Credit Cards

Chase Freedom Flex® Credit Card Review: Max Rewards

Acheive financial freedom with Chase Freedom Flex® Credit Card! Earn cash back on purchases and enjoy 0% intro APR and no annual fee!

Advertisement

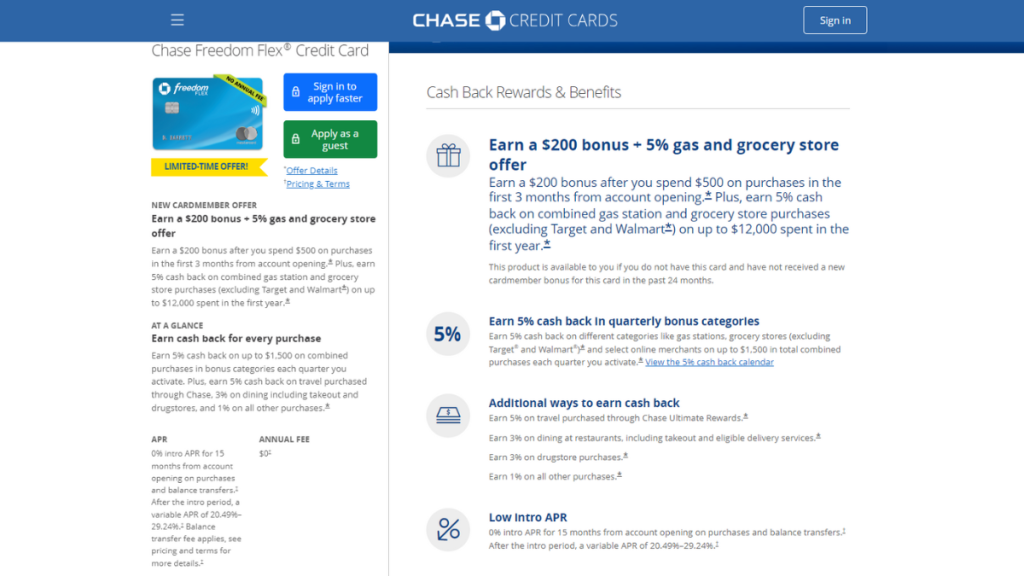

Chase Freedom Flex®: cash back on everyday purchases

The Chase Freedom Flex® credit card distinguishes itself as a versatile contender in the domain of cash-back cards, and this review will delve into its particulars.

The card offers a compelling suite of benefits that cater to a wide range of spending habits. Here, you can explore further details regarding the card’s rewards initiative and supplementary benefits.

| Credit Score: | 670 to 850; |

| Annual Fee: | None; |

| Purchase APR: | 0% on the first 15 months, 20.49% to 29.24% after; |

| Cash Advance APR: | 0% in the first 15 months, 20.49% to 29.24% after; |

| Other Fees: | Balance Transfer – 0% on first 15 months, onwards 20.49% to 29.24%. Foreign Transitions – 3% per transaction; |

| Welcome Bonus: | Earn an amazing bonus of $200 when you spend $500 on purchases within 3 months + a 5% cash back offer on gas and grocery stores; |

| Rewards: | 5% on travel purchases made with Chase Ultimate Rewards; 3% on dining at restaurants; 3% on drugstores; 1.5% on everything else. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Chase Freedom Flex® Credit Card in action

The Chase Freedom Flex® Credit Card offers a revolving rewards system.

Cardholders can amass a 5% cash back on up to $1,500 in combined purchases within designated bonus categories every quarter upon activation.

Additionally, individuals holding the card enjoy a 5% return on travel expenditures made through Chase Ultimate Rewards®.

Also, 3% on dining, as well as 3% on drugstore purchases. For all other purchases, the card offers an unbounded 1% cash back.

The Chase Freedom Flex® Credit Card empowers users to accrue rewards across diverse spending categories while enjoying a 0% intro APR on purchases and baçance transfers for the initial 15 months.

With no annual fee, this card is an accessible option for many consumers. The card provides multiple safeguards, encompassing zero liability, purchase protection, extended warranty coverage, and insurance for trip cancellation/interruption.

Moreover, new cardholders have the opportunity to earn an impressive welcome bonus within the first three months from the opening of the account!

Key advantages and possible limitations

The Chase Freedom Flex® Credit Card offers many benefits, but it’s important to weigh both the pros and potential cons to determine if it’s suitable for your financial needs.

Positive aspects of the Chase Freedom Flex® Credit Card

- Amazing rewards program: Collect up to 5% cash back on all your purchases using the Chase Freedom Unlimited®.

- Welcome Bonus: A generous welcome offer is available for new cardholders who meet the spending requirement in the first three months.

- No Annual Fee: The card does not charge an annual fee, which is beneficial for users who want to minimize their costs.

- 0% Intro APR: During the initial 15 months, there is an introductory 0% APR on both purchases and balance transfers.

- Additional Perks: Cardholders enjoy various additional benefits, including trip cancellation/interruption insurance and purchase protection.

Challenges with the Chase Freedom Flex® Credit Card

- Foreign Transaction Fees: The card incurs charges for foreign transactions, potentially posing a significant expense for individuals who frequently travel abroad.

- Rotating Categories Require Activation: The 5% cash back on rotating categories requires cardholders to actively activate these each quarter, which can be a hassle for some users.

- Variable APR After Intro Period: Once the introductory APR period ends, the card’s regular APR may be higher than some cardholders are comfortable with, depending on their creditworthiness.

Your blueprint for getting the Chase Freedom Flex® Credit Card

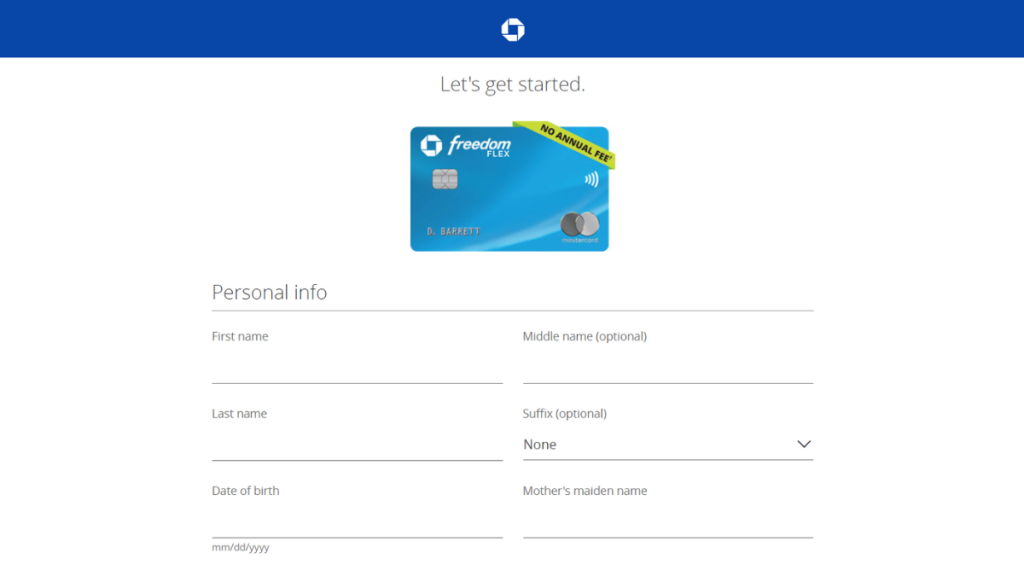

Initiating the application for the Chase Freedom Flex® Credit Card is a straightforward procedure that may open the door to a lucrative rewards program and enhanced financial flexibility.

Prospective applicants should first evaluate their creditworthiness, considering that this card typically demands a good to excellent credit score.

Next, gather personal financial information, as the application asks for income, employment, and bank account details.

Finally, applicants can submit their application online through the Chase website.

Upon approval, cardholders can manage their account through the user-friendly Chase mobile app or online banking platform.

Must-have qualifications for the Chase Freedom Flex® Credit Card?

The crucial qualifications for applying for the Chase Freedom Flex® Credit Card encompass:

- Age Requirement: Must be at least 18 years old.

- Credit Score: Generally, a good to excellent credit score is needed (670 or higher on the FICO scale is recommended, but applicants with slightly lower scores may occasionally be considered).

- U.S. Social Security Number Requirement: A valid Social Security number is mandatory for applicants.

- U.S. Mailing Address: Requires a physical U.S. address (no P.O. Boxes).

- Income Verification: Ability to provide proof of a steady income to demonstrate the ability to pay back any debts incurred.

- Banking Relationship: While not strictly required, having an existing relationship with Chase can be beneficial.

- Credit History: A solid credit history with a track record of on-time payments is important.

- Legal Status: Must be a U.S. citizen or a legal resident of the United States.

Note that meeting these qualifications does not guarantee approval, as issuers consider a variety of factors when assessing a credit card application.

It is also important to read the latest terms and conditions directly from Chase, as the requirements may change.

Routes you can follow to apply for the Chase Freedom Flex® Credit Card

There are various application methods are available for this credit card, each tailored to provide convenience and accessibility.

Whether you prefer online applications, in-person discussions, or phone conversations, Chase provides an option that fits your preference.

Completing your application online

The most convenient and fastest way to apply is through Chase’s official website.

This process involves filling out an application form with your personal and financial details.

Completing your application by phone

If you prefer to apply over the phone, Chase has customer service representatives available to guide you through the application process.

Completing your application in person

You have the option to visit a Chase branch and engage with a banker who can assist you in navigating the application process.

This option allows for a more personal interaction and the opportunity to ask questions directly.

Completing your application Mail-in

Occasionally, Chase may send out pre-selected offers through the mail, which you can respond to by completing the enclosed application form and sending it back.

Each of these routes will require the same basic information and documentation to process your application.

Ensure you have all the necessary details on hand, such as your Social Security number, income information, and personal identification, to streamline the application process.

Try the Chase Freedom Unlimited® for a different experience

In case the Chase Freedom Flex® Credit Card does not align with your needs or preferences, an alternative worth exploring is the Chase Freedom Unlimited®.

Indeed, Chase brings amazing credit card features to those who want to use plastic with benefits! Stay with us as we unravel the mechanics of the Chase Freedom Unlimited®!

Chase Freedom Unlimited® Credit Card Review

Chase Freedom Unlimited® full review – Get limitless rewards on every purchase – 0% intro APR and no annual fee!

Trending Topics

Prime Visa Credit Card Review: $100 Amazon Gift Instantly

If you’re an Amazon loyalist, this Prime Visa Credit Card review is made for you! Learn how to earn valuable cash back with no annual fee.

Keep Reading

Shop Your Way Mastercard® Review: Easy Point Earnings

Discover in our Shop Your Way Mastercard® review how to earn big on gas and groceries while enjoying extended warranty perks on purchases.

Keep Reading

VentureOne Rewards Credit Card Review: Travel Perks Galore

Check our in-depth VentureOne Rewards Credit Card review to learn how you can benefit from unlimited miles on purchases and 0% intro APR.

Keep ReadingYou may also like

Freedom Gold Card Review: Up to a $750 credit limit!

Do you enjoy shopping at Horizon Outlet? Then, explore the Freedom Gold Card review and take advantage of not paying a security deposit!

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Rebuild Your Credit!

With cash back and no annual fee, the Petal® 1 "No Annual Fee" Visa® Credit Card is an option for those without a credit score!

Keep Reading