Credit Cards

Chase Freedom Unlimited® Credit Card Review: Versatile cash back

Your key to financial freedom - earn up to 5% cash back on purchases + $200 welcome bonus! Meet the Chase Freedom Unlimited® Card!

Advertisement

Chase Freedom Unlimited®: earn up to 5% back with a $0 annual fee!

If you’re looking to earn more cash back, then stick in this Chase Freedom Unlimited® full review. This card can be a really smart move for a $0 annual fee!

This credit card brings many more benefits! So if you’re interested, don’t miss our full article! Let’s get started!

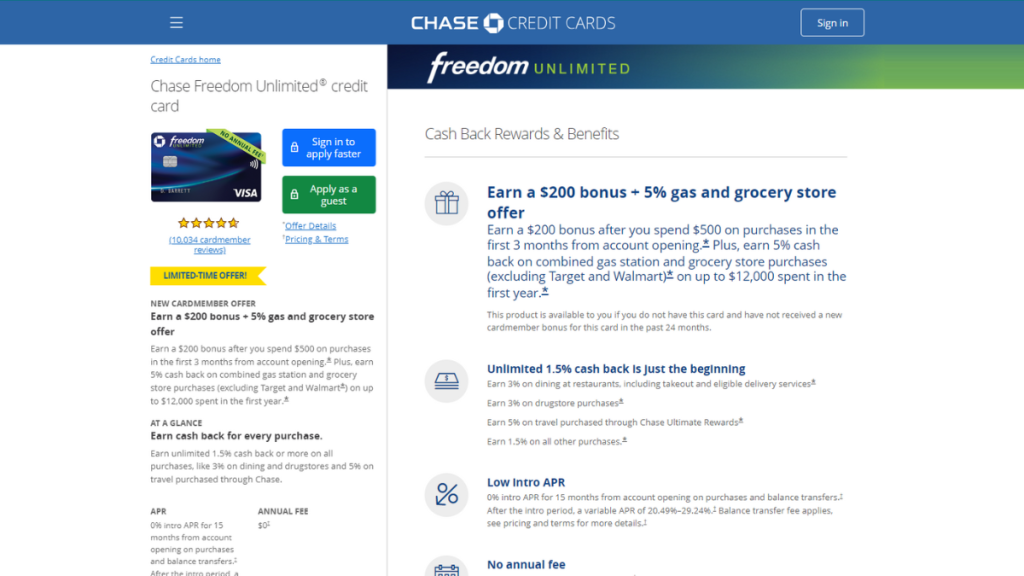

| Credit Score: | 670 to 850; |

| Annual Fee: | None; |

| Purchase APR: | 0% on the first 15 months, onwards 20.49% to 29.24%, based on your creditworthiness; |

| Cash Advance APR: | 29.99%; |

| Other Fees: | Balance Transfer – 0% on first 15 months, onwards 20.49% to 29.24%Foreign Transitions – 3% of the amount of each transaction in U.S. dollars |

| Welcome Bonus: | $200 bonus when spending $500 in purchases for the 1st 3 months. Also, for a limited time, you’ll earn 5% back (on up to $12K spent in the 1st year) on gas station and grocery store purchases (not available on Target and Walmart stores); |

| Rewards: | Earn 5% back on travel (only available for purchases made through the Chase Ultimate Rewards); 3% on dining and drogstores purchases, and 1.5% at all other purchases you make with the card! |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Chase Freedom Unlimited® Credit Card in action

The Chase Freedom Unlimited® rewards you on everyday purchases with an amazing cash back rate! Which is an amazing tool for those who want to save!

You can use the card for regular purchases such as groceries, gas, dining, shopping, and more.

Earn a flat percentage of cashback on all purchases and accumulate rewards without worrying about changing categories.

Benefit from payment flexibility and combine rewards with other Chase cards for greater value. Use your rewards strategically to maximize their benefits.

Key advantages and possible limitations

The card offers stability and a good rewards plan, but other elements are also taken into account.

Positive aspects of the Chase Freedom Unlimited® Credit Card

- Flat-rate Cashback: Offers a consistent cashback percentage on all purchases, making it simple to earn rewards without worrying about rotating categories.

- Introductory Bonus: Typically provides a sign-up bonus after meeting spending requirements in the initial months, boosting the initial cash back earnings.

- No Annual Fee: There’s no yearly fee for card ownership, which can be appealing for those seeking rewards without additional costs.

- Extra Perks: Benefits may include purchase protection, extended warranties, rental car insurance, and access to exclusive events or experiences.

Challenges with the Chase Freedom Unlimited® Credit Card

- Limited Bonus Categories: Lacks higher cashback rates in specific spending categories compared to cards with rotating category bonuses, potentially offering fewer rewards for certain types of purchases.

- Foreign Transaction Fees: Chase will charge you for transactions made abroad, so it can be an additional cost when traveling.

- Potentially Lower Earning Potential: While the consistent cashback rate is convenient, it might offer lower rewards compared to cards with higher cashback rates in specific spending categories, especially if your spending aligns more with those categories.

Your blueprint for getting the Chase Freedom Unlimited®

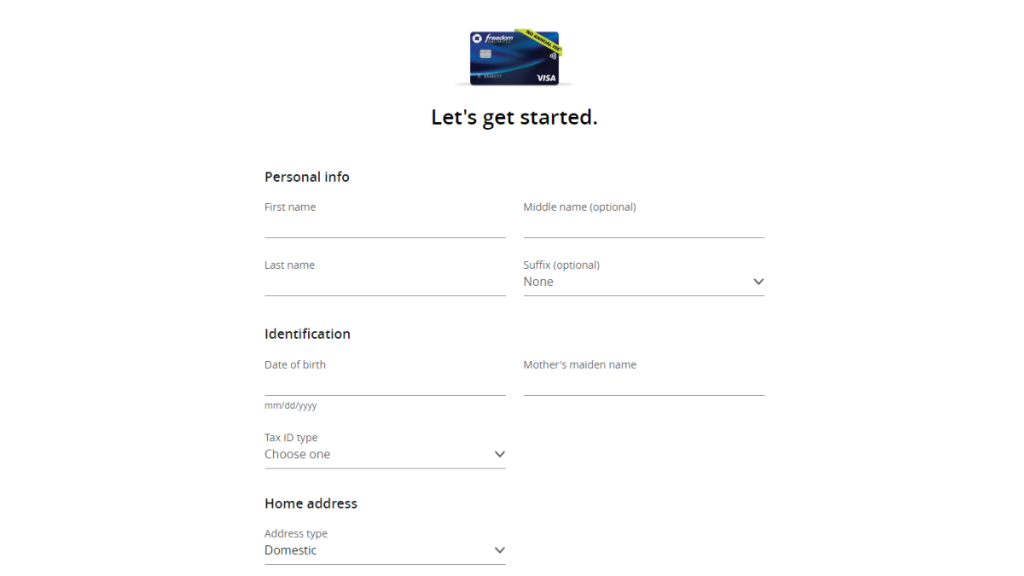

To apply for the Chase Freedom Unlimited®, make sure you meet the bank’s minimum credit requirements; having a credit score in the higher range can increase your chances of approval.

Visit the Chase Freedom Unlimited® website to find detailed information about the card and fill in the application form with documents and information.

Wait for an analysis and response.

Must-have qualifications for the Chase Freedom Unlimited®?

To successfully apply for this credit card, you must meet the requirements below:

- Good-Excellent Credit Rating: you’ll need 670 to 850 to qualify;

- Income and Employment Information: You’ll need to provide details about your income, employment status, and possibly other financial information to demonstrate your ability to manage the card’s credit line;

- Age Requirement: You must be at least 18 to get this credit card;

- Legal Residency in the United States: You typically need to be a U.S. citizen or a legal resident with a valid SSN or ITIN;

Meeting these requirements doesn’t guarantee approval, as the decision also depends on various factors, including your credit history, debt-to-income ratio, and other financial considerations.

Routes you can follow to apply for the Chase Freedom Unlimited®

There are several ways to apply. Applying online offers convenience, while applying at an agency allows direct interaction with a representative.

The choice will depend on your personal preferences and what is safest and most comfortable.

Completing your application online

Access the Chase Bank website – we’ve provided it through the article to make your experience even easier.

Then, hit the “Apply Now” button to access their application form, where you must provide your personal and financial information.

Completing your application via mobile app

Download the Chase Mobile app at your mobile device! Open the Chase Mobile App and either log in if you’re an existing Chase customer or sign up for an account if you’re new to Chase.

Once logged in, navigate to the credit cards section or look for an option that allows you to apply for a credit card.

Find your desired credit card, and select it to start your application process! In addition, you can use the app to manage your account, so it is quite an amazing tool!

Completing your application in person

Visit the nearby Chase Bank branch or an affiliated location! You can find it using the bank’s website, mobile app, or a search engine.

Gather necessary documents such as identification (driver’s license, passport), Social Security number, employment details, income information, and any other relevant financial documents.

Speak with a Representative, and inform that you’re interested in applying for this credit card!

They will provide you with an application form to fill out.

Try the Capital One VentureOne for a different experience

Choosing the right card depends a lot on your financial goals and personal spending patterns, so it’s good to carefully evaluate your options.

VentureOne is considered a good option for those who want to earn miles for traveling without dealing with complicated spending categories.

If you have the profile of a traveler and want to earn miles for travel without dealing with complicated spending categories, consider this a good option and visit our next review for more information.

VentureOne Rewards Credit Card Review

Discover in our VentureOne Rewards Credit Card review how you can earn a big welcome bonus, miles on every purchase, and pay no annual fee.

Trending Topics

First Digital Mastercard® Review: Apply even with a low credit!

The First Digital Mastercard® review introduces you to a credit card with 1% cash back on all purchases and no security deposit required!

Keep Reading

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep ReadingYou may also like

Prime Visa Credit Card Review: $100 Amazon Gift Instantly

If you’re an Amazon loyalist, this Prime Visa Credit Card review is made for you! Learn how to earn valuable cash back with no annual fee.

Keep Reading

Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card: Earn back

If you want to know how to apply for the Petal® 1 "No Annual Fee" Visa® Credit Card, it's an easy process: receive it in 10 days!

Keep Reading

Chase Slate Edge℠ Review: Get Financial Control

Explore our Chase Slate Edge℠ Credit Card review for 0% intro APR, no annual fee, and exclusive benefits that can elevate your finances.

Keep Reading