you want to consider your options, you need to check other cards!

Take the Chase Freedom Unlimited® as an illustration, offering remarkable advantages such as rewards on purchases! Read on and learn more about this card.

Chase Freedom Unlimited® Credit Card Review

Chase Freedom Unlimited® full review – Get limitless rewards on every purchase – 0% intro APR and no annual fee!

Trending Topics

Neo Credit Card Review: Flexible Credit Solutions

Read our Neo Credit Card review for insights on how to earn up to 15% cashback on first-time purchases and easy, secure card management.

Keep Reading

Chase Freedom Unlimited® Credit Card Review: Versatile cash back

Chase Freedom Unlimited® full review - Get limitless rewards on every purchase - 0% intro APR and no annual fee!

Keep Reading

Financial Wellness: Tips for Achieving Financial Stability

In this article, learn practical strategies to achieve financial wellness and attain a more balanced and peaceful life.

Keep ReadingYou may also like

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading

Group One Platinum Card Review: Shop with Ease

Discover the Group One Platinum Card in our review! Perfect for bad credit, with a $750 merchandise credit line, and no rates on purchases.

Keep Reading

Shop Your Way Mastercard® Review: Easy Point Earnings

Discover in our Shop Your Way Mastercard® review how to earn big on gas and groceries while enjoying extended warranty perks on purchases.

Keep Reading