Credit Cards

Barclaycard Platinum Credit Card review: Long interest-free!

Is the Barclaycard Platinum Credit Card right for you? Dive into our detailed review, dissecting its features and benefits to help you decide if this card aligns with your financial goals!

Advertisement

Barclaycard Platinum Credit Card review: No annual fee!

Welcome to an insider’s look at the Barclaycard Platinum Credit Card review—a powerhouse in credit offerings.

Moreover, in today’s financial landscape, finding a card that meets and exceeds your expectations can be a game-changer. So, read on to learn more about this card!

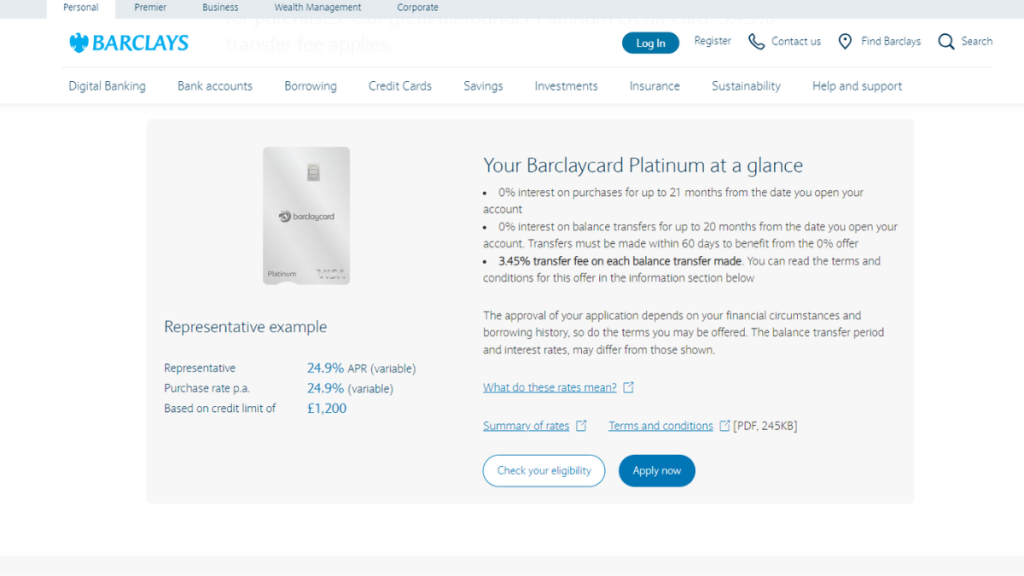

| Annual Fee | There is no annual fee; |

| Credit Limit | There is a minimum credit limit of £50, and it can go up to as much as necessary, depending on the financial situation of the cardholder; |

| Representative APR | 24.90% variable representative APR; |

| Purchase Rate | 0% interest on purchases for up to 21 months from the account opening date; 24.90% variable representative APR; |

| Welcome Bonus* | Also, 0% interest on balance transfers for up to 18 months from the account opening date; *Terms apply |

| Rewards | There are no rewards or cashback programs. |

You will be redirected to another website

Barclaycard Platinum Credit Card Overview

Join us on this exploration to uncover whether this card aligns with your lifestyle and financial goals, providing you with the insights to make a confident choice in the world of cards.

Moreover, in addition to this perk, the Barclaycard Platinum Card extends its allure with a competitive APR (Annual Percentage Rate).

Also, this empowers users to manage their finances more efficiently while minimizing interest costs.

Barclaycard Platinum Credit Card’s main features

Although this card offers some of the best perks to its cardholders, there are also some downsides.

Moreover, you can get incredible 0% interest intro periods for balance transfers.

However, there are no rewards programs, which can be a major downside for those who love getting credit card rewards.

Therefore, check out our pros and cons list below to determine if this is the best card for your needs!

Pros

- You can transfer your existing credit card balances and keep spending;

- There are no annual fee or monthly fee charges to use this card;

- You’ll get early access to exclusive events through Barclaycard Entertainment.

Cons

- You’ll need to pay a balance transfer fee of 2.99%;

- There is a minimum income requirement to qualify for this card;

- If you have a low credit score, you’ll have lower chances to qualify;

- You’ll probably get higher rates and shorter interest-free periods if you get accepted with a low score.

Minimum credit score to apply

There is little information about the minimum credit score to get this card. However, we recommend having at least a good credit score before you start the application process.

Moreover, you can check your eligibility for free before you start the official application process.

This way, you’ll be able to get a preapproval with no credit score harm before you apply.

How do I apply for the Barclaycard Platinum Credit Card?

You’ll only need an internet connection to apply for this card and meet the requirements.

Apply for the card: Online

In this guide, we’ll navigate the application process for the Barclaycard Platinum Card and unlock the steps to access its benefits.

Before you start applying for this card, you need to check the requirements. For example, you’ll need to be at least 21 years old and a permanent UK resident.

Moreover, you’ll need a personal income of more than £20,000 per annum.

They will also analyze other criteria. So, to apply online, you’ll need to go to the official website and provide the information needed.

In addition, you may need to send documents that prove the information you provide.

Then, you’ll be able to submit your application and wait for a response.

Apply for the card: Mobile App

There is not much information about the application process through the mobile app.

However, you can use the mobile app to manage all your card’s features and more.

Barclaycard Platinum Credit Card or Barclaycard Forward Card?

If you’re unsure about getting this Barclaycard, try applying for a different one! Therefore, you can try applying for the Barclaycard Forward!

Also, this card offers a 3% reduction in your interest rate if you use it responsibly and make all your payments on time.

Moreover, there is no annual fee, and you can get a 0% interest intro period as a new cardholder.

But which card is best for you? Check out our comparison table below to learn more!

| Barclaycard Platinum Credit Card | Barclaycard Forward Card | |

| Annual Fee | There is no annual fee; | No annual fee; |

| Credit Limit | There is a minimum credit limit of £50, and it can go up to as much as necessary, depending on the financial situation of the cardholder; | The credit limit depends on your financial situation; |

| Representative APR | 24.90% variable representative APR; | 33.90% variable representative APR; |

| Purchase Rate | 0% interest on purchases for up to 21 months from the account opening date; 24.90% variable representative APR; | 33.90% variable representative APR; |

| Welcome Bonus* | Also, 0% interest on balance transfers for up to 18 months from the account opening date; *Terms apply | 0% on purchases in your first three months with the card; *Terms apply |

| Rewards | There are no rewards or cashback programs. | There are no regular rewards for this card. |

So, if you like the features of the Barclaycard Forward, you can read our blog post below to learn more and learn how the application process works!

Barclaycard Forward Card review

This credit card promises a 3% reduction in your interest rate if you make your payments on time. Check out the Barclaycard Forward Card!

Trending Topics

Santander All-in-One Credit Card: The Ultimate Card for Convenience and Rewards

Discover the Santander All-in-One Credit Card, offering 0% interest, cashback on every purchase, and no foreign transaction fees.

Keep Reading

NatWest Balance Transfer Credit Card: A Smart Choice for Managing Debt

Manage your debt with the NatWest Balance Transfer Card. Enjoy 0% interest for 22 months on balance transfers with no annual fees.

Keep ReadingYou may also like

Halifax Clarity Credit Card: The Ultimate Travel Companion

Halifax Clarity Card offers fee-free spending abroad, no annual fee, and competitive exchange rates. It is ideal for frequent travellers.

Keep Reading

Benefits of the MBNA Platinum Credit Card: A Flexible Solution for Balance Transfers

Discover the MBNA Platinum Credit Card's 0% interest on balance transfers and purchases, ideal for debt consolidation and big purchases.

Keep Reading

TSB Advance Credit Card: low-interest with flexible benefits.

Discover the TSB Advance Credit Card—offering low interest rates, 0% on purchases, and balance transfers for 3 months. Learn more here.

Keep Reading