Credit Cards

Apply for PREMIER Bankcard® Secured Credit Card: Quick process!

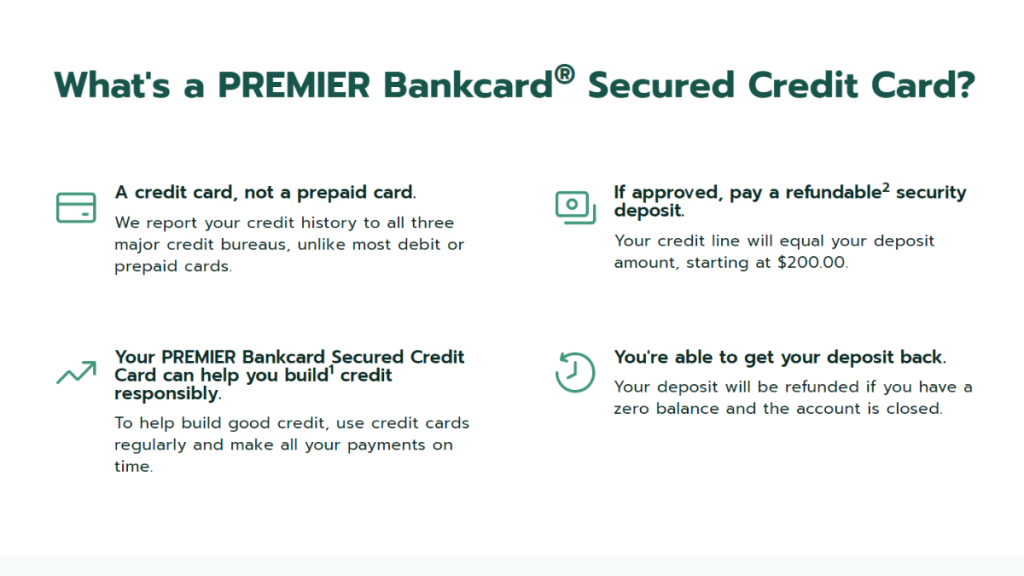

An exclusive application with practical features, the PREMIER Bankcard® Secured Credit Card offers an excellent experience. To apply, you just need to provide some data and specific information! Come find out more!

Advertisement

Applying without leaving your home is possible with the PREMIER Bankcard® Secured Credit Card! Use the mobile app strategically!

If you want to know how to apply for the PREMIER Bankcard® Secured Credit Card, you are in the right place. In addition to the conveniences this card offers, you can complete your application quickly, all from the comfort of your home!

Also, you don’t need to worry about the financial institution’s response. In a short time, you’ll receive a response with the available offers. So, want to discover how to apply without risks? Then, check out our special blueprint!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Completing Your Application Online

The first step to apply for the PREMIER Bankcard® Secured Credit Card is to access the card’s website! Click on the “credit card” tab at the top of the screen and choose the “explore our credit cards” option.

On the next page, you can compare the different card offers from the bank. Regardless, select the Secured card to apply.

Now, you can get more information and read the complete details about the card.

This is an excellent time to review the fees and updated APR. Remember that before applying, it’s crucial to read the entire contract!

Then, click on the “apply now” button to start your application process.

More information

Soon, you’ll be redirected to a virtual form. Fill in your personal details, including name, last name, complete address, home and mobile phone numbers, date of birth, social security number, and more.

You may also need to provide information about your current job and monthly income. Finally, click “Continue.”. Now, wait for the financial institution’s approval.

If approved, remember to pay the security deposit to begin using your card! Moreover, the PREMIER Bankcard® Secured Credit Card has an app that can help you manage your account after receiving the card. So, let’s check out more information.

Completing Your Application via Mobile App

It seems that you cannot apply for the card through the PREMIER Bankcard® Secured Credit Card mobile app. However, the bank offers a functional and intuitive app with versions available for download on iOS and Android.

With this app, you can perform various transactions, including payments and transfers. Additionally, you can set up alerts and check your statement directly on your phone.

The PREMIER Bankcard® Secured Credit Card app is well-rated by users, with 4.6 stars on Google Play and 4.7 on the App Store, accumulating over 200,000 downloads.

Try the Destiny Mastercard® for a Different Experience

See how simple it is to apply for the PREMIER Bankcard® Secured Credit Card? Take advantage of the opportunity this card offers to rebuild your credit score in a straightforward way.

Moreover, before making your final decision about the best credit card for your daily life, it’s essential to explore different offers. To help you expand your financial horizons, we introduce the Destiny Mastercard®!

With this card, you also have the opportunity to rebuild credit without worrying about a security deposit. Additionally, the annual fee is quite affordable, but the interest rates may be higher.

So, check and compare two interesting options for building and rebuilding credit! Opt for making informed and conscious choices! Come find out more about the Destiny Mastercard®!

Destiny Mastercard® Review

The Destiny Mastercard® is an unsecured credit card designed for those seeking to rebuild their credit scores.

Trending Topics

Prime Visa Credit Card Review: $100 Amazon Gift Instantly

If you’re an Amazon loyalist, this Prime Visa Credit Card review is made for you! Learn how to earn valuable cash back with no annual fee.

Keep Reading

Don’t Let Limited Credit Hold You Back: Choose the Credit Card Tailored for You

Discover the best credit cards for limited credit and start building your credit history while enjoying rewards. Find the right card for you!

Keep Reading

Bank of America® Unlimited Cash Rewards Credit Card Review: earn cash back

With this review of the Bank of America® Unlimited Cash Rewards Credit Card, you'll discover how to increase your cash back!

Keep ReadingYou may also like

Apply for First Digital Mastercard®: Earn cash back

If you want to apply for the First Digital Mastercard®, know that the process is virtual, no need to go to the bank to get your card!

Keep Reading

Apply for Revvi Credit Card: Fill out the form in minutes!

If you want to apply for the Revvi Credit Card, you can relax! The entire process is done online without stress and complications!

Keep Reading

Travel on a Budget: Tips for Affordable Adventures

Conquer amazing destinations without breaking the bank. Essential tips for travel on a budget, from transportation to food.

Keep Reading