Credit Cards

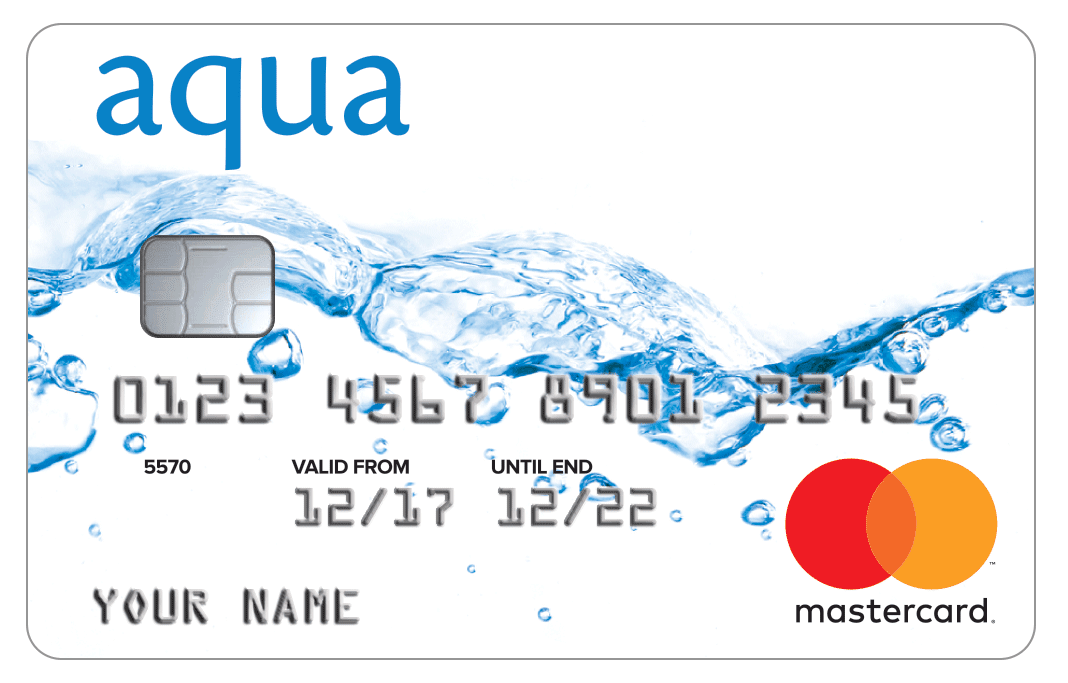

Aqua Advance Credit Card review: No annual fee!

Navigate the world of credit building with confidence! Our comprehensive blog post reviews the Aqua Advance Credit Card, shedding light on its accessibility, rewards for responsible use, and user-friendly perks. Find out if it's the key to unlocking your financial goals!

Advertisement

Aqua Advance Credit Card review: No foreign transaction fees!

Welcome to our Aqua Advance Credit Card review – a financial tool designed for those navigating the complexities of credit building and reconstruction.

Also, whether you’re looking to establish your credit history, recover from past setbacks, or simply seek a card with unique benefits, join us as we explore the aspects of this credit card!

| Annual Fee | There are no annual fees; |

| Credit Limit | From £250 to £1,500; |

| Representative APR | 34.90% representative variable APR; |

| Purchase Rate | 2.529% or 3.141% or 3.432% or 3.717% or 3.992%; |

| Welcome Bonus | No welcome bonuses; |

| Rewards | There are no rewards programs; |

You will be redirected to another website

Aqua Advance Credit Card Overview

A distinctive feature is its commitment to rewarding responsible card usage. Lower interest rates are granted as cardholders demonstrate consistent and disciplined financial behavior.

This Aqua credit card stands out with its user-friendly features, including no annual fees and no currency conversion charges for transactions made overseas.

Additionally, cardholders benefit from complimentary access to CreditView, a tool for monitoring their credit scores and obtaining detailed credit reports.

While Aqua Advance offers perks like no annual fees and no charges for overseas transactions, potential applicants should be mindful of its high APR of 34.9%.

Moreover, despite these considerations, the Aqua Advance Credit Card is a viable option for individuals looking to establish or enhance their credit profile.

Therefore, this card offers a pathway to responsible credit use and potential long-term financial benefits.

Aqua Advance Credit Card’s main features

Even though this card offers incredible features to its users, it also has some downsides. For example, there are no rewards programs or welcome bonuses.

Therefore, read our pros and cons list below to learn how this card works and see if it is the best option for your current needs.

Pros

- You’ll be able to get low rates if you use this card responsibly;

- You can have a chance to qualify for this card even with a low score;

- There are no foreign transaction fees and no annual fees;

- You’ll be able to access your credit score for free;

- There are text alerts to help you keep track of your finances at all times;

- You can check if you’re available for this card with no credit score harm.

Cons

- If you have held any other Aqua, Marbles, Opus, or other related card in the past, you may not be able to apply for the Aqua Advance Credit Card;

- The APR can be as high as 34.90%.

Minimum credit score to apply

There is little information about the minimum credit score required to apply for this Aqua card. However, you’ll have a chance to qualify even with a low score.

You can also check if you are eligible in as little as 60 seconds with no credit harm.

Apply for the Aqua Advance Credit Card: Prequalify in 60 seconds!

You can easily apply for this credit card online through the official website. Also, you’ll be able to pre-qualify before you start the application.

Apply for the card: Online

Before you start the online application, you’ll need to learn about the requirements. Therefore, read some of the main ones below:

- Be over 18 years old;

- Have a permanent UK address;

- You can’t be bankrupt;

- You’ll need a current UK bank account.

These are just some of the requirements for getting this card. Moreover, you can check if you’re eligible for it without harming your credit score.

Apply for the card: Mobile App

To apply for this card, you must complete the online application process after checking your eligibility.

Therefore, you can read our topic above to see our tips on applying online through the official website.

However, you can use the Aqua mobile app to make payments, manage your credit card, and access any other financial products you have with Aqua.

Aqua Advance Credit Card or Classic Card?

Are you unsure about getting the Aqua Advance card? We can help you learn about a different card!

Aqua Classic Credit Card review: Build credit!

Dive into the details of the Aqua Classic Credit Card with our insightful review. Uncover the card's 24/7 fraud protection and more!

Trending Topics

MBNA Long Balance Transfer Card: Maximising Your Savings with Low Interest

Maximise your savings with the MBNA Long Balance Transfer Card, offering 31 months of 0% interest on balance transfers.

Keep Reading

HSBC Student Credit Card: A Flexible Solution for Managing University Expenses

HSBC Student Credit Card offers a no-fee way to build credit while managing expenses. It has flexible limits and mobile banking support.

Keep Reading

The Advantages of the Post Office Credit Card: A Versatile Tool for UK Consumers

Discover the benefits of the Post Office Credit Card, from no overseas fees to 0% interest offers for UK shoppers.

Keep ReadingYou may also like

Virgin Atlantic Reward Credit Card: Maximise Your Travel Rewards

Earn Virgin Points with the Virgin Atlantic Reward Credit Card. No annual fee and great rewards for frequent Virgin Atlantic flyers.

Keep Reading

Vanquis Credit Builder Card: A Reliable Way to Improve Your Credit Score

Improve your credit score with the Vanquis Credit Builder Card, offering low limits, flexible payments, and no annual fee.

Keep Reading

TSB Advance Credit Card: low-interest with flexible benefits.

Discover the TSB Advance Credit Card—offering low interest rates, 0% on purchases, and balance transfers for 3 months. Learn more here.

Keep Reading