Credit Cards

Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card: Earn back

You can apply for the Petal® 1 "No Annual Fee" Visa® Credit Card with an offer you received or discover the conditions the card offers for you!

Advertisement

Complete your application from the comfort of your home!

Applying for the Petal® 1 “No Annual Fee” Visa® Credit Card is a process that begins with a test among the card offers available! This way, you can find out if you qualify without risks!

This card offers an opportunity for you to enjoy incredible cash back without the need to pay an annual fee. Moreover, your credit limit will be determined in your application process, so let’s get started?

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Completing your application online

Firstly, to apply for the Petal® 1, you need to access the Petal website! Select the “cards” option in the top menu. Then, choose Petal® 1.

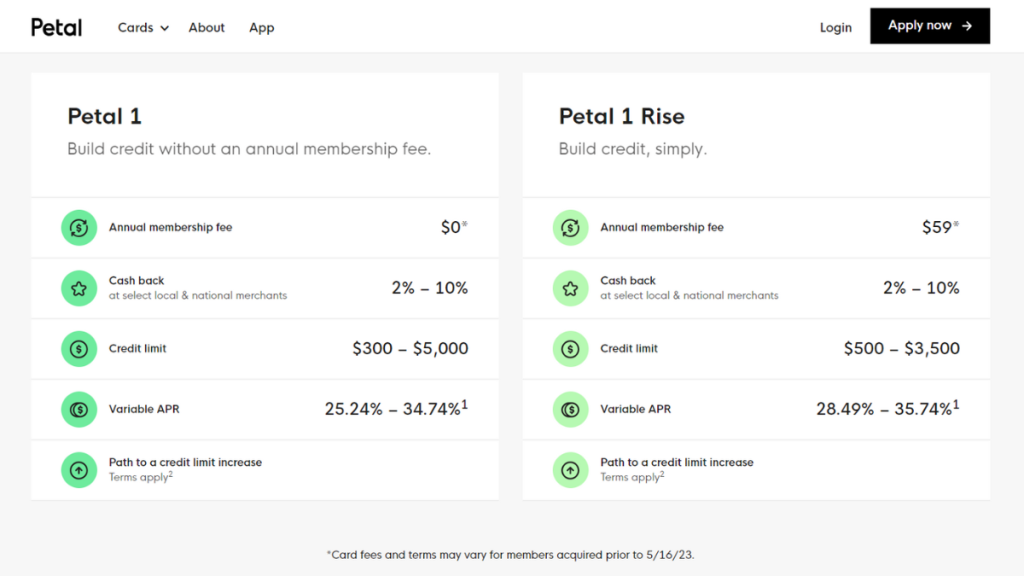

There are two options for this card, and before opting for the no annual fee variant, you’ll need to undergo prequalification.

So, click on the “apply now” option. Additionally, this is the moment to review all the details.

You can compare the two cards to understand the advantages of each! Moving on to the application process, you need to fill out an online form.

If you already have an offer, you can click on that option and enter the code.

In any case, the form requires you to fill in details such as

- Email address;

- First and Last name;

- Phone number;

- Street address;

- Social Security Number;

- Birthday;

- Employment Status;

- Income;

- Housing Type and Cost.

Then, simply read the terms and check the boxes if you agree to all the details. Finally, click “Continue.” This way, you can observe the conditions of your card.

If you decide to apply for this card, you’ll receive your card within 10 working days. But, you can already start by downloading the mobile app on your smartphone!

Completing your application via the mobile app

Although it’s not possible to apply for this card through your mobile app, this is a crucial feature for you to manage your account and make the most of the card!

So, download the app from the iOS or Android stores! Additionally, there have been over 100,000 downloads on both platforms.

Moreover, you can redeem your cash back through the app. Another advantage of the mobile app is facilitating all daily transactions, such as financial control, payments, transfers, and even requesting an increase in your credit limit!

All of this with an intuitive and practical design! In other words, there are plenty of reasons for you to download the app after you join the card!

Try the Citi® Diamond Preferred® Card for a different experience

Did you enjoy discovering how to apply for the Petal® 1? So, apply as soon as possible and download the mobile app to enjoy all the available benefits!

But if this card didn’t interest you as much, there are other options that might catch your attention. Thus, we present to you the Citi® Diamond Preferred® Card! This is an option full of exclusive features!

With reduced APR in the first few months of use, you gain an advantageous opportunity. Moreover, you can get pre-sale tickets for various available activities!

If you liked what you read, how about checking out other recommendations? Discover the required credit score to join, the annual fee amount, and much more!

Citi® Diamond Preferred®

Are you ready to achieve your full financial potential? Then don't miss the Citi® Diamond Preferred® Card! 0% intro APR period and $0 annual fee!

Trending Topics

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Rebuild Your Credit!

With cash back and no annual fee, the Petal® 1 "No Annual Fee" Visa® Credit Card is an option for those without a credit score!

Keep Reading

Wells Fargo Reflect® Card Review: Extensive APR intro!

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Keep ReadingYou may also like

Upgrade Triple Cash Rewards Visa® Review: The Smart Choice

Read our Upgrade Triple Cash Rewards Visa® review - get 3% cash back on select categories and no annual fees. Ideal for everyday spending.

Keep Reading

Quicksilver Cash Rewards Credit Card Review: Big Earnings

Check our Quicksilver Cash Rewards Credit Card review to learn about unlimited cash back and $0 annual fee benefits that redefine shopping.

Keep Reading

Group One Platinum Card Review: Shop with Ease

Discover the Group One Platinum Card in our review! Perfect for bad credit, with a $750 merchandise credit line, and no rates on purchases.

Keep Reading