Credit Cards

Chase Slate Edge℠ Review: Get Financial Control

The Chase Slate Edge℠ Credit Card offers a chance for you to manage your finances towards better credit health. Read on for key insights on how you can make the most out of this card!

Advertisement

Maximize your credit potential with unique benefits like credit limit increases and fraud protection

Uncover the benefits of the Chase Slate Edge℠ Credit Card in our in-depth review, showing how this one-of-a-kind credit solution can easily bring financial control to your fingertips.

With a lengthy low APR period, no annual fees, and exclusive perks focused on your credit health, the Chase Slate Edge℠ Credit Card is a one-of-a-kind card. Read on to learn more!

| Credit Score: | Ideal for people with Good to Excellent scores. |

| Annual Fee: | Absolutely no annual fee. |

| Purchase APR: | Enjoy a 0% APR period for the first 18 months of membership, then a variable 20.49%–29.24% takes the stage. |

| Cash Advance APR: | The variable rate for is set at 29.99%. |

| Other Fees: | Throughout the intro promotion, the balance transfer fee stands at 3%, later adjusting to 5%. For international purchases, a 3% currency conversion fee applies, and late or returned payments might result in charges up to $40. |

| Welcome Bonus: | Chase offers a credit limit increase review within the first six months as long as you pay your balance on time and spend at least $500 within that time frame. |

| Rewards: | You won’t find any traditional rewards program attached to this card. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Chase Slate Edge℠ in action

Experience a financial shift with the Chase Slate Edge℠ at your side. With no APR for a long period on purchases and transfers, it’s ideal for those planning ahead or consolidating debt.

Moreover, the lack of an annual fee is a major perk. This feature alone makes it a wallet-friendly option, especially for those looking to save every dollar.

Furthermore, the card encourages responsible credit use. By paying on time and spending wisely, you’re eligible for a 2% APR reduction every year, fostering good financial habits.

Additionally, the card offers a chance to increase your credit limit. Just spend $500 in six months and pay on time for a boost, increasing your creditworthiness and spending power.

Finally, this card provides powerful security features. With proactive fraud monitoring and zero liability on unauthorized charges, it ensures your financial safety and peace of mind.

Key advantages and possible limitations

Knowing what to expect from the ups and downs is important, and that’s what we’ll analyze now in this Chase Slate Edge℠ review.

Positive aspects of the Chase Slate Edge℠

- Take advantage of a generous low intro APR for a 18-month period.

- No annual fee means more savings and less worry about extra costs.

- Eligible for a 2% APR reduction annually, rewarding responsible use.

- Opportunity for credit limit increase with just $500 spent in six months.

- Enjoy partner benefits like DashPass and Instacart+ memberships for a limited time.

Challenges with the Chase Slate Edge℠

- After the intro period, the APR jumps to a variable up to 29.24%, which can be high.

- Lacks rewards or cash back incentives, limiting its appeal.

- International travels and online purchases might take a hit with a 3% foreign fee.

- Higher cash advance APR and fees, so not the best choice for cash transactions.

- No welcome bonus, missing that initial perk offered by many other credit cards.

Your blueprint for getting the Chase Slate Edge℠

Moving forward, we’ll tell you the key requirements for you to easily apply and get this card in your wallet. Meeting them all could improve your approval odds and speed up the process.

Must-have qualifications for the Chase Slate Edge℠

- Good to Excellent credit score recommended for higher approval chances.

- Must be 18 years or older, with a valid social security number or ITIN.

- Also, a stable income source to ensure ability to manage credit card payments.

- U.S. resident with a physical mailing address and valid contact information.

- Lastly, no major recent credit issues like bankruptcy or default on other cards.

Routes you can follow to apply for the Chase Slate Edge℠

Chase offers a user-friendly mobile app, which helps in managing their financial solutions. However, applications for their products can only go through two ways.

Currently, you can make use of technology and apply online, or you can visit the nearest branch and request your Slate Edge℠ in person. Below, we’ll tell you how to do both.

Completing your application online

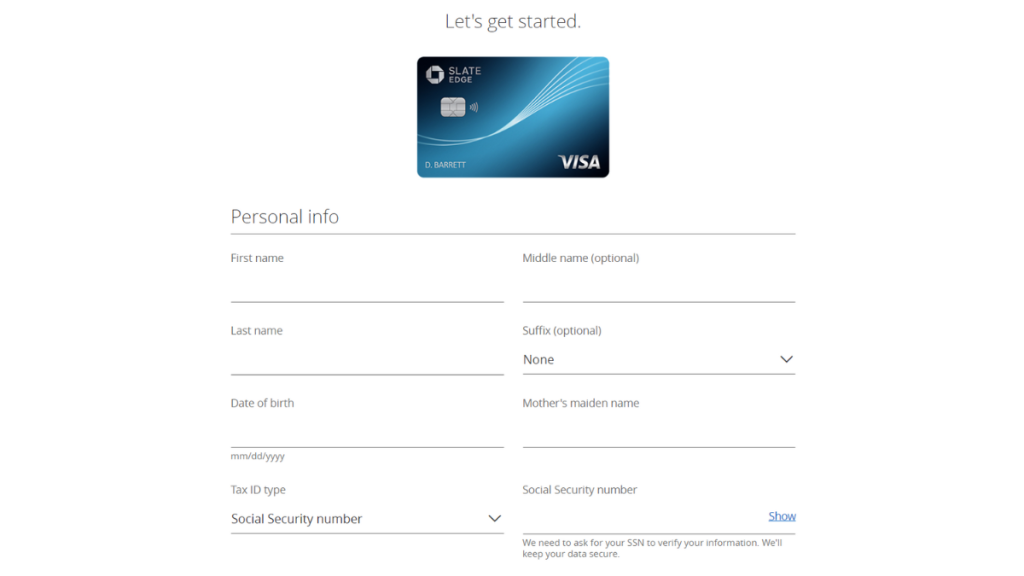

The first step is accessing Chase’s online portal and browsing its homepage until you find the Chase Slate Edge℠. Click on it and you should find its dedicated page.

Then, click on the green button to apply as a guest, and you’ll reach the application form. Enter your personal details such as name, address, and social security number.

Following this, the form will ask for your financial information. Include your income, job status, and housing costs. This will help the bank learn whether or not the card fits your profile.

Lastly, double-check all the information you’ve provided and submit your application. You can expect a prompt response from Chase regarding the status of your request.

Completing your application in person

Chase makes it easy to find the nearest branch with their ‘Branch Locator’ online feature. Use it to find your local Chase Bank and pay them a visit to apply for your Slate Edge℠.

Remember to take all your documentation in a physical form with you. When in the branch, find a staff member to let them know you’d like to apply for the Slate Edge℠ Credit Card.

Then, fill in the application with your personal and financial details. Don’t hesitate to ask the branch staff for assistance if you need any help or clarification during the process.

Finally, hand over your completed form to the representative. They will process your application and inform you about the next steps and when to expect a response.

Try the Quicksilver Cash Rewards for a different experience

Our Chase Slate Edge℠ Credit Card review ends with a clear picture: this is a card that stands out as a practical and no-frills option for handling your credit.

However, when it comes to rewards, it lacks the perks of traditional cards. If you’re looking for an alternative that combines a long APR intro with cash back, take a look at the Quicksilver Cash Rewards Credit Card.

The Quicksilver Cash Rewards Card from Capital One offers the best of both worlds, and tops it off with no annual fees. It’s a complete financial solution in every aspect.

If this sounds like something you’re after, check the following link to learn more about the Quicksilver Cash Rewards’ features, benefits, and more.

Quicksilver Cash Rewards Credit Card review

Are you in the market for the perfect cash back rewards credit card? Well, you've found it! Check our full Quicksilver Cash Rewards Credit Card review to learn more.

Trending Topics

Bank of America® Unlimited Cash Rewards Credit Card Review: earn cash back

With this review of the Bank of America® Unlimited Cash Rewards Credit Card, you'll discover how to increase your cash back!

Keep Reading

Prime Visa Credit Card Review: $100 Amazon Gift Instantly

If you’re an Amazon loyalist, this Prime Visa Credit Card review is made for you! Learn how to earn valuable cash back with no annual fee.

Keep Reading

Revvi Credit Card Review: Rebuild Your Credit Securely!

Discover how to get cash back on all your purchases with the Revvi Credit Card Review. This card welcomes people with bad credit scores!

Keep ReadingYou may also like

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep Reading

Upgrade Triple Cash Rewards Visa® Review: The Smart Choice

Read our Upgrade Triple Cash Rewards Visa® review - get 3% cash back on select categories and no annual fees. Ideal for everyday spending.

Keep Reading

Chase Freedom Unlimited® Credit Card Review: Versatile cash back

Chase Freedom Unlimited® full review - Get limitless rewards on every purchase - 0% intro APR and no annual fee!

Keep Reading