Credit Cards

Apply for Revvi Credit Card: Fill out the form in minutes!

There are several credit cards for individuals with a poor credit history. However, the Revvi Credit Card can offer you unique opportunities!

Advertisement

Revvi Visa® Credit Card: Pay a one-time enrollment fee to access exclusive cash back!

Do you want to apply right now for the Revvi Credit Card? So, there are four steps you need to execute to join the Revvi Credit Card! But the positive point is that everything happens virtually and without complications!

So, check out our special blueprint. Here, we will help you and introduce you to the Revvi Credit Card mobile app! So, don’t miss this opportunity and apply for this card by accessing the website!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Completing your application online

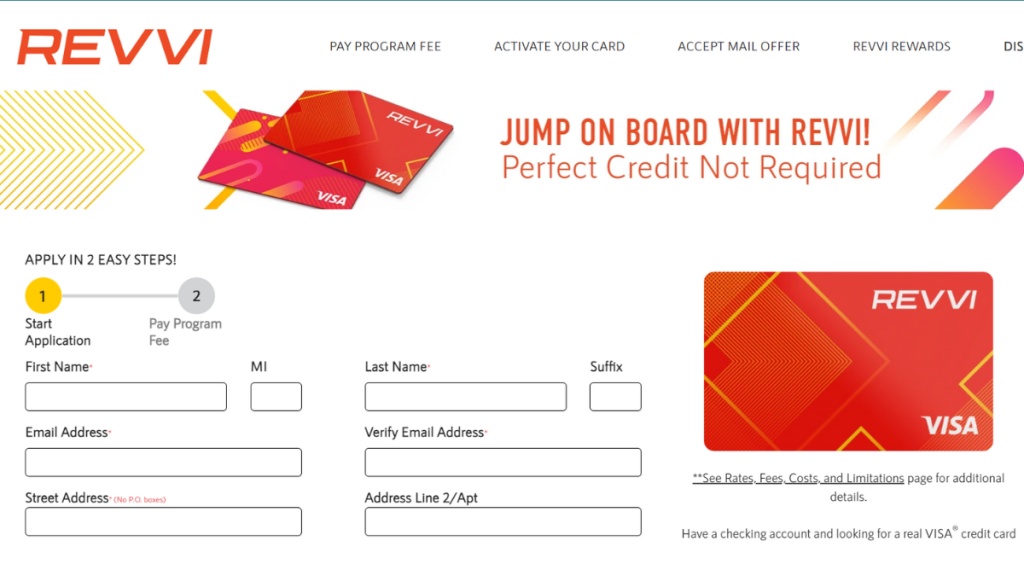

Firstly, to apply for the Revvi credit card, you need to go to the card’s page. Take this opportunity to read all available information and check fees, rules, terms of use, and more!

Moreover, the homepage is already the first step of the form. Then, fill in all the information. This includes some personal data such as:

- First and last name;

- Email address;

- Street Address;

- City;

- State;

- Zip code;

- Home and mobile phone number.

Next, the second step is to continue your application, providing additional information such as monthly income and Social Security Number, among other details. Then, you can choose the card design that interests you the most.

Application Costs

The Revvi credit card is issued in several versions, and depending on your choice, you may need to pay an extra fee of approximately $10. So, upon making your selection, submit your form and wait for the bank’s response.

The Revvi credit card usually contacts you quickly. The analysis should take only a few minutes. So, upon receiving a favorable response, you need to pay the one-time fee of $95 to open your account!

Now, you’re ready to enjoy the features and set up your account with your credit card. Moreover, the Revvi credit card has a mobile app ideal for your daily management! Want to know more?

Completing your application via mobile app

Although there is no information about applying for the Revvi credit card through the mobile app, you can download it to manage your account. By the way, it is available for iOS and Android and has over 100,000 downloads.

The rating varies from 3 stars on Google App to 2.2 stars on the App Store. Anyway, this is a good way to make transactions, check balances, and other details about your account and your card!

Try the Destiny Mastercard® for a different experience

Liked learning some details about how to apply for the Revvi Credit Card? In addition to this experience, we can introduce you to another card that has fewer fees but does not offer 1% cash back.

Thus, the Destiny Mastercard® is a viable option for those looking to rebuild or build credit solidly.

Moreover, every card designed for customers with a low credit score will have slightly higher interest rates.

But that doesn’t mean they can’t be fair and affordable rates. So, the Destiny Mastercard® only charges you a US$ 49 annual fee, which can be a great opportunity to save.

Additionally, it has the protection of being a Mastercard and can be used internationally with a fee of only 1% of the amount. So, come learn more details in our exclusive review!

Destiny Mastercard® Review

Build credit like a pro with the Destiny Mastercard® Credit Card! Ensure a smooth application process and achieve your financial goals!

Trending Topics

Apply for PREMIER Bankcard® Secured Credit Card: Quick process!

If you want to apply for PREMIER Bankcard® Secured Credit Card, you must know you can apply in just a few minutes at the official website.

Keep Reading

Self Visa® Secured Card Review: Build credit!

Discover how the Self Visa® Secured Card can jumpstart your credit journey from scratch with no credit history!

Keep Reading

Gemini Credit Card® Review: Crypto on Every Swipe!

Explore our Gemini Credit Card® review to learn how you can get instant crypto rewards, stylish metal card designs, and top security.

Keep ReadingYou may also like

PREMIER Bankcard® Secured Credit Card Review: Enhance Your Credit!

With the PREMIER Bankcard® Secured Credit Card review, you'll learn how to build credit by having your history reported to major bureaus!

Keep Reading

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep Reading

Discover it® Chrome Credit Card Review: Road Perks!

Explore our Discover it® Chrome Credit Card review and see how to earn 2% cash back on gas and dining, plus no annual fee.

Keep Reading