Credit Cards

Bank of America® Unlimited Cash Rewards Credit Card Review: earn cash back

A card for those seeking cash back, the Bank of America® Unlimited Cash Rewards Credit Card might be the option you've been waiting for! How about earning a welcome bonus? Come find out how!

Advertisement

A no-annual-fee card with a 0% intro APR: get to know the Bank of America® Unlimited Cash Rewards!

The answer to how to enhance your cash back can be found in this Bank of America® Unlimited Cash Rewards Credit Card review!

So, without having to pay an annual fee and with affordable rates, you can enjoy this card. So read on and learn more!

| Credit Score | 690 – 850; |

| Annual Fee | 0% for 15 cycles, and then: 18.24% to 28.24%; |

| Purchase APR | 0% for 15 cycles, and then: 18.24% to 28.24%; |

| Cash Advance APR | 21.24% to 29.24%; |

| Other Fees | Balance transfer: 3%Foreign transactions: 3%; |

| Welcome Bonus | $200 online cash rewards bonus; |

| Rewards | 1.5% cash back in any purchase. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Bank of America® Unlimited Cash Rewards Credit Card in action

Now, let’s continue our Quicksilver Cash Rewards Credit Card review by introducing how you can make the most of the advantages this card offers.

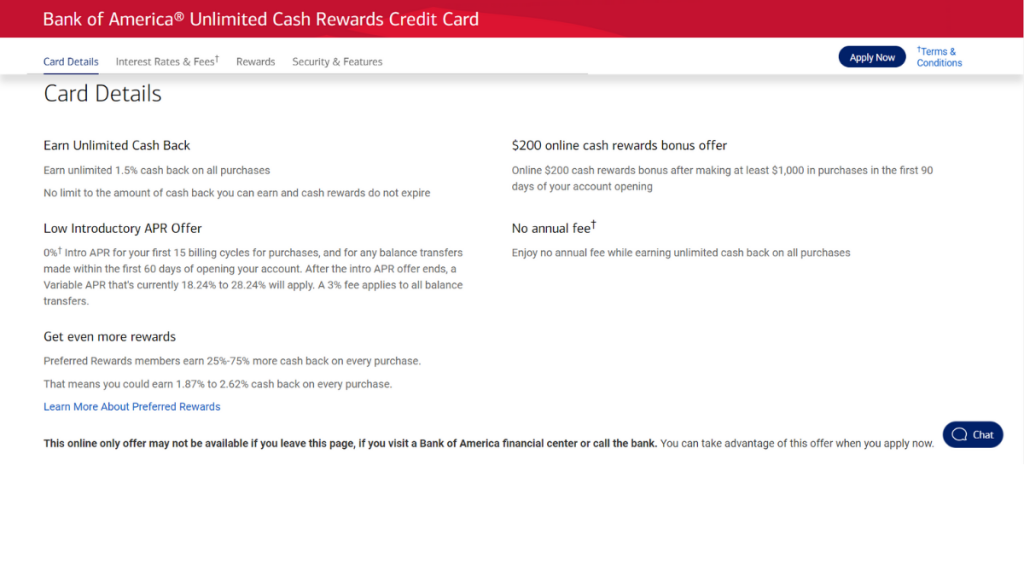

Firstly, this is a cash back card that offers 1.5% on every purchase. However, you can increase this value to 2.62% by becoming a member of Bank of America Preferred Rewards®.

To do so, you need to maintain a minimum amount in the bank, ranging from US$ 20,000 to US$ 10 million!

Depending on the amount, you will be in one of the five different categories and have access to different cash back percentages.

Additionally, you can redeem your cash back in various ways: on your statement, in your checking account, in your savings account, etc. Plus, your rewards have no expiration date!

Key advantages and possible limitations

The Bank of America® Unlimited Cash Rewards Credit Card has a lot to offer, but whether it’s worth it goes beyond this review. It depends on you and what you’re looking for in a card!

So, check out some positive points and limitations to understand what’s best for you!

Positive aspects of the Bank of America® Unlimited Cash Rewards Credit Card

One of the main positives of the Bank of America® Unlimited Cash Rewards Credit Card is the possibility of increasing your cash back from 1.5% to as much as 2.62%.

Moreover, the card is contactless, making your payments easier and transactions even more secure!

Furthermore, after spending US$ 1,000 in the first month and a half of card usage, you earn an incredible bonus! That’s US$ 200 online in your account!

Challenges with the Bank of America® Unlimited Cash Rewards Credit Card

Now, for a complete Bank of America® Unlimited Cash Rewards Credit Card review, it’s necessary to point out the negative aspects as well. The first point is that perhaps the cash back may not be as attractive to you.

Additionally, it’s quite challenging to qualify; an excellent credit score is required. For this level of requirement, you might find cards with more benefits.

Furthermore, the Bank of America® Unlimited Cash Rewards Credit Card charges a 3% fee on international transactions.

Your blueprint for getting the Bank of America® Unlimited Cash Rewards Credit Card

Taking our entire Bank of America® Unlimited Cash Rewards Credit Card review into account, if you want to join, we’ll help you! Rest assured that the process is simple and can be done online!

The whole process is quite straightforward, involving a form with your details and later, contact from the bank. Do everything in a few minutes.

So, check out our blueprint and get more insights on how to follow the enrollment process! But are there any limitations for applicants?

Must-have qualifications for the Bank of America® Unlimited Cash Rewards Credit Card?

The main limitation of the Bank of America® Unlimited Cash Rewards Credit Card is the credit score, which must be proven.

Thus, if yours isn’t excellent, with a value between 690 and 850, it’s difficult to qualify.

Also, remember that you need to live in the US and be over 18 years old!

So, submit your application and wait for the bank’s contact to know if you’ve been approved. Take advantage of the quick and easy process.

Routes you can follow to apply for the Bank of America® Unlimited Cash Rewards Credit Card

The best way to join the Bank of America® Unlimited Cash Rewards Credit Card is online through the website.

Thus, you can access the link we provide below and start the process.

Completing your application online

So, when accessing the site, click on the “apply now” button. This will redirect you to a virtual form. Fill in all the information, such as name, address, phone number, and other details.

After completing this step, you’ll need to provide other information involving income and credit history, among other questions. However, after you finish and submit your form, you’ll receive a response in 30 seconds!

So, don’t miss the chance to submit your application for the Bank of America® Unlimited Cash Rewards Credit Card and receive this card full of cash back benefits!

Try the Quicksilver Cash Rewards Credit Card for a different experience

Liked learning about the Bank of America® Unlimited Cash Rewards Credit Card review? Now that you know how to earn more cash back with this excellent card, join in!

On the other hand, how about exploring other offers available to you? If you really want to find the best high credit score card, here you’ll find a variety of options and reviews.

For example, have you heard of the Quicksilver Cash Rewards Credit Card? With it, you enjoy a 1.5% cash back with no annual fee and can also benefit from a welcome bonus of US$ 200!

Another advantage is for travelers! With this card, you don’t have to worry about fees abroad! In other words, this is a great option for those planning to travel or those who enjoy shopping overseas! So, come and learn more details!

Quicksilver Cash Rewards Credit Card Review

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Trending Topics

Discover It® Secured Credit Card Review: Up to 2% cash back!

Unlock financial freedom with our in-depth Discover It® Secured Credit Card review. Enjoy 2% cash back with no annual fee!

Keep Reading

Apply for Revvi Credit Card: Fill out the form in minutes!

If you want to apply for the Revvi Credit Card, you can relax! The entire process is done online without stress and complications!

Keep ReadingYou may also like

Travel on a Budget: Tips for Affordable Adventures

Conquer amazing destinations without breaking the bank. Essential tips for travel on a budget, from transportation to food.

Keep Reading

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading