Credit Cards

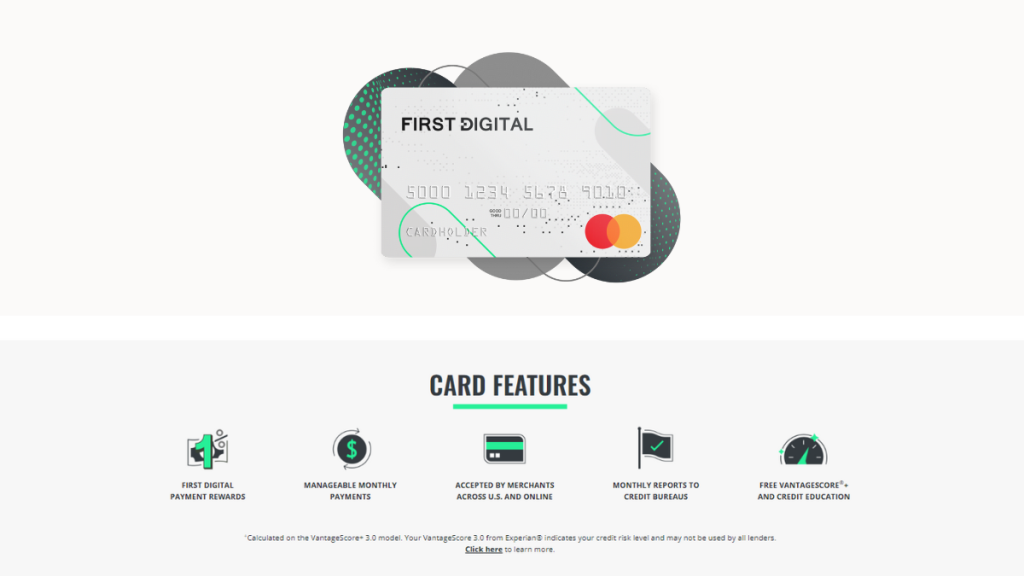

Apply for First Digital Mastercard®: Earn cash back

The First Digital Mastercard® offers unique conveniences and comes with an exclusive app for you to access your account! Join as soon as possible and enjoy all the benefits with top-notch security with Mastercard. Come find out more!

Advertisement

Joining in just a few minutes is possible with the First Digital Mastercard®!

It’s easy to apply for the First Digital Mastercard®! The application process consists of four steps on the financial institution’s website. So, you’ll need to provide your information and wait for First Digital’s response.

By the way, this contact takes about 60 seconds. In other words, you quickly find out whether you are approved to start using the First Digital Mastercard® or not.

Additionally, to receive your card and activate your account, the whole process takes an average of three weeks! Remember that you will need to pay the issuance fee of US$ 35 for shipping, in addition to the included fees.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Completing your application online

So, you should access the First Digital Mastercard® website and start your application at any time! First, fill out the form with the requested information.

This includes only your name, email, complete address (with zip code), and landline and mobile phone numbers! Moreover, you need to confirm that you are over 18 years old and live in the US. Then, click on the “apply now” button.

Additionally, you’ll need to continue your application in the other three steps, providing more personal information, such as credit score, income, and current job.

After that, you’ll need to choose a design for your card. First Digital offers some options, but remember that depending on your choice, there will be an additional fee of US$ 10.

More information

To complete the process, you must make the payment of the initial fees. Remember that this card does not require a security deposit, but the fees exceed that amount, which is refundable on other cards.

The fees include a one-time charge of US$ 95 and an annual fee of US$ 75 in the first year. Additionally, in the first year, you don’t need to worry about paying the monthly account maintenance fee.

Moreover, if you want an additional card, you must pay an extra US$ 29. Then, just wait while the card is sent to you!

Completing your application via mobile app

Although it is not possible to apply for the First Digital Mastercard® outside the website, this card has an exclusive app for its users. So, you can enjoy several advantages.

If you are looking for a practical card, you can count on the First Digital Mastercard® in the palm of your hand at all times. The download is quick, and the app is intuitive!

With the app, you have various functions available: payments, inquiries, various types of financial transactions. It’s a great way to control your expenses and ensure the best financial success!

Additionally, you can find the app for free on both iOS and Android. In other words, no one is left out! The app has 3.7 stars on Google Play and 2.2 on the App Store and already has over 10,000 downloads!

Try the Wells Fargo Reflect® Card Review for a different experience

Applying for the First Digital Mastercard® is simple, isn’t it? So, if that’s your intention, don’t miss this opportunity to have a 1% cash back on your purchases and sign up through the website!

However, there are other credit cards that may catch your attention, offering benefits but charging less APR, for example. So, how about learning a little about the Wells Fargo Reflect® Card?

With this card, enjoy over a year with a 0% purchase APR! Moreover, you don’t have to pay an annual fee! The fees are more affordable, and other benefits are available!

Did you like this possibility? Then, compare the two cards to make the most informed decision for your reality! Check out our review and learn all the details and transparency of the Wells Fargo Reflect® Card!

Wells Fargo Reflect® Card Review

Dive into our Wells Fargo Reflect® Card review and see how you can benefit from a lengthy low APR period, plus zero annual fees.

Trending Topics

Financial Wellness: Tips for Achieving Financial Stability

In this article, learn practical strategies to achieve financial wellness and attain a more balanced and peaceful life.

Keep Reading

Prime Visa Credit Card Review: $100 Amazon Gift Instantly

If you’re an Amazon loyalist, this Prime Visa Credit Card review is made for you! Learn how to earn valuable cash back with no annual fee.

Keep ReadingYou may also like

Student Loan Debt Solutions: Strategies for Managing and Reducing Your Debt

Learn practical solutions to reduce and handle your student loan debt in the United States and achieve financial freedom.

Keep Reading

Freedom Gold Card Review: Up to a $750 credit limit!

Do you enjoy shopping at Horizon Outlet? Then, explore the Freedom Gold Card review and take advantage of not paying a security deposit!

Keep Reading

Investing for Beginners: Creating a Plan, and Managing Your Investments

Invest safely! This guide covers everything from basic concepts to advanced strategies to help you get started on your financial journey.

Keep Reading